SREI Infrastructure Finance has come out with public issue of non-convertible debentures (NCD) offering up to 9.50% interest rate. The issue opens on February 9 and closes on March 7, 2018.

SREI Infra Finance is primarily into financing of infrastructure projects along with advisory.

SREI Infra Finance NCD – Significant Points:

- Offer Period: February 9 to March 7, 2018

- Annual Interest Rates for Retail Investors: 8.5% to 9.5% depending on tenure

- Additional coupon of 0.25% p.a. for Category III investors who are holder of NCDs, shareholders and senior citizens

- Price of each bond: Rs 1,000

- Minimum Investment: 10 Bonds (Rs 10,000)

- Max Investment Limit for Retail Investor: Rs 10 Lakhs

- Credit Rating: “BWR AA+” (Outlook Stable) by “BRICKWORK”

- NCD Size: Rs 200 crore with option to retain oversubscription of Rs 2,000 crore

- Allotment: First Come First Serve

- Listing: Bonds would be listed on BSE and NSE and will entail capital gains tax on exit through secondary market

Also Read – Know NCD – Investment Tips, TDS and Taxation

SREI Infra Finance NCD – Investment Options:

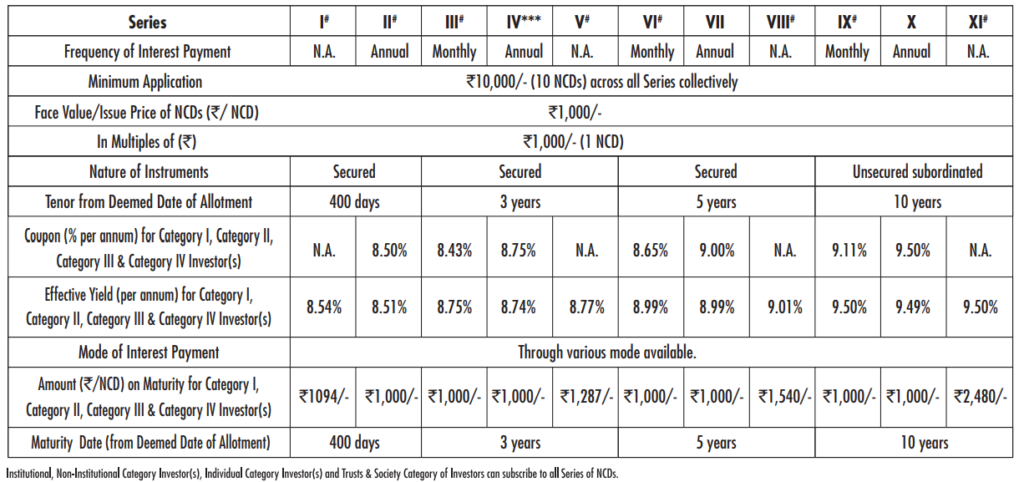

There are 11 options of investment in SREI Infra Finance NCD.

Our Company shall allocate and allot Series IV NCDs wherein the Applicants have not indicated their choice of the relevant NCD Series.

Series I, Series II, Series III, Series V, Series VI, Series VIII, Series IX and Series XI would be allotted compulsorily in dematerialized form to all categories of Investors.

SREI Infra Finance NCD – Who can Apply?

This issue is open to all Indian residents, HUFs and Institutions.

- Category I – Institutional Investors – 20% of the issue is reserved

- Category II – Non-Institutional Investors, Corporates – 20% of the issue is reserved

- Category III – Retail Individual Investors including HUFs – 60% of the issue is reserved

However NRIs cannot apply for this NCD.

Why you should invest?

- The credit rating is AA+ which is good for investment purpose

- The NCD is secured (series I to VIII), which means the above debt is backed by assets of the company

- The interest rates are 2%-3% higher than your regular Bank FDs

- No TDS if invested in Demat Form

Also Read: Highest Interest Rate on Recurring Deposits

Why you should not invest?

- Infrastructure Financing is risky business as the success depends on timely and successful completion of the project. In India, there are a lot of infrastructure projects struck at various stages for various reasons.

- The NPA is 3.54% which is bad

- The profits of the company declined in last few years

- You can also invest in high rated company fixed deposits

How to Apply?

If you have Demat account apply through that or ASBA facility provided by banks. It’s the easiest way to apply and also avoids a lot of hassle in terms of KYC and paper work

In case you don’t want to do it online, you can download the application form from company site or Financial Institutions and submit to collection centers.

Recommendation:

- My recommendation is to invest some part of your Fixed Income investment in this NCD Issue (go for Secured bonds only Series I to VIII)

- You should always have diversified portfolio be it fixed deposit, NCD or equity investment

- Its good idea to remain invested till maturity because liquidity on exchanges is low and hence you would get lower than market value

If you plan to invest in this issue, do it early as most NCD issues are over-subscribed within few days of opening.

want to know how much safe is investment in srei’s bond. srei comes in the market with bond issue almost every quarter since so many years Brokers say its credit rating is not good Do they Redeem bonds on time

Yes they are safe. The credit rating is AA+ which is investment grade. Also if they default, who would invest in their bonds in future. You can look to invest in their SECURED bonds!