SREI Infrastructure Finance Ltd one of the leading infrastructure companies in India has come out with Secured Redeemable Non Convertible Debentures (NCDs) of Rs 75 crore with over-subscription of additional Rs 75 crore.

SREI Infrastructure Finance Ltd NCD – Significant Points:

- Offer Period: April 4 – April 25, 2013

- Annual Interest Rates for Retail Investors:

- 10.35% (Quarterly) or 10.75% (Annually) for 3 Years

- 11.00% for 5 Years

- The money doubles in 6 Years 6 Months (11.24% annual interest)

- Price of each bond: Rs 1,000

- Minimum Investment: 10 Bonds (Rs 10,000)

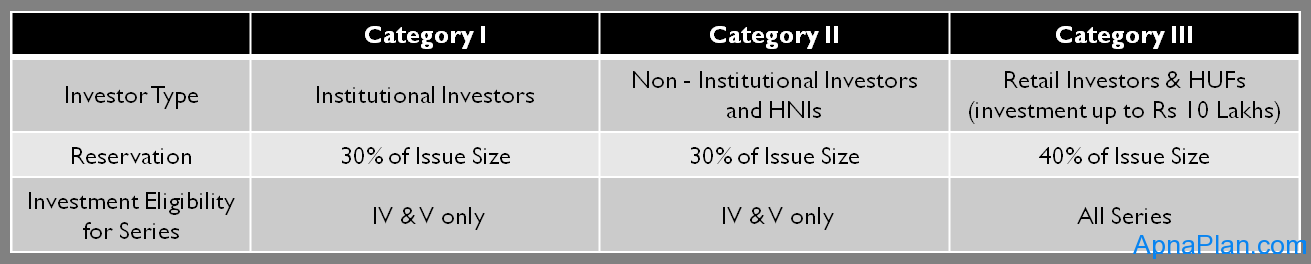

- Max Investment Limit for Retail Investor: Rs 10 Lakhs

- Credit Rating: ‘CARE AA-‘ by CARE and ‘BWR AA’ by Brickwork

- Allotment: First Come First Serve

- Listing: Bonds would be listed on BSE and will entail capital gains tax on exit through secondary market

- Loan against NCDs: The Company, at its sole discretion, subject to applicable statutory and/or regulatory requirements, may consider granting of a loan facility to the holders of NCDs against the security of such NCDs

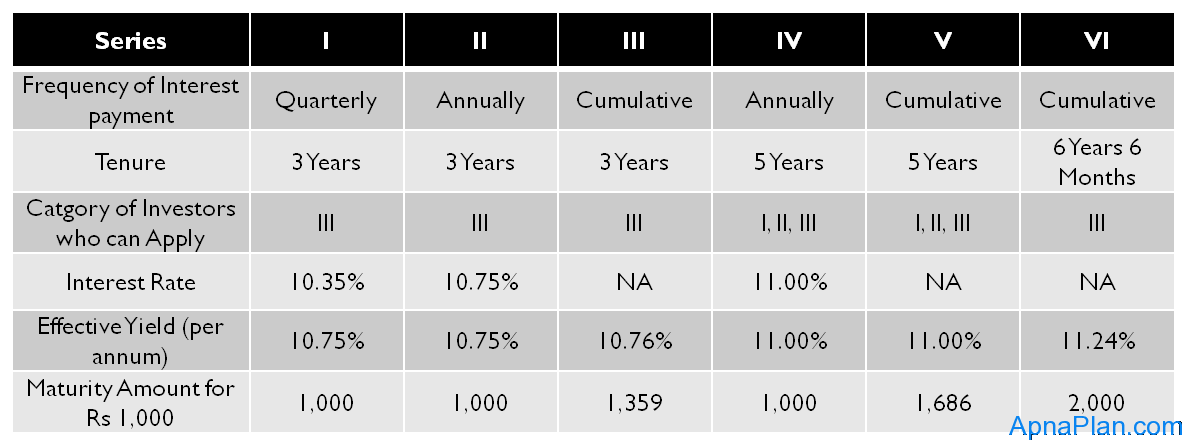

SREI Infrastructure Finance Ltd NCD – Investment Options:

The SREI Infrastructure Finance Ltd NCD has following six series options for investments:

SREI Infrastructure Finance Ltd NCD – Who can Apply?

The investors have been divided into 3 categories of investors as in the table below:

Why you should invest?

- The interest offered is 1 – 2% higher than the bank fixed deposit

- The interest rates are on a downward trend, so further decrease in interest rates would give capital appreciation on these bonds

- This NCD is secured and has good credit rating, which means relatively lower risk

Also Read: 50 Best Bank Fixed Deposit Schemes

Why you should not invest?

- Though this NCD can be sold anytime on BSE, but the liquidity is usually low. So you might not get right price if you want to sell urgently

- The interest on NCD is fully taxable according to the tax slab you fall in

Useful Tips:

- No TDS (Tax deduction at source) is deducted when the NCDs are held in demat account.

About SREI Infrastructure Finance Ltd:

Srei Infrastructure Finance Limited (SIFL) incorporated in 1985 and having it’s headquarter at Kolkata is primarily engaged in financing of infrastructure projects and equipments. Apart from Infrastructure Financing, SIFL is also engaged in infrastructure project development and provides advisory services.

SREI Infrastructure Finance Ltd NCD – Application Form:

You can download the application form for SREI Infrastructure Finance Ltd NCD – April 2013 from here.