Sovereign Gold Bond is quite a popular investment scheme and rightly so. It’s one of the best ways to invest in gold due to ease of investment, easy management, tax free capital gains and guarantee by government of India. However there has always been confusion about Sovereign Gold Bond Dates – When the New Issue would come out. In the past 5 years there has been no particular trend for the Sovereign Gold Bond Dates. There have been times when there has been Sovereign Gold Bonds every week for 3 months and then there have been periods when there was no issue for 6 months.

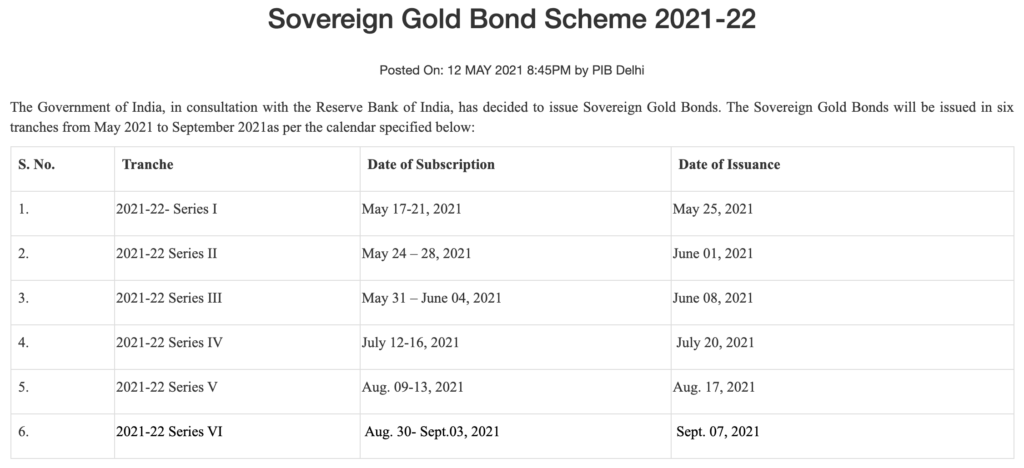

I think government of India needs to work out a systematic timing for the same. The good thing is the government now publishes half-yearly schedules in advance as the table below shows for FY 2021-22.

Should you Invest in Gold?

We looked at more than 55 years history of gold to see if its a good idea to invest in Gold. We concluded that its more volatile than perceived but investing in long term may provide you with more stable returns. You can look at the complete analysis and our conclusion here – Looking at Gold Price History in India – Should you Invest in Gold?

Ideally this should have been made more systematic like every first week of the month and additionally in Diwali (or other festivals). This would help the investors plan their cash-flows accordingly.

Sovereign Gold Bond Dates since 2015

The table below lists down all the issues of Sovereign Gold Bond since 2015 – when the first issue came out in November 2015.

| Year | Name | Open Date | Close Date | Issue Date | Issue Price | Early Redemption Date | Date of Redemption | Number of units (in grams) |

|---|---|---|---|---|---|---|---|---|

| 2015-16 | SGB-2015-Series-I | 05-Nov-15 | 20-Nov-15 | 30-Nov-15 | 2,684 | 30-Nov-20 | 30-Nov-23 | 908,807 |

| 2015-16 | SGB-2016-Series-I | 18-Jan-16 | 22-Jan-16 | 08-Feb-16 | 2,600 | 08-Feb-21 | 08-Feb-24 | 2,858,082 |

| 2015-16 | SGB-2016-Series-II | 08-Mar-16 | 14-Mar-16 | 29-Mar-16 | 2,916 | 29-Mar-21 | 29-Mar-24 | 1,113,656 |

| 2016-17 | SGB-2016-17-Series-I | 18-Jul-16 | 22-Jul-16 | 05-Aug-16 | 3,119 | 05-Aug-21 | 05-Aug-24 | 2,953,025 |

| 2016-17 | SGB-2016-17-Series-II | 01-Sep-16 | 09-Sep-16 | 30-Sep-16 | 3,150 | 30-Sep-21 | 30-Sep-24 | 2,615,800 |

| 2016-17 | SGB-2016-17-Series-III | 24-Oct-16 | 02-Nov-16 | 17-Nov-16 | 3,007 | 17-Nov-21 | 17-Nov-24 | 3,598,055 |

| 2016-17 | SGB-2016-17-Series-IV | 27-Feb-17 | 03-Mar-17 | 17-Mar-17 | 2,943 | 17-Mar-22 | 17-Mar-25 | 2,220,885 |

| 2017-18 | SGB 2017-18-Series-I | 24-Apr-17 | 28-Apr-17 | 12-May-17 | 2,951 | 12-May-22 | 12-May-25 | 2,027,695 |

| 2017-18 | SGB 2017-18-Series-II | 10-Jul-17 | 14-Jul-17 | 28-Jul-17 | 2,830 | 28-Jul-22 | 28-Jul-25 | 2,349,953 |

| 2017-18 | SGB 2017-18-Series-III | 09-Oct-17 | 11-Oct-17 | 16-Oct-17 | 2,956 | 16-Apr-23 | 16-Oct-25 | 264,815 |

| 2017-18 | SGB 2017-18-Series-IV | 16-Oct-17 | 18-Oct-17 | 23-Oct-17 | 2,987 | 23-Apr-23 | 23-Oct-25 | 378,945 |

| 2017-18 | SGB 2017-18-Series-V | 23-Oct-17 | 25-Oct-17 | 30-Oct-17 | 2,971 | 30-Apr-23 | 30-Oct-25 | 174,024 |

| 2017-18 | SGB 2017-18-Series-VI | 30-Oct-17 | 01-Nov-17 | 06-Nov-17 | 2,945 | 06-May-23 | 06-Nov-25 | 153,356 |

| 2017-18 | SGB 2017-18-Series-VII | 06-Nov-17 | 08-Nov-17 | 13-Nov-17 | 2,934 | 13-May-23 | 13-Nov-25 | 175,121 |

| 2017-18 | SGB 2017-18-Series-VIII | 13-Nov-17 | 15-Nov-17 | 20-Nov-17 | 2,961 | 20-May-23 | 20-Nov-25 | 135,666 |

| 2017-18 | SGB 2017-18-Series-IX | 20-Nov-17 | 22-Nov-17 | 27-Nov-17 | 2,964 | 27-May-23 | 27-Nov-25 | 105,512 |

| 2017-18 | SGB 2017-18-Series-X | 27-Nov-17 | 29-Nov-17 | 04-Dec-17 | 2,961 | 04-Jun-23 | 04-Dec-25 | 107,380 |

| 2017-18 | SGB 2017-18-Series-XI | 04-Dec-17 | 06-Dec-17 | 11-Dec-17 | 2,952 | 11-Jun-23 | 11-Dec-25 | 81,614 |

| 2017-18 | SGB 2017-18-Series-XII | 11-Dec-17 | 13-Dec-17 | 18-Dec-17 | 2,890 | 18-Jun-23 | 18-Dec-25 | 111,218 |

| 2017-18 | SGB 2017-18-Series-XIII | 18-Dec-17 | 20-Dec-17 | 26-Dec-17 | 2,866 | 26-Jun-23 | 26-Dec-25 | 131,958 |

| 2017-18 | SGB 2017-18-Series-XIV | 26-Dec-17 | 27-Dec-17 | 01-Jan-18 | 2,881 | 01-Jul-23 | 01-Jan-26 | 327,434 |

| 2018-19 | SGB 2018-19-Series-I | 16-Apr-18 | 20-Apr-18 | 04-May-18 | 3,114 | 04-Nov-23 | 04-May-26 | 650,337 |

| 2018-19 | SGB 2018-19-Series-II | 15-Oct-18 | 19-Oct-18 | 23-Oct-18 | 3,146 | 23-Apr-24 | 23-Oct-26 | 312,258 |

| 2018-19 | SGB 2018-19-Series-III | 05-Nov-18 | 09-Nov-18 | 13-Nov-18 | 3,183 | 13-May-24 | 13-Nov-26 | 409,398 |

| 2018-19 | SGB 2018-19-Series-IV | 24-Dec-18 | 28-Dec-18 | 01-Jan-19 | 3,119 | 01-Jul-24 | 01-Jan-27 | 207,886 |

| 2018-19 | SGB 2018-19-Series-V | 14-Jan-19 | 18-Jan-19 | 22-Jan-19 | 3,214 | 22-Jul-24 | 22-Jan-27 | 243,606 |

| 2018-19 | SGB 2018-19-Series-VI | 04-Feb-19 | 08-Feb-19 | 12-Feb-19 | 3,326 | 12-Aug-24 | 12-Feb-27 | 207,388 |

| 2019-20 | SGB 2019-20-Series-I | 03-Jun-19 | 07-Jun-19 | 11-Jun-19 | 3,196 | 11-Dec-24 | 11-Jun-27 | 459,789 |

| 2019-20 | SGB 2019-20-Series-II | 08-Jul-19 | 12-Jul-19 | 16-Jul-19 | 3,443 | 16-Jan-25 | 16-Jul-27 | 535,947 |

| 2019-20 | SGB 2019-20-Series-III | 05-Aug-19 | 09-Aug-19 | 14-Aug-19 | 3,499 | 14-Feb-25 | 14-Aug-27 | 1,024,837 |

| 2019-20 | SGB 2019-20-Series-IV | 09-Sep-19 | 13-Sep-19 | 17-Sep-19 | 3,890 | 17-Mar-25 | 17-Sep-27 | 627,892 |

| 2019-20 | SGB 2019-20-Series-V | 07-Oct-19 | 11-Oct-19 | 15-Oct-19 | 3,788 | 15-Apr-25 | 15-Oct-27 | 455,776 |

| 2019-20 | SGB 2019-20-Series-VI | 21-Oct-19 | 25-Oct-19 | 30-Oct-19 | 3,835 | 30-Apr-25 | 30-Oct-27 | 693,210 |

| 2019-20 | SGB 2019-20-Series-VII | 02-Dec-19 | 06-Dec-19 | 10-Dec-19 | 3,795 | 10-Jun-25 | 10-Dec-27 | 648,304 |

| 2019-20 | SGB 2019-20-Series-VIII | 13-Jan-20 | 17-Jan-20 | 21-Jan-20 | 4,016 | 21-Jul-25 | 21-Jan-28 | 522,119 |

| 2019-20 | SGB 2019-20-Series-IX | 03-Feb-20 | 07-Feb-20 | 11-Feb-20 | 4,070 | 11-Aug-25 | 11-Feb-28 | 405,957 |

| 2019-20 | SGB 2019-20-Series-X | 02-Mar-20 | 06-Mar-20 | 11-Mar-20 | 4,260 | 11-Sep-25 | 11-Mar-28 | 757,338 |

| 2020-21 | SGB 2020-21-Series-I | 20-Apr-20 | 24-Apr-20 | 28-Apr-20 | 4,639 | 28-Oct-25 | 28-Apr-28 | 1,772,874 |

| 2020-21 | SGB 2020-21-Series-II | 05-May-20 | 08-May-20 | 19-May-20 | 4,590 | 19-Nov-25 | 19-May-28 | 2,544,294 |

| 2020-21 | SGB 2020-21-Series-III | 03-Jun-20 | 05-Jun-20 | 16-Jun-20 | 4,677 | 16-Dec-25 | 16-Dec-28 | 2,388,328 |

| 2020-21 | SGB 2020-21-Series-IV | 01-Jul-20 | 03-Jul-20 | 14-Jul-20 | 4,852 | 14-Jan-26 | 14-Jul-28 | 4,130,820 |

| 2020-21 | SGB 2020-21-Series-V | 29-Jul-20 | 31-Jul-20 | 11-Aug-20 | 5,334 | 11-Feb-26 | 11-Aug-28 | 6,349,781 |

| 2020-21 | SGB 2020-21-Series-VI | 26-Aug-20 | 28-Aug-20 | 08-Sep-20 | 5,117 | 08-Mar-26 | 08-Sep-28 | 3,190,133 |

| 2020-21 | SGB 2020-21-Series-VII | 07-Oct-20 | 09-Oct-20 | 20-Oct-20 | 5,051 | 20-Apr-26 | 20-Oct-28 | 1,859,518 |

| 2020-21 | SGB 2020-21-Series-VIII | 04-Nov-20 | 06-Nov-20 | 18-Nov-20 | 5,177 | 18-May-26 | 18-Nov-28 | 1,573,457 |

| 2020-21 | SGB 2020-21-Series-IX | 22-Dec-20 | 24-Dec-20 | 05-Jan-21 | 5,000 | 05-Jul-26 | 05-Jan-29 | 2,869,886 |

| 2020-21 | SGB 2020-21-Series-X | 06-Jan-21 | 08-Jan-21 | 19-Jan-21 | 5,104 | 19-Jul-26 | 19-Jan-29 | 1,214,048 |

| 2020-21 | SGB 2020-21-Series-XI | 01-Feb-21 | 05-Feb-21 | 09-Feb-21 | 4,912 | 09-Aug-26 | 09-Feb-29 | 1,227,915 |

| 2020-21 | SGB 2020-21-Series-XII | 01-Mar-21 | 05-Mar-21 | 09-Mar-21 | 4,662 | 09-Sep-26 | 09-Mar-29 | 3,230,907 |

| 2021-22 | SGB 2021-22-Series-I | 17-May-21 | 21-May-21 | 25-May-21 | 4,777 | 25-Nov-26 | 25-May-29 | 5,318,973 |

| 2021-22 | SGB 2021-22-Series-II | 24-May-21 | 28-May-21 | 01-Jun-21 | 4,842 | |||

| 2021-22 | SGB 2021-22-Series-III | 31-May-21 | 04-Jun-21 | 08-Jun-21 | 4,889 | |||

| 2021-22 | SGB 2021-22-Series-IV | 12-Jul-21 | 16-Jul-21 | 20-Jul-21 | ||||

| 2021-22 | SGB 2021-22-Series-V | 09-Aug-21 | 13-Aug-21 | 17-Aug-21 | ||||

| 2021-22 | SGB 2021-22-Series-VI | 30-Aug-21 | 03-Sep-21 | 07-Sep-21 |

If you look at the table carefully, you will realise how the government has evolved with the Sovereign Gold Bond Dates

How much returns you can get from Sovereign Gold Bond?

We have analysed all the Sovereign Gold Bonds issued till date to give you what kind of returns you can expect from the same. Till today there is just Sovereign Gold Bonds-2015-Series-I which was available for early redemption. For this the annual return has been 13.5% before tax and 12.8% after tax (30% slab). You can get more details here.

- There were just 3 issues in FY 2015-16.

- Again, there were just 3 issues of Sovereign Gold Bond in FY 2016-17.

- However, the government went pretty aggressive in FY 2017-18 and had 14 issues with one issue every week from October to December 2017. Then there were no further issues in FY 2017-18.

- In FY 2018-19 there were total 6 issues of Sovereign Gold Bond. However, it was very randomly spaced over the year. There was 1 issue in April and then regular subscription offers from October.

- In FY 2019-20 there were in all 10 issues. But here too there were no issues till June and then it was regular till end of the year.

- Starting FY 2020-21 the Sovereign Gold Bond Dates became more regular. There were 12 issues in all and almost equally spaced all through the year.

- In FY 2021-22, Sovereign Gold Bond Dates became irregular again. The first issue came in May and then there are 3 consecutive issues every week. After that we would have 1 issue every month for the next 3 months.

Looking at the above data it seems government was able to regularise the Sovereign Gold Bond Dates in FY 2020-21 and plans to have 12 issues every year – with 1 every month. I think Covid emergency like situation in April 2021, made it miss the first month.

Sovereign Gold Bond Investment Trends

Know about the latest issues of Sovereign Gold Bonds

Sovereign Gold Bonds are one of the better ways to invest in gold. It’s safe, backed by government of India and you need not be worried about purity of gold or storage. The icing on the cake is you get interest paid on your investment. You can buy these Sovereign Gold Bonds from NSE/BSE but the liquidity is a problem. So it’s a good idea to subscribe to latest issue of Sovereign Gold Bonds which comes almost every month.

The Sovereign Gold Bond date table above gives us some more interesting facts on the Investment Trends:

- The highest subscription (in terms on number of bonds subscribed for) happened for Sovereign Gold Bonds 2020-21-Series-V which was open in July 2020. The interesting thing is the price for this issue was highest ever at Rs 5,334 per bond as the gold was at its peak. What this tells us that a lot of people got their investment timing wrong and they may see losses going forward.

- Another interesting trend is the subscription started rising as the gold prices started rising sharply from March 2020. This tells us that a lot of investors only start putting out money when the asset has started peaking.

- In the 50 issues of Sovereign Gold Bonds (till Sovereign Gold Bonds 2021-22-Series-I issued on 25 May 2021) government issued 68.6 Million (6.8 crore) bonds equivalent to 68,625 KG of gold. This shows our love for gold not just for jewellery but for investment too.

- In the first 5 series of Sovereign Gold Bonds the interest rate was 2.75% which was later reduced to 2.5% for all subsequent bonds.

- The discount of Rs 50 on issue price for online investment started from the 6th issue of the bond.

We hope that this post would have given you some clarity on Sovereign Gold Bond dates. I think in future it would me more regular and may even be issued in a fixed week of the month along with some special occasions. This would be a win-win for everyone – it will help investors plan their cashflows accordingly and leading to higher collections by government of India.