Government of India announces interest rate on small saving schemes like PPF, Senior Citizen Savings Scheme, Post Office Fixed and Recurring Deposits and Sukanya Samriddhi Account every quarter effective April 2016.

This is done to keep these interest rates in sync with the market rates.

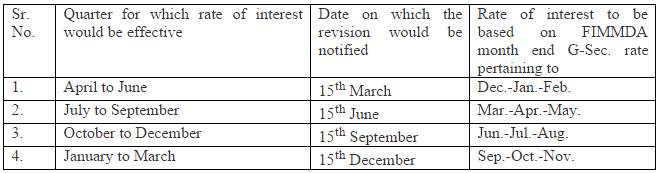

The table below shows the interest reset schedule:

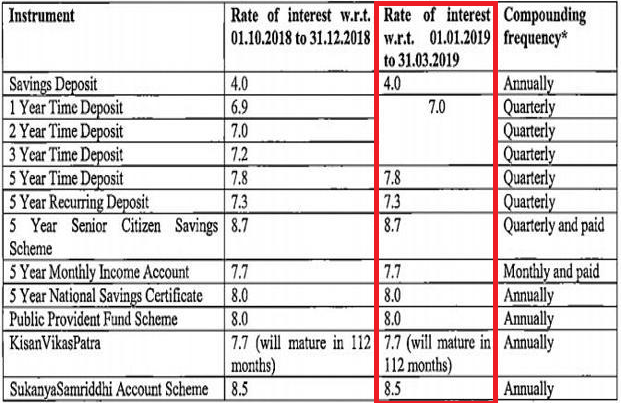

Interest Rates for Q4 FY 2018-19 (Jan – Mar’19)

The government has revised the interest rate on post office time deposit schemes while leaving rates of other popular small savings schemes like the PPF (Public Provident Fund), Sukanya Samriddhi account and Senior Citizen Savings schemes unchanged.

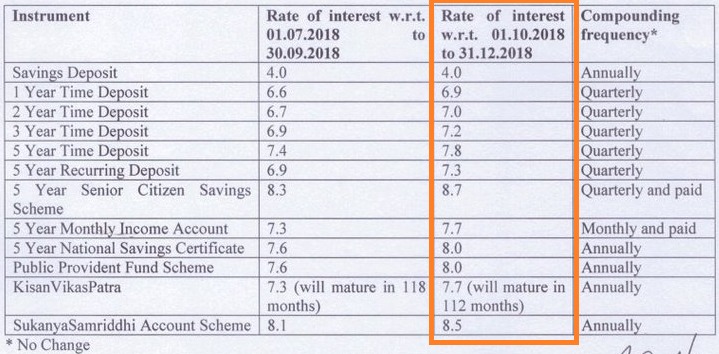

Interest Rates for Q3 FY 2018-19 (Oct – Dec’18)

As expected the interest rate for Small Saving Scheme has increased by 0.3% to 0.4%. The new PPF & NSC interest rate is 8%. The SCSS interest rate has increased to 8.7% and Sukanya Samriddhi Account would offer 8.5%. You can read the detailed notification here.

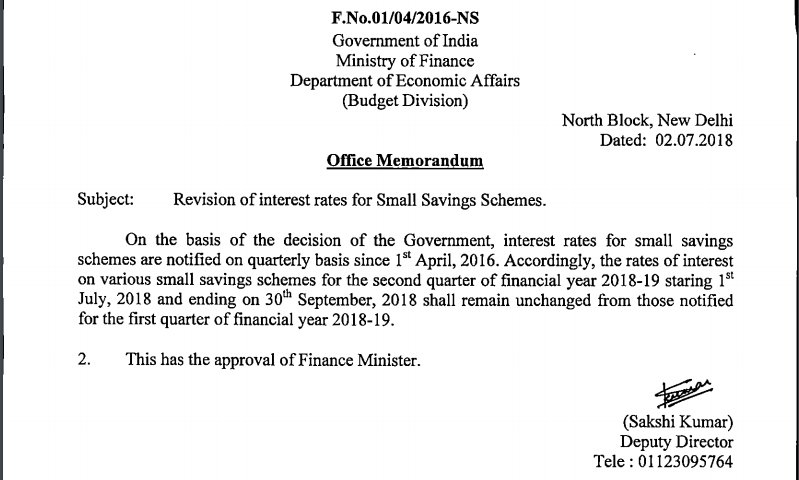

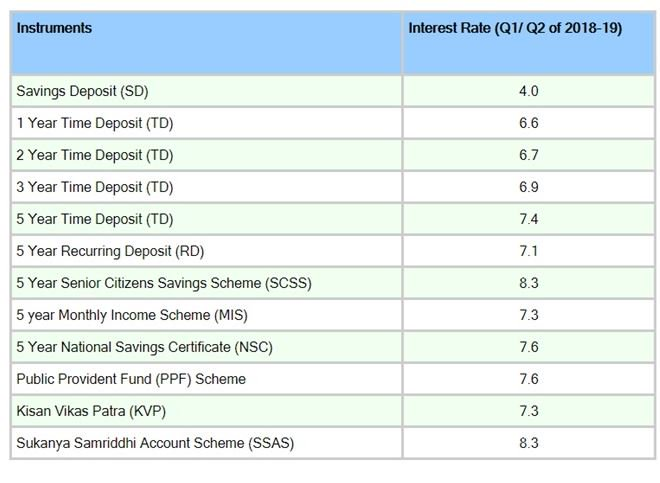

Interest Rates for Q2 FY 2018-19 (Jul – Sep’18)

There has been NO change in the interest rates as compared to the last quarter.

The expectation was the interest rates would go up as the government bond yields which is the benchmark for setting these rates had gone up. Unfortunately the government is NOT following its own rules!

Also Read: Highest Interest Rate on FD compared across 46 banks

The table below shows the interest rates:

Download the Official Notification from here.

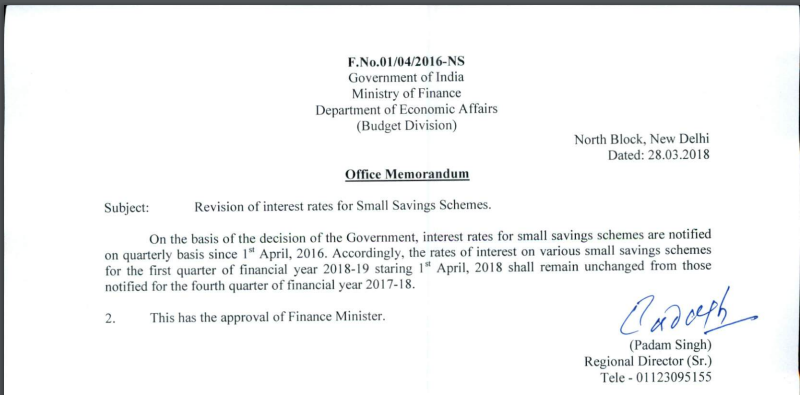

Interest Rates for Q1 FY 2018-19 (Apr – Jun’18)

There has been NO change in the interest rates as compared to the last quarter.

The table below shows the interest rates:

Download the Official Notification from here.

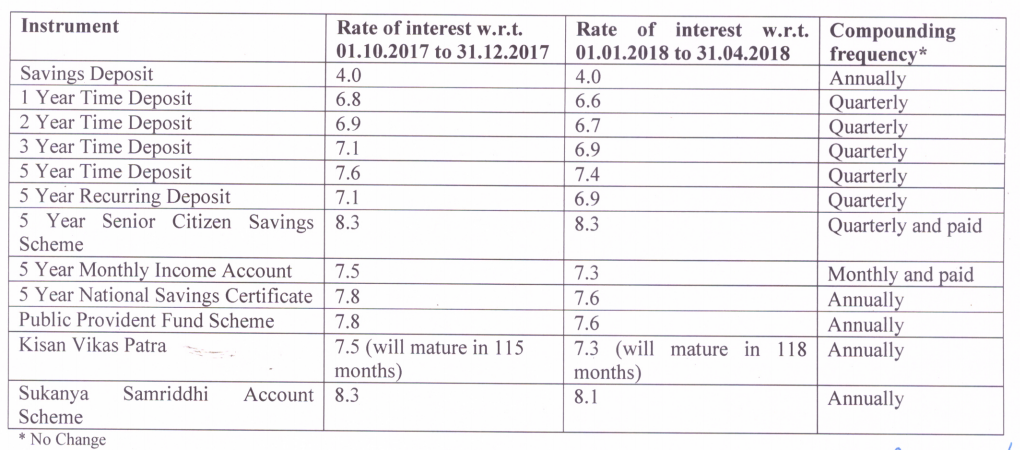

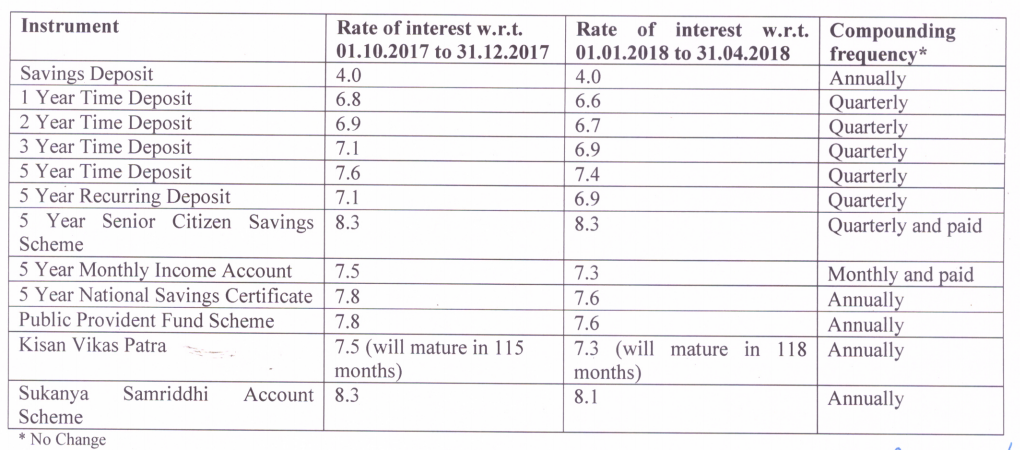

Interest Rates for Q4 FY 2017-18 (Jan – Mar’18)

The interest rate on small saving schemes have been reduced by 0.2% (except for Senior Citizens Saving Scheme) for January 1, 2018 to March 31, 2018 quarter.

- There is No change in Senior Citizens Saving Scheme interest rate and would offer 8.3%

- PPF and NSC will fetch a lower annual rate of 7.6% while KVP will yield 7.3% and mature in 118 months.

- Sukanya Samriddhi Account will offer 8.1% from existing 8.3% annually

- Term deposits of 1-5 years will fetch a lower interest rate of 6.6% – 7.4%, to be paid quarterly, while the five-year recurring deposit is pegged at 6.9%.

- Post Office Savings Account Interest Rate has been kept at 4%.

Also Read: NSC is better than Tax Saving Bank FD!

Download the Official Notification from here. There is typo in date 31.04.2018 is actually 31.03.2018!

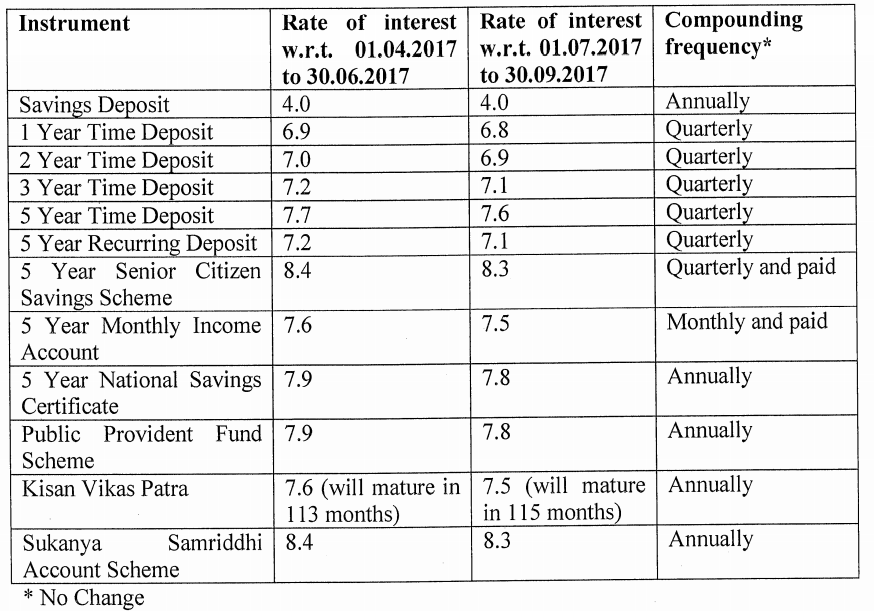

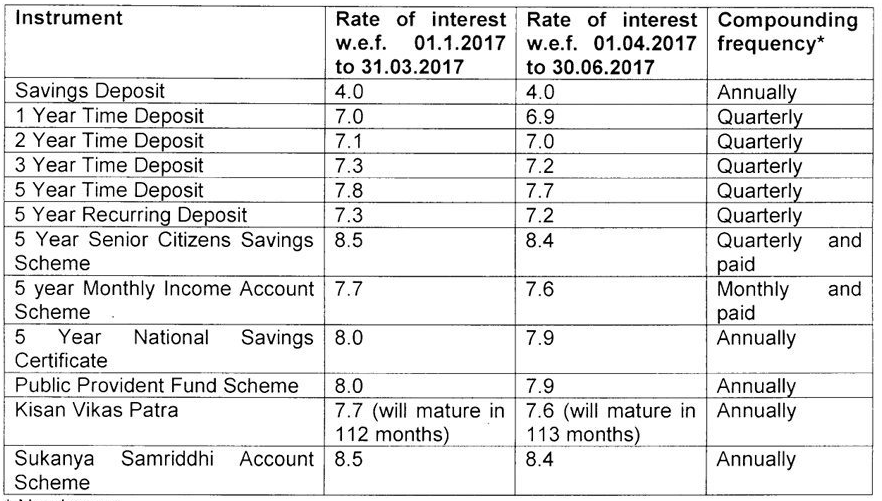

Interest Rates for Q2/3 FY 2017-18 (July – Dec’17)

The interest rate on small saving schemes have been reduced by 0.1% from July 2017 for the quarter of July to December 2017.

Interest Rates for Q1 FY 2017-18 (April – June’17)

The interest rates for April to June’17 quarter have been reduced by 0.1% for all schemes except savings account. The table below gives the details:

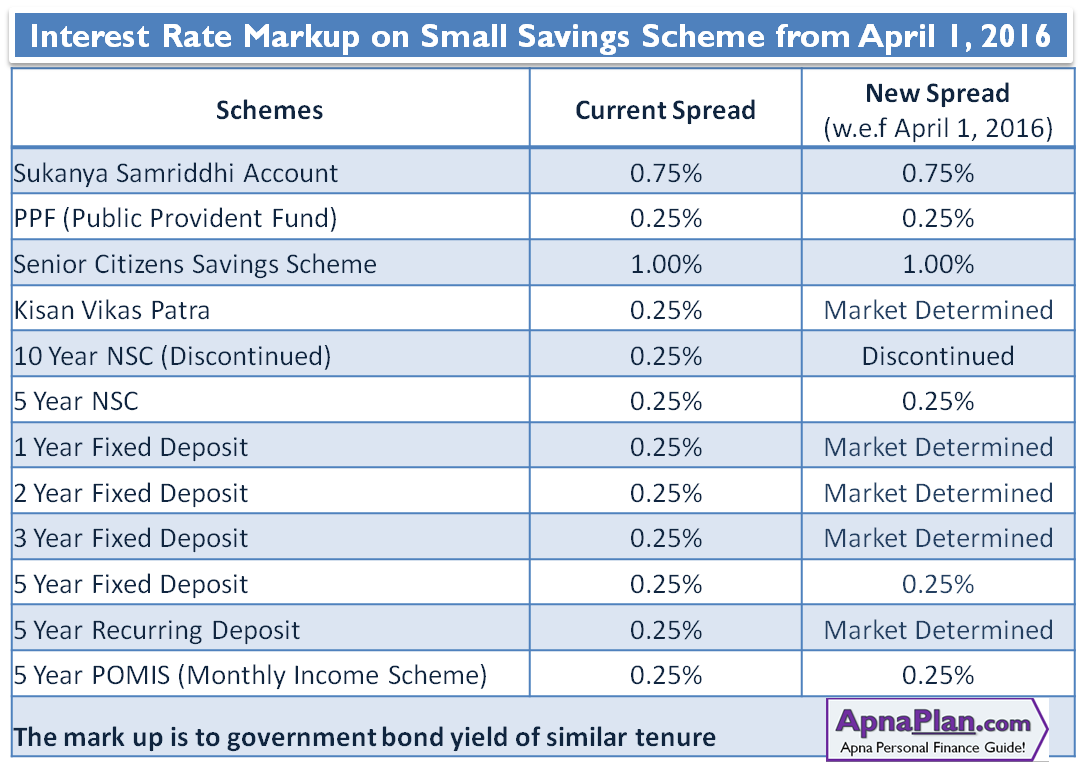

How are Interest Rates Determined?

For long term and socially important small saving schemes like PPF, SCSS, Sukanya Samriddhi Scheme, NSC and 5 Year post office fixed deposit the rates are fixed as slight mark up to the government bond yields.

For other small saving schemes namely Post Office Fixed Deposits (1, 2 and 3 years tenure), Recurring Deposits and Kisan Vikas Patra the interest rates would be market determined, which means would be similar to that offered by banks on corresponding deposits.

Learn all about PPF, Sukanya Samriddhi Scheme & Senior Citizen Savings Scheme

The table below gives the markup factor:

Unfortunately government is not following the above rules. There have been substantial reduction in benchmark yields but is not reflected in small saving schemes – which is good news for investors.

Small Saving Scheme Interest Rates History:

You can click on relevant links to go to historical interest rates:

- Interest Rates for FY 2014-15

Some Pointers:

The interest offered are locked-in for Post Office Fixed Deposits, Recurring Deposits, POMIS, KVP, NSC and Senior Citizen Savings Scheme and so the interest offered is as on the date of investment for the entire tenure.

However for Sukanya Samriddhi Account and PPF the interest is offered as declared every quarter irrespective of the time of opening of account.

You can bookmark this page as we would update this every quarter as and when the new interest rates are declared.

All information in the artical are very useful. Thanks for sharing your ideas.

SIR, Very useful. Thank you.

You put great information about small saving schemes in India.

Thank for sharing.

Regards,

Rashmi

Hi Amit,

The above information is very useful. Can you please add NPS details as well to the above list? Thanks

You can learn more about NPS here.

Hi Amit,

Very useful article indeed. The interest rate of Sukanya Samriddhi Account has been reduced a lot compared to it’s launch time. However, it still is the best savings scheme for a girl child in India. Thank you for sharing the new interest rates for this quarter.