This post covers SBI Recurring Deposit Interest Rates, features, maturity amount along with other details. Recurring Deposit is a good way to accumulate money for any goal in safe and consistent manner. You deposit a fixed amount every month and at the end of it – on maturity you get your principal and accumulated interest.

SBI Recurring Deposit Scheme – Features

- The tenure of SBI recurring deposit may be from from 12 to 120 Months – in multiple os 3 months like 3, 6, 12, 15 months and so on.

- SBI RD is available both online and in Offline mode in all branches

- Nomination facility available

- The minimum amount of monthly instalment shall be Rs 100.

- There is NO limit on maximum amount you can deposit in RD

- The amount of instalment and number of instalment can not be changed after opening of the account.

- Loan against security of the balance in the Recurring Deposit accounts available to the extent of 90% of the deposit, at 0.5% p.a. above the rate of deposit

- TDS (Tax deduction at source) at the rate of 10% is deducted, if the interest income is more than Rs 40,000 in financial year

- Passbook Issued

- Hassle free premature spot payment anytime

- Senior citizens get up to additional 0.80% interest rate (Customers with age greater than 60 years are Senior Citizens) depending on the tenure of RD

- Can open RD online in SBI through e-RD feature in SBI internet banking

- Charges for RD pre-mature closure – Interest will be applied on premature withdrawal of RD at 1.00% below the rate applicable for the period the deposit has remained with the bank.

- The SBI Recurring Deposit account can be transferred from one branch to other.

SBI Recurring Deposit Interest Rates 2021

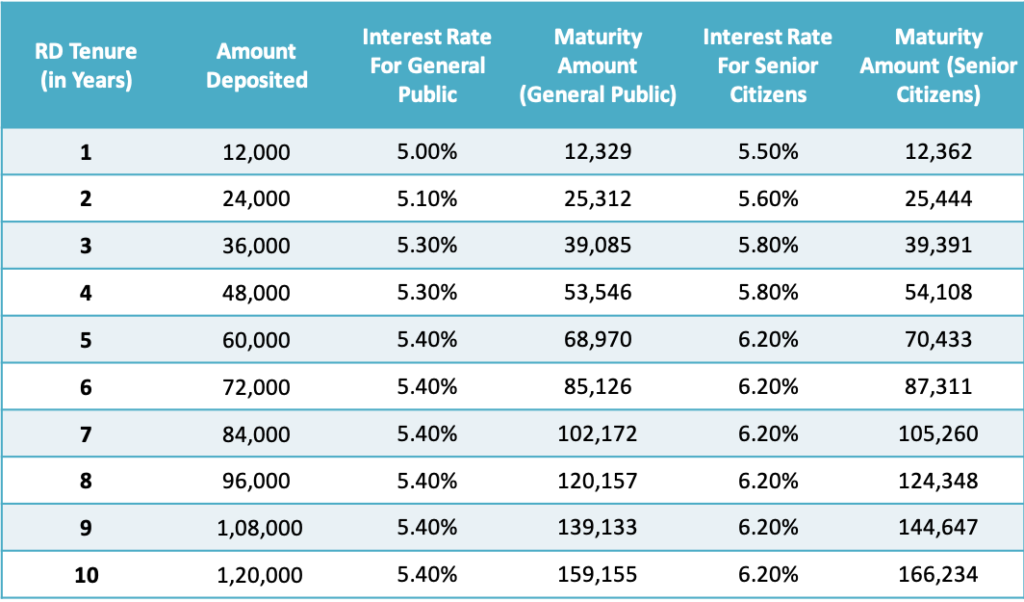

SBI Recurring Deposit Interest Rates has been last revised on 8th January 2021. General Public can get 3.90% – 5.40% while senior citizens get 4.40% – 6.20% depending on the tenure of deposit. The table below gives the details.

SBI Recurring Deposit Interest Rates 2021 & Maturity value

The table below shows SBI Recurring Deposit Interest Rates & the maturity value for Rs 1,000 monthly deposit for general public and senior citizens for 1 to 10 years.

How to Calculate Maturity Amount on SBI RD

The interest on SBI Recurring Deposit is compounded quarterly and is computed using the formula below.

M=R[(1+i) (n-1)]/1-(1+i)(-1/3))

Where, M = Maturity value

R = Monthly Instalment [60 for Post office RD]

N = number of quarters (tenure) [20 for Post office RD]

i = Rate of interest/400Helpful Posts on Recurring Deposits

- Which bank offers Highest Interest Rate on Bank FD?

- 13 Most Important things to know before investing in Bank Fixed Deposits

- Section 80TTB: Senior Citizens can Save Tax on their Interest Income

- TDS threshold on Bank FD increased to Rs 40,000 from April 1, 2019

- Avoid TDS: fill Form 15G and 15H

- Small Bank FDs offer interest up to 9% – Should you invest?

- How SWP in Debt Funds generate higher returns than FD

- How to increase bank deposit insurance through Joint accounts?

- How Safe is Your Fixed Deposit in Bank?

- How you loose Money in Fixed Deposits?

- Fixed Deposits that you can use to save Tax

- Fixed Deposits for NRIs

- Highest Interest Rate on Recurring Deposits

- Understanding Compounding and Yield in Fixed Deposit

- How to get Credit card against Fixed Deposit?

- 7 High Rated Companies Offering more than Bank Fixed Deposits

- All about Post Office FD Schemes

Who should open SBI Recurring Deposit Account?

SBI Recurring Deposit suits someone with consistent regular income (like salary) and would like to accumulate certain amount for a goal without taking much investment risk. An example could be if you want to buy car in next 2 years, you can easily open a RD account with any leading bank and start saving. If you deposit Rs 5,000 every month for 2 years at 7%, you would get about Rs 1,29,000 at maturity. This would be good for downpayment of the car.

It’s also for someone who may not have lump sum amount available for fixed deposit but would like to lock prevailing higher interest rate for long period of time. An example situation is – In March 2013 SBI was offering 9% interest rate on their recurring deposits for 10 years. I had opened a RD with Rs 5,000 just to lock a high interest rate for 10 years. On maturity I would get about Rs 9.7 lakhs – which is good accumulated amount. As of today SBI is offering 5.4%. So I have a good investment. It’s always good idea to lock when interest rate cycle reverses and it goes high.

SBI RD Penalty for Default in Instalment Payment

Whenever a depositor fails to pay the instalment on due date for three consecutive months a service charge of Rs 10/- is applicable. Penalty in case of delay in payment of instalment of RD of 5 years or less shall be Rs 1.50 for every Rs 100 per month and Rs 2.00 for every Rs. 100 per month for the account on more than 5 years. For example, if you deposited Rs 1,000 every month in SBI RD for less than 5 years maturity – If you miss payment for 1 month, you will need to deposit that instalment next month with Rs 15 as penalty (1.5 * 1000/100). If the same RD was for more than 5 years tenure, your fine would be Rs 20.

In case there is no instalment payment for six consecutive months, the SBI recurring deposit account would be closed and the available balance would be paid back to the linked account.

I have open a rd account of 5000/pm for 5years. If i would like to close the rd account before maturity on third month of its opening. Then what will be tbe principal amount of the deposited money and what amount will be deducted from the principal amount.

The penalty on premature withdrawal for recurring deposit would ary from bank to bank. In most cases there would be no deduction from principal but you would get lower interest.

I am looking for flexible RD option for one year can you please tell me which plan should i go for

Sir, I have recurring deposit in SBI. Can I deduct it from Income Tax for the FY 2015-2016

Recurring deposit are not eligible for tax benefit

Sir I have deposit 10,000 every month my rd account is three years how much back money my maturity time

I cannot tell you the maturity amount until you disclose the interest rate. Assuming investment at 8%, you would get Rs 40,7728 on maturity.

Plz tell me that why the my rd not deducted this month ?

Please contact your branch or customer care.

Hi sir,

I want to invest 1,000 every month for two years. Pls suggest me the best.

Choose which ever bank offers highest interest rate for your duration – here is comparison of RD interest across major banks in India

Hi sir,

I want to invest 10,000 every month for two years. Pls suggest me the best.

Here is comparison of interest rates on recurring deposit across all major banks in India.

what is best plan for child education, pl suggest . i can save 4000 per year

Hello sir. Can anybody replies me pls.

And please let me know the calculation also if possible

Sir i am paying Rs.5000 every month in sbi for one year. What amnt will i get after one year. pls suggest me

Assuming you invested at 8% interest rate, you would get Rs 62,648 on maturity. Of this Rs 60,000 is the principal amount and Rs 2,648 would be interest earned.

Hi sir, as per my calculation it is 4800/- and your calculation is 2648/-. How it is pls let me know.

If you deposit Rs 5000 for 1 year at 8%, you get Rs 400 as interest. In case of 1 year RD, you deposit 1st installment for 12 months, 2nd installment for 11 months and so on. So you cannot get Rs 4800!

Hello Sir,

Can you please suggest to me monthly account or fixed deposit, which is best sir, i have only 20,000 present… but this amount belongs to my child, tell me which is the best….

I have compared the recurring deposit interest rates across all major banks in India. The FD rates are also in this range. You can have a look and decide for yourself.

dear sir,

i want to invest 2000 rs. but should i invest in rd or Mutual fund

@Ashish this information is not enough for suggesting where to invest. It depends on your risk bearing capacity, duration of investment among other things.

I would like to invest 6000/- per month for a period of 3years.which will be better for me..rd or mutual fund??? Please suggest.

It depends on your risk profile and tax bracket. Debt Mutual funds are risky but more suited for higher tax bracket else go for recurring deposit.

Sir I’m going to fix deposite of Rs 200000 lac for 5 years. then what amount I’ll get on maturity time. pls tell

A fixed deposit of Rs 2 lakhs for 5 years at annual interest of 7% would give you Rs 2.8 lakhs at maturity.

Sir I want to invest rd 2000 per month for 15 years in a sip plan.can you suggest a best plan and way to invest.approximately how much I ‘ll get get in maturity….Pls ans……

SIP and Recurring deposits are two different things. You can do SIP in Mutual Funds while RD is done with banks. If you are looking for 15 years investment horizon, I would recommend equity or balanced mutual fund. On an average you can expect 10 – 12% annualized returns but remember the returns are volatile. You can gain 50% in one year while loose 30% in another. But historically speaking, Indian broader market indices (SENSEX/NIFTY) have never given negative returns for period of more than 10 years.

Thanks amit for quick reply.I m a housewife and interested in sip.Pls advice me how and where to start.can I invest ‘rs 2000 per month….Pls make me know the safest process with low to medium risk

Dear Sir,

i would like to Deposit 2lakh as mis policy, how much i will get interest every month? please tell me.