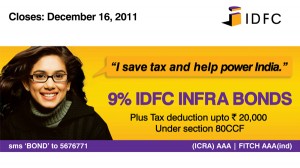

These bonds have got the highest credit rating of (ICRA) AAA by ICRA and Fitch AAA (ind) by Fitch.

Issue opens: November 21, 2011

Issue closes: December 16, 2011

Scheme Features: IDFC Infrastructure Bonds 2011

| Series | 1 | 2 |

| Face Value | 5,000 per Bond | |

| Minimum number of bonds per application | Two bonds and in multiples of one bond thereafter. For the purpose of fulfilling the requirement of minimum subscription of two bonds, an applicant may choose to apply for two bonds of the same or different series. | |

| Interest payment | Annual | Cumulative |

| Interest Rate | 9% p.a. | N.A. |

| Maturity Amount | 5,000 | 11,840 |

| Maturity | 10 years from the deemed date of allotment | |

| Yield on Maturity | 9% | 9% compounded annually |

| Buyback Facility | Yes | |

| Yield on Buyback | 9% | 9% compounded annually |

| Buyback Date | Date following 5 years and one day from the deemed date of allotment | |

| Buyback Amount | 5,000 per bond | 7,695 per bond |

Salient Features: IDFC Infrastructure Bonds 2011

- The bonds don’t attract any TDS in case the investments are in demat form

- The bonds are available in Demat & Physical form

- The bonds will be listed on NSE and BSE and can be traded after the 5 year lock-in period

- Investors can mortgage or pledge these bonds to avail loans after the lock-in period.

- An investor would need a PAN card to invest in these bonds.

- The bonds will be issued only to Resident Indian Individuals and HUF

- An applicant may subscribe to the two series of Bonds offered but the minimum application under each series shall be one bond i.e., 5,000

- Interest on the Bonds shall be payable on annual or cumulative basis depending on the series selected by the bond holders

- The interest accrued on the bonds will be credited to the respective bank registered with the demat account through ECS on the due date for interest payment

Should you invest in IDFC Infrastructure bond 2011?

Rate of interest for PPF is 8.6% while in IDFC Bond you can lock-in your investment for 10 years at 9% interest. I think its the right time to invest in IDFC Infrastructure Bonds 2011.

Your returns would depend on the tax bracket you are. For details on the same Click here.

- If you are in 30% tax bracket your annual return would be 15.6% per annum

- while for 20% tax bracket your return would be 13% and

- for 10% tax bracket the returns would be 10.85%

I think its a decent return and its recommended to lock-in in such tax saving instruments at this high interest rate period.

To Conclude:

I suggest everyone in the higher tax bracket to subscribe to the Infrastructure bonds. You may subscribe to this IDFC bond or wait for other institutions to issue these kinds of bonds. But by the end of this financial year you must opt to save tax on additional Rs 20,000!

Distributors:

| LEAD MANAGERS | |

| ICICI Securities Limited | Karvy Investor Services Limited |

| JM Financial Consultants Private Limited | IDFC Capital Limited |

| Kotak Mahindra Capital Company Limited | |

| BROKERS TO THE ISSUE | |

| Almondz Global Securities Limited | Karvy Stock Broking Limited |

| Bajaj Capital Investor Services Limited | Kotak Securities Limited |

| Enam Securities Private Limited | NJ India Invest Private Limited |

| Edelweiss Broking Limited | RR Equity Brokers Private Limited |

| HDFC Securities Limited | Sharekhan Limited |

| IDBI Capital Market Services Limited | SMC Global Securities Limited |

| JM Financial Services Private Limited | SBI Cap |

| CO-LEAD MANAGERS | |

| RR Investor Capital Services Private Limited | Bajaj Capital |

| SMC Capitals | |

| BANKERS | |

| HDFC Bank Ltd. | IndusInd Bank Ltd. |

| ICICI Bank Ltd. | Dhanalakshmi Bank Ltd. |

| IDBI Bank Ltd. | ING Vysya Bank Ltd. |

| Axis Bank Ltd. | Kotak Mahindra Bank |

Kindly provide folio number of idfc infrastructure bond trench 2

My pan no. AIFPG3163P

I have four idfc infra development bonds with folio nos IDB0148133 .These have matured on 21/02/2021,but, no maturity proceeds have been credited to my account till date. My account no. is same as was at the time of purchase. Bank is same, only IFSC code has been changed to ICIC0006938. I tried to update bank details at idfcfirstbank.com but was unable due to cumbersome process. I can informed at my cell nos 8696948801 or at my mai id [email protected]