Every year there are some changes in Income Tax Return – ITR Forms. This is to capture additional information which would help tax department to assess the income and tax more accurately and prevent any tax evasion.

In accordance the above and many instances of past fraud tax refund by salaried, the Form 16 has been modified and also the new ITR Forms ask for more detailed information about the salary. The good thing is you can pick most of the fields for ITR related to salary directly from your Form 16 unlike previous years. The post below helps with which field from Form 16 goes where in ITR Forms.

Form 16 New Format

The revised format of Form 16 (applicable from AY 2019-20) would enable the tax department to have detailed break up of the income and tax breaks claimed by a salaried employees. Following are the broad changes:

- Detailed break-up of tax-exempt allowances such as HRA, LTA

- Detailed break-up of tax-breaks under section 80C to 80U as declared to employer

- In case you hhave worked for more than 1 employer, Previous employer income as reported to your current employer

- Standard deduction of Rs 40,000

- Any other income declared to employer other than salaries

As I do not have actual Form 16 yet, I have created a dummy.

Salary Structure

Below is the salary structure of the employee with gross salary of Rs 7 Lakhs:

| Salary Component | Amount (Rs.) |

| Basic Salary | 3,60,000 |

| House Rent Allowance | 1,20,000 |

| Special Allowance | 1,54,000 |

| Leave Travel Allowance | 30,000 |

| NPS Contribution (Employer) | 36,000 |

| Gross Salary | 700,000 |

Additionally, the employer has provided car to the the employee as a perk. The value of this perk as per Income Tax is Rs 21,600 annually.

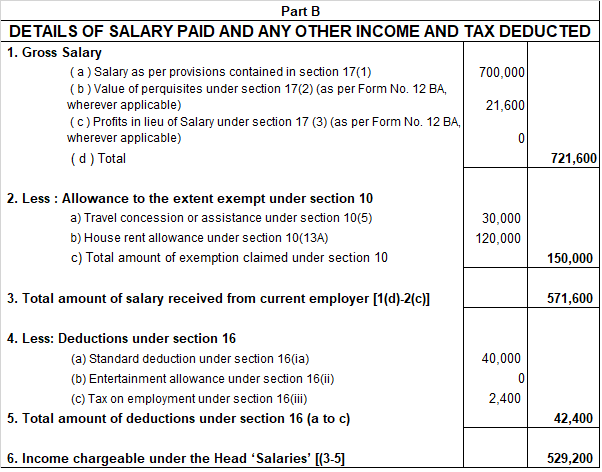

Below is the Form 16 (Part B) related to salary details above:

We would use this Form 16 to show you how you can fill up ITR Form 1&4 and ITR Form 2 & 3. The ITR 1 & ITR 4 are relatively simpler and ITR 2 & ITR 3 are the more complicated ones.

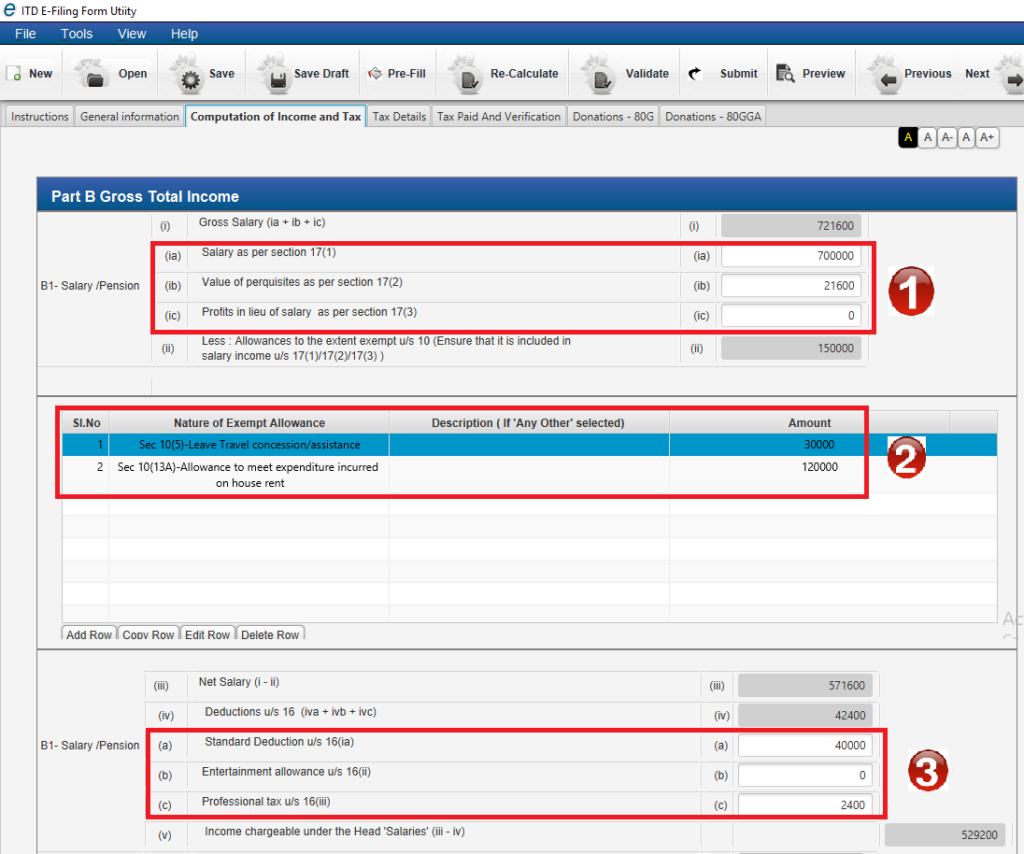

Details of Income from Salary in ITR-1 and ITR-4

Below is the snapshot of Details of Income from Salary from ITR 1 Form. This is similar for ITR 4. We have 3 broad sections as highlighted by Number 1, 2 & 3.

First Section: Salary Details (as 1)

You can directly get all 3 numbers from the Form 16 (Part B) – Gross Salary header.

Second Section: Allowances to the extent exempt under section 10(as 2)

There are 13 exempt allowances listed under this section which you can choose from the drop down box. In case you do not find your’s you can select Any Other and fill the details:

- Sec 10(5)- Leave Travel concession/assistance

- Sec 10(6)- Remuneration received as an official, by whatever name called, of an Embassy, High Commission etc

- Sec 10(7)- Allowances or perquisites paid or allowed as such outside India by the Government to a citizen of India for rendering services outside India

- Sec 10(10)- Death–cum-retirement gratuity received

- Sec 10(10A)- Commuted value of pension received

- Sec 10(10AA)- Earned leave encashment on retirement

- Sec 10(10B)(i)- Retrenchment Compensation received in respect of schemes not approved

- Sec 10(10B)(ii)- Retrenchment Compensation received in respect of approved scheme

- Sec 10(10C)- Amount received/receivable on voluntary retirement or termination of service

- Sec 10(10CC)- Tax paid by employer on nonmonetary perquisite

- Sec 10(13A)- House rent allowance

- Sec 10(14)(i)- Prescribed allowances or benefits specifically granted to meet expenses incurred in performance of duties of office or employment

- Sec 10(14)(ii)- Prescribed allowances or benefits granted to meet personal expenses in performance of duties of office or employment or to compensate for increased cost of living

- Any Other – In case of any other allowances enter the details in a text box provided

This information too is present in Form 16 directly as “Less: Allowances to the extent exempt under section 10”. In our case it was 2 tax exempt allowances and we have filled the ITR Form accordingly:

- House rent allowance under section 10(13A)

- Travel concession or assistance under section 10(5)

Third Section: Deductions under section 16 (as 3)

You can fill this section again directly from Form 16 with the header “Less: Deductions under section 16”. We had two valid fields for our case:

- Standard deduction under section 16(ia): Rs 40,000

- Tax on employment under section 16(iii): Rs 2,400

As you can see with the new Form 16 filling ITR 1 and ITR 4 would become relatively easier. In the section below we cover more complex ITR 2 & ITR 3.

Also Read: All bout Standard Deduction for Salaried and Pensioners

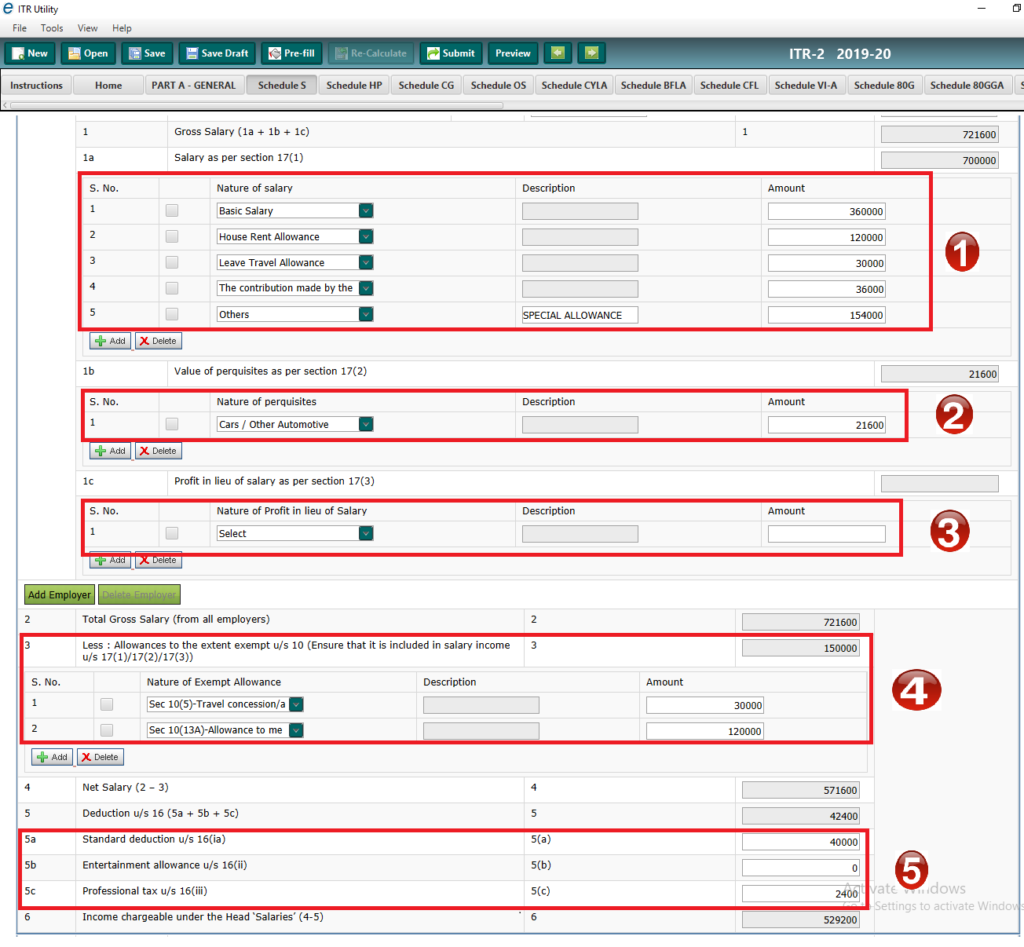

Details of Income from Salary in ITR-2 and ITR-3

The Salary details as asked in ITR-2 & ITR-3 is much more complicated and below is a snapshot of the same. We have divided it into 5 sections as shown by numbers 1 to 5.

First Section: Salary as per section 17(1) (as 1)

The ITR Form 2 requires the details of your salary components. you can get these details from your Form 16. Following 17 choices are available from the drop down:

- Basic Salary

- Dearness Allowance (DA)

- Conveyance Allowance

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

- Children Education Allowance (CEA)

- Transport Allowance (TA)

- Other Allowance

- Contribution made by employer towards pension scheme referred to in section 80CCD

- Amount deemed to be income under rule 6 of Part-A of Fourth Schedule

- Amount deemed to be income under rule 11(4) of Part-A of Fourth Schedule

- Annuity or pension

- Commuted Pension

- Gratuity

- Fees/ commission

- Advance of salary

- Leave Encashment

- Others (please enter the details in the text box)

In our case we have the following:

- Basic Salary: 3,60,000

- House Rent Allowance: 1,20,000

- Leave Travel Allowance: 30,000

- Contribution made by employer towards pension scheme referred to in section 80CCD: 36,000

- Others: Special Allowance: 1,54,000

Also Read: Should you Choose to be Employee or Independent Consultant from Taxation Perspective?

Second Section: Value of perquisites as per section 17(2) (as 2)

You need to fill the details of perks you get and the value of the same. The total amount should match with what you have in Form 16 header “Value of perquisites under section 17(2)”. Following are the 18 options:

- Accommodation

- Cars / Other Automotive

- Sweeper, gardener, watchman or personal attendant

- Gas, electricity, water

- Interest free or concessional loans

- Holiday expenses

- Free or concessional travel

- Free meals

- Free education

- Gifts, vouchers, etc.

- Credit card expenses

- Club expenses

- Use of movable assets by employees

- Transfer of assets to employee

- Value of any other benefit/ amenity/ service/privilege

- Stock options (non-qualified options)

- Tax paid by employer on non-monetary perquisite

- Other benefits or amenities (please enter the details in a separate text box).

In our case we just had 1 perk – Cars / Other Automotive with annual perquisite value of Rs 21,600.

Third Section: Profits in lieu of salary under section 17(3) (as 3)

For most cases this is not applicable but has following four choices available:

- Any compensation due or received by an assessee from an employer or former employer in connection with the termination of his employment or modification of the terms and conditions relating thereto.

- Any payment due or received by an assessee from an employer or former employer, or from a provident or other fund (excluding employees contribution and interest thereon), or any sum received under Keyman Insurance Policy, including bonus on such policy.

- Any amount due or received by an assessee from any person before joining any employment with that person, or after cessation of his employment with that person.

- Any other (please enter the details in a separate text box).

Fourth Section: Allowances to the extent exempt under section 10 (as 4)

There are 13 exempt allowances listed under this section which you can choose from the drop down box. In case you do not find your’s you can select Any Other and fill the details:

- Sec 10(5)- Leave Travel concession/assistance

- Sec 10(6)- Remuneration received as an official, by whatever name called, of an Embassy, High Commission etc

- Sec 10(7)- Allowances or perquisites paid or allowed as such outside India by the Government to a citizen of India for rendering services outside India

- Sec 10(10)- Death–cum-retirement gratuity received

- Sec 10(10A)- Commuted value of pension received

- Sec 10(10AA)- Earned leave encashment on retirement

- Sec 10(10B)(i)- Retrenchment Compensation received in respect of schemes not approved

- Sec 10(10B)(ii)- Retrenchment Compensation received in respect of approved scheme

- Sec 10(10C)- Amount received/receivable on voluntary retirement or termination of service

- Sec 10(10CC)- Tax paid by employer on nonmonetary perquisite

- Sec 10(13A)- House rent allowance

- Sec 10(14)(i)- Prescribed allowances or benefits specifically granted to meet expenses incurred in performance of duties of office or employment

- Sec 10(14)(ii)- Prescribed allowances or benefits granted to meet personal expenses in performance of duties of office or employment or to compensate for increased cost of living

- Any Other – In case of any other allowances enter the details in a text box provided

This information too is present in Form 16 directly as “Less: Allowances to the extent exempt under section 10”. In our case it was 2 tax exempt allowances and we have filled the ITR Form accordingly:

- House rent allowance under section 10(13A)

- Travel concession or assistance under section 10(5)

Fifth Section: Deductions under section 16 (as 5)

You can fill this section again directly from Form 16 with the header “Less: Deductions under section 16”. We had two valid fields for our case:

- Standard deduction under section 16(ia): Rs 40,000

- Tax on employment under section 16(iii): Rs 2,400

Helpful Posts on e-filing ITR for AY 2019-20

- 9 Most Important Changes in ITR Forms for AY 2019-20

- Calculate your Tax liability for FY 2018-19 (AY 2019-20)

- Download 44 page slideshow showing all tax exemptions

- Which ITR form to fill for Tax Returns for AY 2019-20?

- Filing ITR for Senior Citizen with Pension & FD (With Screenshots)

- How to Claim Tax Exemptions while filing ITR?

- Use Challan 280 to Pay Self Assessment Tax Online

- Form 26AS – Verify Before Filing Tax Return

- 5 Ways to e-Verify your Income Tax Returns

- What if You DO NOT file your Returns by due Date?

- Can I file my Last Year Tax Return?

- Why and How to Revise Your Tax Return?

- What does Intimation U/S 143(1) of Income Tax Act mean?

- What happens after you file your ITR?

Salary from Multiple Employer

In case you have changed jobs in last financial year, you would have worked with more than one employer. In this case you need to enter all the above details for all employers. You can add more employers by clicking on the green button with label “Add Employer”

Salary Details in ITR Form

I think with the revised Form 16 life has become easier for tax payers to pick numbers directly from it and fill up details of salary income in respective ITR Forms 1,2,3 & 4. Do not forget to mention exempt allowances or other details. Income Tax Department now has all the details of your salary component directly from employer and any mismatch may invite further notices. So be careful while filling numbers and choose the right headers. We hope this post would have helped you in “filling Details of Income from Salary in ITR Form”.

Respected sir, Kindly show ITR 2 how to file…in context of mutual fund Gain / loss…(STCG& LTCG)