Repo (Repurchase) rate is the interest rate on which the banks borrow money from RBI (Reserve Bank of India) for their short term needs. These repo rates are fixed by RBI from time to time.

Why is Repo Rate Required?

Repo rate is one of the tools available with RBI to control the money flow in the economy. If RBI wants to make borrowing money expensive it increases repo rates and vice-versa.

Also Read: Impact of RBI Rate Cut on Your Investments and Loans

Historical Repo Rates:

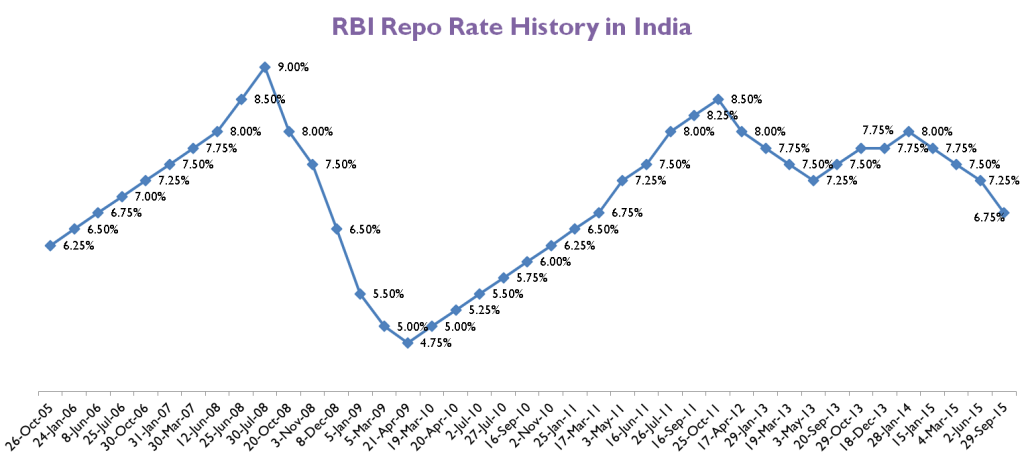

The table gives the historical repo rates as fixed by RBI from time to time.

| Date | Repo Rate | Repo Increase/Cut |

| 26-Oct-05 | 6.25% | 0 |

| 24-Jan-06 | 6.50% | -0.25% |

| 8-Jun-06 | 6.75% | -0.25% |

| 25-Jul-06 | 7.00% | -0.25% |

| 30-Oct-06 | 7.25% | -0.25% |

| 31-Jan-07 | 7.50% | -0.25% |

| 30-Mar-07 | 7.75% | -0.25% |

| 12-Jun-08 | 8.00% | -0.25% |

| 25-Jun-08 | 8.50% | -0.50% |

| 30-Jul-08 | 9.00% | -0.50% |

| 20-Oct-08 | 8.00% | 1.00% |

| 3-Nov-08 | 7.50% | 0.50% |

| 8-Dec-08 | 6.50% | 1.00% |

| 5-Jan-09 | 5.50% | 1.00% |

| 5-Mar-09 | 5.00% | 0.50% |

| 21-Apr-09 | 4.75% | 0.25% |

| 19-Mar-10 | 5.00% | -0.25% |

| 20-Apr-10 | 5.25% | -0.25% |

| 2-Jul-10 | 5.50% | -0.25% |

| 27-Jul-10 | 5.75% | -0.25% |

| 16-Sep-10 | 6.00% | -0.25% |

| 2-Nov-10 | 6.25% | -0.25% |

| 25-Jan-11 | 6.50% | -0.25% |

| 17-Mar-11 | 6.75% | -0.25% |

| 3-May-11 | 7.25% | -0.50% |

| 16-Jun-11 | 7.50% | -0.25% |

| 26-Jul-11 | 8.00% | -0.50% |

| 16-Sep-11 | 8.25% | -0.25% |

| 25-Oct-11 | 8.50% | -0.25% |

| 17-Apr-12 | 8.00% | 0.50% |

| 29-Jan-13 | 7.75% | 0.25% |

| 19-Mar-13 | 7.50% | 0.25% |

| 3-May-13 | 7.25% | 0.25% |

| 20-Sep-13 | 7.50% | -0.25% |

| 29-Oct-13 | 7.75% | -0.25% |

| 18-Dec-13 | 7.75% | 0.00% |

| 28-Jan-14 | 8.00% | -0.25% |

| 15-Jan-15 | 7.75% | 0.25% |

| 4-Mar-15 | 7.50% | 0.25% |

| 2-Jun-15 | 7.25% | 0.25% |

| 29-Sep-15 | 6.75% | 0.50% |

I heard in a TV discussion : Historically growth rate of deposits in Indian Banks has touched 50 year low. This means that sensible savers are switching their loyalty to some other avenues to protect their interest. Given the NPA syndrome, banks are no more a safe haven to park the hard earned money of Senior Citizen. It is so very unfortunate that the Govt has chosen to reduce the Post Office Savings Rates, that too on a floating basis every quarter. Post Offices also will lose their sheen. Govt should review their decision on protecting the deposit rates at post office, just like the recently introduced MCLR mechanism for bank’s lending operations

RBI Repo Rate cut will badly affect to the Investors who want to invest in the schemes like Fixed Deposits and Recurring Deposits, on the other side it will act as a blessing for the New Borrowers as they need to pay low EMI for the same Loan Amount now.

This will not effect much to the existing borrowers, But this will badly affect to Senior Citizens who are dependent on the interest of Fixed Deposits as their regular income.

It will impact the sales of Automobile Sectors also in the Festival season as Loan will be cheaper now and definitely going to positively affect the Real Estate market as Home Loan will be cheaper now.

But to cut Repo Rate 4 times in just 9 months, I don’t think going to impact positively to Indian Consumers.

I totally agree with your comments Shikha. If you see the overall impact of rate cuts it’s the savers who loose and borrowers who gain. But unfortunately due to functioning of Indian banks savers loose much more as the deposit rates have already come down by more than 2% in last 1 year while the lending rates have hardly come down by 0.5% to 0.75%.

About the positive impact on home & auto sector I really doubt because such low reductions hardly impact your EMI. If you take home loan of Rs 50 lakhs and the rate reduction happens from 10.5% to 10% the monthly saving in EMI is Rs 1,650. This is not going to impact your decision to buy a Rs 65 Lakh house 🙂

I am more worried about Government looking to reset interest rates on Small saving schemes like PPF, Senior Citizen Savings Scheme, etc under pressure from banks.