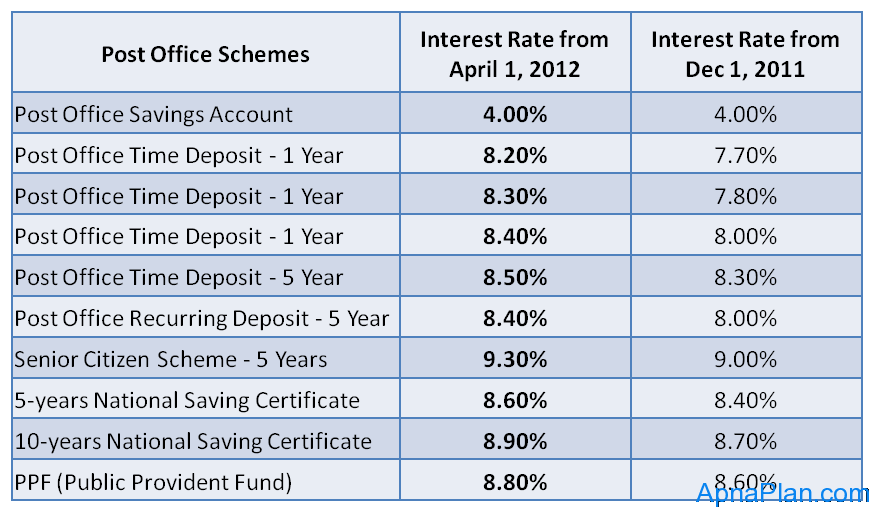

Finally the interest rates for small savings schemes such as public provident funds (PPF), post office deposits and National Savings Certificate (NSC) have been increased by 0.2% – 0.5%.

The above interest rate increase would be effective from April 1, 2012.

Now, deposits in PPF account will fetch 8.8% a year, compared with 8.6% now, while 10-year NSCs will earn 8.9% instead of 8.7%. Savings instruments with a longer tenure of five years or more have seen a more modest increase compared to products such as one or two-year post office deposits where the rise is 50 basis points. In contrast, the Employees Provident Fund Organization will pay 8.25% on EPF (Employee’ Provident Fund).

| Scheme | Interest Rate from April 1, 2012 | Present Interest Rate |

| Post Office Savings Account | 4.00% | 4.00% |

| Post Office Time Deposit – 1 Year | 8.20% | 7.70% |

| Post Office Time Deposit – 1 Year | 8.30% | 7.80% |

| Post Office Time Deposit – 1 Year | 8.40% | 8.00% |

| Post Office Time Deposit – 5 Year | 8.50% | 8.30% |

| Post Office Recurring Deposit – 5 Year | 8.40% | 8.00% |

| Senior Citizen Scheme – 5 Years | 9.30% | 9.00% |

| 5-years National Saving Certificate | 8.60% | 8.40% |

| 10-years National Saving Certificate | 8.90% | 8.70% |

| PPF (Public Provident Fund) | 8.80% | 8.60% |

The good news is the investment of up to Rs 1 lakh in most small savings schemes such as PPF and NSC qualify for income tax relief. This would start competing with Bank Fixed deposits, which would be now under pressure to increase their Fixed Deposit rates.

You can know all about above Small Savings Schemes like NSC, PPF, etc by Govt. of India here.

For the convenience of readers I am uploading the revised interest rates in picture form, so that you can download it keep it for ready reference.