What is the interest rate on PPF (Public Provident Fund) for 2019? How and when the interest rates of PPF set? What are the historical interest rates offered? We try to answer these common queries about PPF in this post.

PPF is one of the most popular and probably one of the best investment options in India. And rightly so because of the features, tax benefit and almost risk-free returns that it offers.

How and when does the interest rates change?

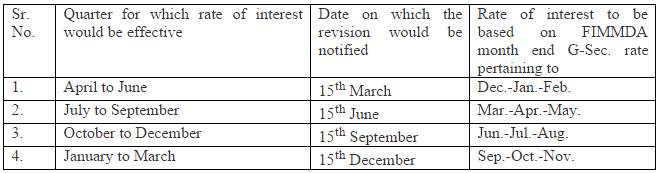

Starting April 2016, Government of India announces interest rate on small saving schemes including PPF, Sukanya Samriddhi Account, Senior Citizen Savings Scheme, Post Office Fixed and Recurring Deposits every quarter. This is done to keep these interest rates in sync with the market rates. The table below shows the interest reset schedule:

Also Read: Best Tax Saving Investments u/s 80C

PPF Interest Rate History:

PPF was launched in 1986-87 and offered interest rate of 12%. It remained so till year 2000. After this the rates started coming down. From April 2003 to March 2011, PPF offered 8% interest. Starting April 2011, the interest rates for PPF along with other small saving schemes was linked to government bond yields. As of 2019, PPF interest rates are 7.9% (Jul to Sep)

The table below gives the details of PPF interest rates.

Starting FY 2016-17 interest rates were reset quarterly

| Financial year | Apr – Jun | Jul – Sep | Oct – Dec | Jan – Mar |

| 2019 – 20 | 8.00% | 7.90% | ||

| 2018 – 19 | 7.60% | 7.60% | 8.00% | 8.00% |

| 2017 – 18 | 7.90% | 7.80% | 7.80% | 7.60% |

| 2016 – 17 | 8.10% | 8.10% | 8.10% | 8.00% |

Before FY 2016-17 interest rates were reset every year (Sometimes adhoc)

| Financial Year | Interest Rate | Comments |

| 2015 – 16 | 8.70% | |

| 2014 – 15 | 8.70% | |

| 2013 – 14 | 8.70% | |

| 2012 – 13 | 8.80% | |

| 2011 – 12 | 8.20% | 8% for Apr’11 to Nov’11 and 8.6% for Dec’11 to Mar’12 |

| 2010 – 11 | 8.00% | |

| 2009 – 10 | 8.00% | |

| 2008 – 09 | 8.00% | |

| 2007 – 08 | 8.00% | |

| 2006 – 07 | 8.00% | |

| 2005 – 06 | 8.00% | |

| 2004 – 05 | 8.00% | |

| 2003 – 04 | 8.00% | |

| 2002 – 03 | 8.92% | 9% for Apr’02 to Feb’03 and 8% for Mar’03 |

| 2001 – 02 | 9.46% | 9.5% for Apr’01 to Feb’02 and 9% for Mar’02 |

| 2000 – 01 | 10.88% | 11% for Apr’00 to Feb’01 and 9.5% for Mar’01 |

| 1999 – 00 | 11.83% | 12% for Apr’99 to Jan’00 and 11% for Feb’00 to Mar’00 |

| 1998 – 99 | 12.00% | |

| 1997 – 98 | 12.00% | |

| 1996 – 97 | 12.00% | |

| 1995 – 96 | 12.00% | |

| 1994 – 95 | 12.00% | |

| 1993 – 94 | 12.00% | |

| 1992 – 93 | 12.00% | |

| 1991 – 92 | 12.00% | |

| 1990 – 91 | 12.00% | |

| 1989 – 90 | 12.00% | |

| 1988 – 89 | 12.00% | |

| 1987 – 88 | 12.00% | |

| 1986 – 87 | 12.00% |

Also Read: All you wanted to know about PPF

Best Features of PPF:

- PPF has sovereign guarantee which mean the principal and interest is guaranteed by Government of India. This makes its Credit risk almost zero!

- PPF cannot be attached by courts or government under any circumstances.

- The tax on PPF is EEE (Exempt- Exempt- Exempt) which means that there is tax benefit when investment is made, there is no tax when the investment earns interest every year and there is also no tax when the investment is withdrawn on maturity.

- The investment in PPF up to Rs 1,50,000 is exempted from income tax u/s 80C. [Budget 2014]

Download Excel based PPF Calculator for Maturity, Loan & Partial Withdrawal

PPF Account – Investment Rules:

- The interest is compounded annually and is credited to the account at the end of financial year.

- The interest in PPF is calculated on minimum balance between 5th to the last day of the month. So you should make your investment before 5th of the month or it would not get interest for the month.

- One Person can only open one PPF Account. If additional account is found, no interest would be paid on that.

- The limit for deposit on PPF is Rs 1.5 Lakhs per year [increased in Budget 2014]. If you manage to deposit more than that in financial year, no interest would be paid on that.

- You need to invest minimum of Rs 500 in a financial year.

- On non-deposit of at least Rs 500 in a financial year the account is discontinued. The discontinued PPF account continues to earn interest.

- To revive the discontinued PPF account, you need to pay penalty of Rs 50 per year of non-payment along with the deposit of Rs 500 per missing payment year.

- The deposit should be in multiple of Rs 10. You cannot deposit Rs 501 but deposit Rs 500 or Rs 510.

- You can make maximum of 12 deposits in a financial year. It need not necessarily be monthly.

- There is provision of Loan against PPF, partial withdrawal, pre-mature closure and extension of PPF account.