Post Office Monthly Income Scheme (PO-MIS) is a good scheme to generate fixed income every month by depositing a fixed amount. We have designed a simple excel based Post Office MIS calculator where you can input the investment amount, interest rate and it will calculate monthly income and maturity value.

Post Office MIS Calculator

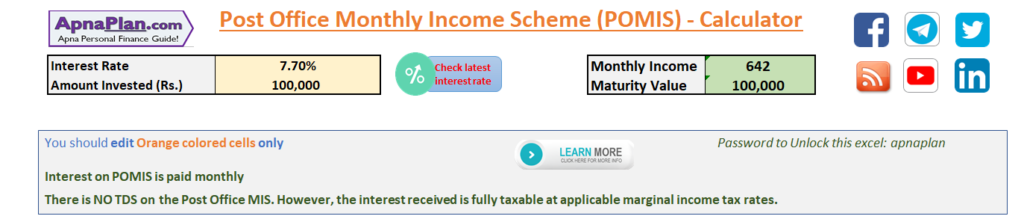

Calculating Post Office MIS monthly interest payout is pretty simple using the formula below:

Monthly Interest in POMIS = Amount Invested * Annual interest Rate/12Using this formula, if you invest Rs 1 Lakh at 7.7% interest, the monthly interest payout is Rs 642 (1,00,000 * 7.7%/12)

How to use POMIS Calculator?

As you can see in the picture above, the POMIS calculator is quite simple and easy to use. You just need to input the amount invested and the interest rate. The calculator will calculate the monthly interest income and the maturity value. Just to mention the maturity value is same as amount invested.

Post Office MIS Interest Rate

As of June 2021, Post Office MIS or POMIS offers interest rate of 6.6% (April to June 2021 quarter). This interest is paid every month to the linked saving account. There is NO additional interest paid for Senior citizens. The interest rate is reset by Government of India at start of every quarter on January 1, April 1, July 1 and October 1. The good news is this interest rate is generally higher than most banks offer. As the Government subsidises the interest rate the limit of investment in POMIS is Rs 4.5 Lakhs for single account holder and Rs 9 lakh for Joint account.

Post Office MIS Plan – Rules & Features

Following are the rules and features related to Post Office MIS Plan

Investment Limit

- The maximum investment limit is Rs 4.5 lakh for individuals and Rs 9 lakh in case of joint account.

- The maximum limit for account for minor is Rs 3 lakh.

- The minimum investment amount is Rs 1,500 (Investment can be made in multiples of 1500)

The tenure for Post Office MIS is 5 years and can be extended to another 5 years on maturity.

On maturity, the principal amount is returned back to the investor.

From April 1, 2016 the interest rate on Post Office MIS is reset every quarter i.e. in April, July, October and January. For FY 2020-21 (July to September 2020) the interest rate is 6.60%.

Interests are paid monthly under this scheme. There is no additional interest for senior citizens.

You must also have or open Post Office Savings account where the monthly interest payment would be credited.

Premature closure of POMIS is allowed after completion of 1 year. If the account is closed between 1 to 3 years, 2% of the deposited amount is deducted as penalty. The penalty is 1% if the POMIS is closed after 3 years.

Calculator for Small Saving Scheme – PPF, SCSS, Sukanya Samriddhi, NSC, Post Office FD/RD/MIS

Small saving scheme sponsored by Government of India like Sukanya Samriddhi Account, PPF, Senior Citizens’ Savings Scheme are quite popular and rightly so because of the safety, higher interest rate offered among other things. We have built calculator for each of them where you can check the maturity amount, loan eligibility, partial withdrawal and more. Click on the links to get the relevant calculator

Sukanya Samriddhi Yojana Calculator

Senior Citizens’ Savings Scheme Calculator

Eligibility for Post office MIS Account

Post office MIS Account is an excellent low risk investment option for regular income. Following people are eligible for opening POMIS account:

- The account holder should be 18 years or more and resident of India. Hence NRIs are not eligible to open Post office MIS Account.

- Parents/Legal guardian can open account on behalf of their children if they are above 10 years of age. The investment limit for a minor is Rs 3 Lakh.

- The minimum amount for opening the account is Rs 1,500 and the maximum limit is Rs 4.5 lakh for single account and Rs 9 Lakh for joint account

Advantages of Post office MIS

Post office MIS – POMIS is a very good investment product and offer following benefits:

- Safety of Principal & Interest Payment – The POMIS is offered and backed by Government of India, which makes it completely safe from credit default. You can sleep peacefully that you won’t loose this money.

- Higher Interest rate than Banks – As mentioned above, the interest rate for Post Office MIS is higher than most big banks (including the senior citizens rates). This leads to a higher payout every month.

- Easy to Invest and Manage – Its very easy to invest and manage POMIS. You just need to visit Post Office once while opening or closing the account. The interest is credited to your saving account every month which can be accessed through ATM or online.

- Guaranteed Returns – Once invested the interest rate is guaranteed for the entire tenure of investment. This means you need not be worried on how much money would be credited to your account every month.

- Can be transferred as you move – The account can be transferred from one post office to other, so you need not worry if you move places.

Is there any extra advantages of post office MIS for senior citizens?

There is NO additional interest rate offered to senior citizens in POMIS. However this is a good product for senior citizens for regular retirement income. They can easily invest up to Rs 9 Lakhs (joint account between husband and wife) and get Rs 4,950 every month (assuming 6.6% interest rate) directly in savings account without any hassles. The other good thing is the interest rate for Post Office MIS is still higher than most bank offers to senior citizens.

Get Highest Fixed Deposit Interest Rates

Fixed Deposit with Banks is one of the most popular and convenient investment option. To help you choose the best, we compare the interest rates on fixed deposit across all major 48 banks in India including government, private, foreign and small financial banks in India every month. This may prove to be quite handy for you in choose the Best Bank FD scheme.

How to Open POMIS Account?

Opening POMIS Account is not a difficult thing. You need a set of KYC documents, filled up application form and go and deposit to Post Office. As of now it does require physical visit to the post office while opening the account. Here are the steps to Open the POMIS account:

- Visit your local Post Office

- Ask for the POMIS Form and fill it. It would be even more convenient if you download it online, print it and fill it before hand. This would save you lot of time at post office.

- The form also asks for Nominee details but it is not compulsory. You can also fill up nominee details on a later date or update it as required. This is a point to keep in mind as nomination form requires witness signatures. In case you are unable to find witness at that time you can always do it later.

- Deposit the filled up POMIS Form along with KYC documents, cash or cheque payment of the deposit amount (minimum Rs 1,500)

- The Post Office will issue your POMIS passbook with all the relevant details

Following are the list of documents required for opening POMIS Account

- Two Passport size photographs

- Address Proof

- Identify Proof (Aadhar Card, Voter ID, Pan Card, Ration Card, Driving License or Passport, etc.)

You should have both original and a copy of the documents you submit. You need to self-attest the photocopies and show the original for verification.

How to generate Regular Monthly Income?

There can be several situations when we look for regular income. This is especially true for people after retirement without any pension. Also there would be new entrepreneurs who need regular income until their start-up stabilises. We tell you 13 investments which can generate regular income for you along with their pros and cons.

Tax on Post Office MIS Scheme

There is NO TDS on the Post Office MIS. However, the interest received is fully taxable at applicable marginal income tax rates. Effective April 1, 2018 Interest income up to Rs 50,000 is exempted from tax for Senior citizens u/s 80TTB [Budget 2018]

What Schemes you can Invest in Post Office?

Along with Post Office MIS Plan, you can invest in multiple financial products in Post Office. Following is the list:

- Post Office Savings Account

- Senior Citizens Savings Scheme

- Kisan Vikas Patra

- Public Provident Fund Account

- Sukanya Samriddhi Yojana

- 5-Year Post Office Recurring Deposit Account

- Post Office Time Deposit Account (1, 2, 3 & 5 Year duration)

- National Savings Certificate

Is Money Safe in Post Office?

This is a great question – anywhere you invest, you must ask if your money is safe. Your money is 100% safe in all the post office schemes. As all these investments are backed by Government of India so there is absolutely no chance of any default on principal repayment of timely interest payment. This is one of the reason why most post-office schemes makes sense to invest especially for low-risk taking person.

Post Office MIS Calculator FAQ

✅How to use the POMIS Calculator?

Just input your investment amount and interest rate. The calculator would give you the monthly payout you would receive and the maturity amount which is same as invested amount.

✅Who can open Post Office MIS?

Any resident Indian can open Post Office MIS account.

✅Is there investment limit for Post Office MIS?

The minimum investment amount is Rs 1,500. The maximum limit is Rs 4.5 Lakhs for individual accounts and Rs 9 Lakh if held jointly.

✅What is the maturity period for Post Office MIS?

The maturity period of POMIS is 5 years and it can be extended for another 5 years. On maturity the invested amount is returned to the investor.

✅Does Post Office MIS give any tax benefit?

Post Office MIS does NOT have any tax benefit.

✅What is the interest rate on POMIS?

The interest on Post Office MIS is reset every quarter. For the July to September 2020 quarter it is 6.6%.

✅Can you take loan against Post Office MIS?

No you cannot borrow against Post Office MIS.

✅Can NRIs invest in Post Office MIS?

NRIs cannot invest in Post Office MIS.

✅Can Post Office MIS be closed prematurely?

Premature closure of POMIS is allowed after completion of 1 year. If the account is closed between 1 to 3 years, 2% of the deposited amount is deducted as penalty. The penalty is 1% if the POMIS is closed after 3 years.

Is there any exemption U/s 80 C on ist deposit amount

i have one Q.

Why you have not update MIS ( Monthly income account ) calculator

900000