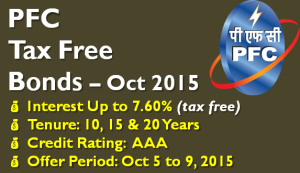

PFC (Power Finance Corporation Ltd), a Navratna company of Government of India is issuing its Tax Free Bond. It would offer coupon rate up to 7.60% for retail investors depending on tenure. You can choose between tenure of 10, 15 and 20 Years. The bond issue would be open for subscription for October 5 to 9, 2015. The post gives the details of the same.

About PFC:

PFC (Power Finance Corporation Ltd) is Government of India Financial institution and can be considered as financial back bone of Indian Power Sector. It provides financial assistance to power projects across India including generation, transmission, distribution and RM&U projects.

Salient Features: PFC Tax Free Bonds 2015

- Offer Period: October 5 to 9, 2015 (the offer can be pre-closed on full subscription)

- Annual Interest Rates for Retail Investors: 7.36% for 10 Years, 7.52% for 15 Years, 7.60% for 20 Years

- The interest rates are 0.25% less for HNIs, QIBs and corporate subscribers.

- NRIs can invest in these bonds

- 40% of issue is reserved for Retail Investors

- Price of each bond: Rs 1,000

- Minimum Investment: 5 Bonds (Rs 5,000)

- Max Investment Limit for Retail Investor: Rs 10 Lakhs

- Can be applied both in Physical and Demat Form

- Allotment: First Come First Serve

- Listing: Bonds would be listed on BSE and will entail capital gains tax on exit through secondary market

- Tax/TDS: As these are tax Free Bonds so no tax is to be paid and there is no TDS on interest

Also Read: PPF – A Must Have Investment

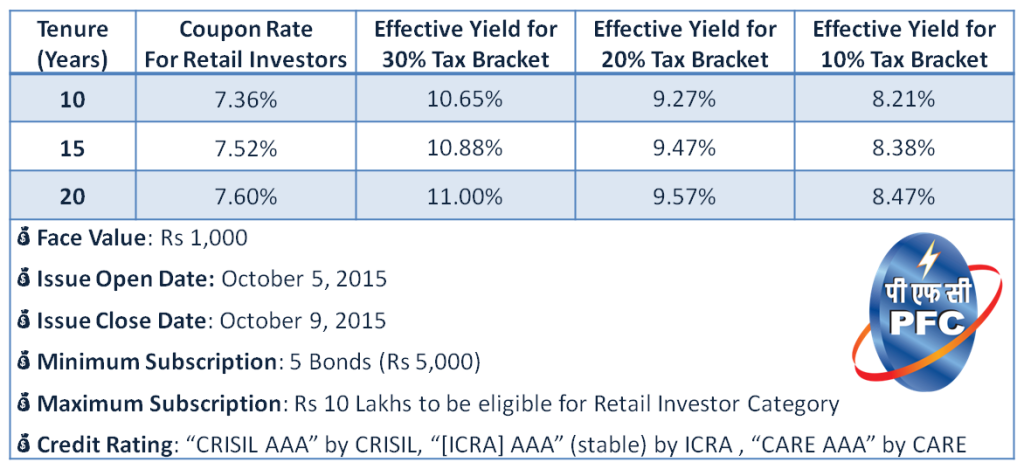

PFC Tax Free Bond – Interest Rate:

The PFC Tax Free Bond offers the following interest rates. The interest would be paid every year.

The table also shows the effective interest rate for different tax slabs. For e.g. To earn post tax 7.36% interest on deposit a person in 30% tax bracket should actually get pre tax return of 10.65%.

How Interest Rate on Tax Free Bonds Determined?

As per rules, the interest rate offered on Tax-free bonds are linked to yield on Government Bonds. Companies with AAA rated tax free bonds can offer up to 55 basis points lower to the G-Sec yield to retail investors and 80 basis points lower for other investors.

Who should invest?

Tax Free Bonds are suited for people in the tax bracket of 20% or higher who are looking for regular and safe income. In case you do not want regular income you should first exhaust your Rs 1.5 lakhs PPF limit where the returns are 8.7% and tax free. Salaried employees should opt for VPF before looking at tax free bonds. Both the above options have higher returns, tax free and partial exit options after 5/6 years.

Also Read: What is the Maximum Income Tax You can Save for FY 2015-16?

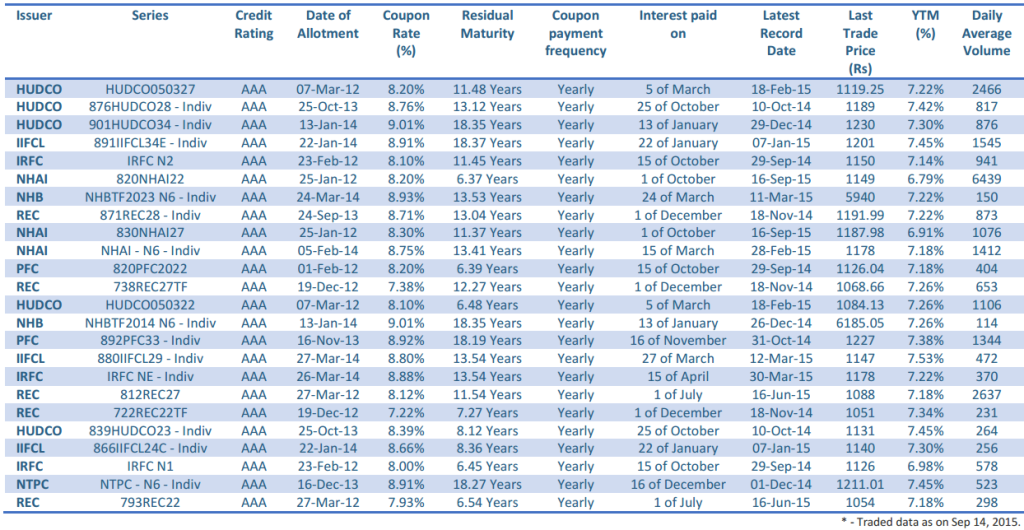

Tax Free Bonds – Secondary Market:

You can also buy Tax free bonds from the secondary market that are listed on stock exchanges. The table below gives the snapshot of the best tax free bonds available in secondary market. You can compare the YTM (last column) to the interest offered on PFC.

The problem is liquidity of bonds. There are very few transactions in a day and you might not be able to buy at fair price. Also you incur brokerage in tune of 0.5% to 1% on these purchases.

Why you should invest?

- Almost “NO” credit risk. The bonds are rated “AAA” and the company is owned by Government of India. The bonds are secured to the full extent and have the highest credit rating (AAA).

- For retail investors, the interest offered is higher than the offers on Tax free bonds in Secondary Market.

- Good for investors in the tax bracket of 20% or higher looking for safe and regular income for long duration.

- There are chances of further rate cut by RBI in next 3 to 6 months. If it happens there would be capital appreciation of around 8% to 10% in the bond price.

Why you should not invest?

- PPF and EPF/VPF offer tax free interest rate of more than 8.7%. So you should first exhaust those options especially if you are not looking for regular income.

- If you are in 10% tax bucket or pay no taxes. You would be better off with banks Fixed deposits or debt mutual funds.

Also Read: Highest Interest Rate on Recurring Deposits [comparing 41 banks]

How to Apply?

The bonds can be issued both in physical and demat form. For applying through Demat Account, go to the IPO/NCD/Bonds offer tab of your Demat account and fill out relevant details.

You can download the Physical Form from the Edelweiss Financial Services and follow the instructions.

To Conclude:

PFC Tax Free Bonds 2015 suits investors who are looking for safe, regular income and are in the higher tax bracket. A few more PSUs are going to issue tax free bonds in coming days. The interest rate is expected to be similar. NTPC Tax Free Bond were subscribed 11 times on the first day itself, so if you want to subscribe these bonds, invest early as these would be grabbed very soon and may close for subscription if it gets fully subscribed before closure date.

Hi i have invested in the PFC in 2015. how do i get a statement for the same or will i not get anything from PFC directly if invested in demat form through HDFC securities?

If the bonds have been allotted to your you would get an email confirmation for the same and the PFC bonds would be present in the HDFC securities demat account. Please check.