In last few weeks I have got several mails and comments asking about the tax benefit on NPS. This post explains the tax deduction availa/ble for NPS under 3 sections: 80CCD(1), 80CCD(2) and 80CCD(1B).

Tax Benefit on NPS Tier 1 and/or 2?

NPS has two Tiers – 1 and 2.

NPS Tier 1 is the long term investment, which has restricted withdrawals and meant primarily for retirement planning. On maturity, you can withdraw maximum of 60% of corpus as lumpsum and rest has to be used for annuity purchase.

NPS Tier 2 is for managing short to medium term investment. You can invest and withdraw anytime as per your wish. This is an optional feature and you are asked if you need Tier 2 account while opening NPS.

All the tax benefit related to NPS is available to investment in NPS Tier 1 account only.

Also Read: When and How can Tax Benefits Claimed Earlier be Reversed?

NPS Tax Benefits:

NPS tax benefits are available through 3 sections – 80CCD(1), 80CCD(2) and 80CCD(1B). We discuss each below:

1. Section 80CCD(1)

Employee contribution up to 10% of basic salary and dearness allowance (DA) up to 1.5 lakh is eligible for tax deduction. [This contribution along with Sec 80C has 1.5 Lakh investment limit for tax deduction]. Self employed can also claim this tax benefit. However the limit is 10% of their annual income up to maximum of Rs 1.5 Lakhs.

2. Section 80CCD(1B)

Additional exemption up to Rs 50,000 in NPS is eligible for income tax deduction. This was introduced in Budget 2015.

Also Read: Should You invest in NPS to take tax benefit u/s 80CCD(1B)

3. Section 80CCD(2)

Employer’s contribution up to 10% of basic plus DA is eligible for deduction under this section above the Rs 1.5 lakh limit in Sec 80CCD(1). This is also beneficial for employer as it can claim tax benefit for its contribution by showing it as business expense in the profit and loss account. Self employed cannot claim this tax benefit.

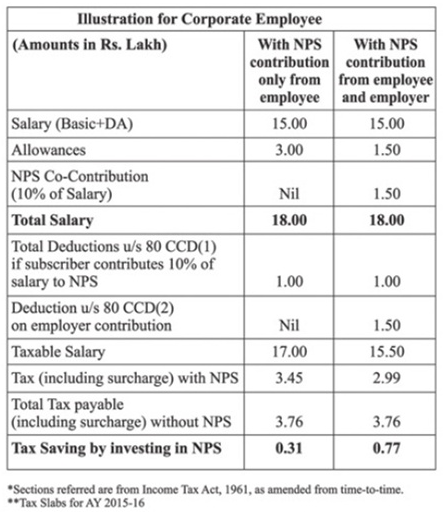

Below is the illustration on how introducing NPS can help you save tax under Section 80CCD(2).

Tax Benefit for Compulsory NPS deduction:

The earlier pension structure was replaced by NPS in most central and state government jobs since 2004. So anyone who joined after that has compulsory deduction for NPS. The deduction is 10% of basic salary and dearness allowance (DA) and the employer too contributes the matching amount. The confusion for most employees is how they take tax benefit on their compulsory NPS deduction?

Here is an example:

Amit is a government employee and his employer deducts Rs 62,000 per annum (which is 10% of basic + DA) from salary as employee’s contribution in NPS. It also deposits Rs 62,000 per annum as employer’s contribution in NPS. How and under which section should he claim tax benefit on NPS?

Let’s take the easy part first. Employee’s contribution in NPS would be eligible for tax deduction u/s 80CCD(1).

The employee has a choice as to which section [80CCD(1) or 80CCD(1B)] he wants to show his contribution. Ideally he should show Rs 50,000 investment in NPS u/s 80CCD(1B). The tax deduction on rest Rs 12,000 can be claimed u/s 80CCD(1). The section 80CCD(1) along with Section 80C has investment limit eligible for tax deduction as Rs 1.5 lakhs. So he should make additional investment of Rs 1,38,000 in Section 80C to save maximum tax. In all he can save Rs 2 lakhs tax u/s 80C and 80CCD(1B).

I hope this would have cleared the confusion on how NPS helps you save tax.

Sir I am a rajasthan govt employee

I deduct 31473 rupees in nps this year

Same 31473 rupees govt give for us

So I would get tax benifit on rupees 31473 or rupees 62946 (31473+31473) under 80ccd1 and 80ccd2

You would get tax benefit on 31473 only. The government contribution is not shown in your Form 16 – hence its anyway exempted from tax.

I am a govt. employee and my contribution in NPS is Rs.45000/-per annum(10% of basic & DA) & i invest as LIC premium as 150000/- per annum.So please advice me to how much amount i show in different section of Incom tax.

Show NPS u/s 80CCD(1B) and LIC Premium in 80C. This will enable you to claim Rs 1.5 Lakh + 45,000 tax exemption

Hello Mr. Amit. I read your presentation on IT savings and found it really helpful. Same is the case with NPS benefits. Then suddenly a thought crossed my mind.

I am a govt employee and my NPS contribution is shown as investment u/s 80CCD(1) (i.e., NPS tier 1) by my employer. What should I do so that this fund is shown as investment in NPS tier 2 so as to claim deductions U/s 80CCD(1B)? In other words, can I still declare NPS contribution from salary u/s 80CCD(1B)? Kindly suggest

You are on the right track and you should show your mandatory investment in NPS u/s 80CCD(1B) upto Rs 50K. Also note that the tax benefit is available for Tier 1 only and not Tier 2.

Sir, during calculating my tax, I am not taking the employee contribution i.e., 80 CCD(1) and also I am not taking employer contribution i.e., 80 CCD (2) and in deduction I am showing the NPS contribution (employee contribution) I.e., 80 CCD (1), is it correct

Yes you should only show employee contribution. Follow your Form 16 strictly – it does not mention employer contribution.

Hi, amit my name is prasad, my gross salary is 7,30,000 rs, my nps contribution is 67,000 rs and employer contribution is also 67,000 rs, other than nps my savings is 95,000 rs that includes LIC,KGID and etc, for this how can I divide my nps to 80ccd(1) , 80ccd(1b) and 80ccd(2), what’s my total savings and how much I have to pay tax.

You should show your (employee) contribution of Rs 50,000 in Sec 80CCD(1B). Rest Rs 17,000 NPS contribution can be shown in 80CCD(1). You can make additional investment of Rs 1,33,000 in ELSS, FD etc u/s 80C to claim more tax exemption.

Hi Amit!!

If i invest 6k in tier 1 n 45 k in tier 2 of NPS can i get the exemption of 50k u/s 80ccd 1b

No the taxexemption u/s 80ccd(1b) is for NPS tier 1 only

Hi Amit,

If i invest 50 k in tier 2 of NPS can i claim the same in 80CCD (1b)

Sir,

Suppose I have Gross Salary of Rs. 10.00 Lacs and it doesn’t include any income on account of 10% NPS contribution from my Employer.

If NPS contribution by my employer is around Rs. 0.80 Lacs, kindly let me know if I can directly show it under 80CCD(2) and claim income tax benefit or 1st I have to increase my Gross Salary to Rs. 10.80 Lacs and thereafter has to claim 80 CCD(2) on Rs. 0.80 Lacs.

Please guide.

You have to increase the salary to 10.8 and then show the exemption. So it would give you no additional tax benefit. Fill up your tax returns as shown in the Form 16 given by employer.

My employee contribution is 130000 whether I can show 50000 in 80ccd(1B) and balance 80000 along with housing loan principal to max.ceiling of 150000

Yes that would be the right approach!

I have claimed both 80ccd(1) & 80ccd (2) as per my Form 16. Now, I got an intimation from the IT Department for a demand by disallowing my 80CCD (2) Claim? is it wrong to claim both 80CCD (1) & 80CCD(2) together?

80CCD(1) is the employee contribution and 80CCD(2) is employer’s contribution. In most cases 80CCD(2) is not added to the total income in form 16 and so deduction is not shown separately. Just check your Form 16 and if it has shown separate deduction for both 80CCD(1) & 80CCD(2), you can send the same to IT department for exemption.

Thanku Amit

I am retired and aged 72 years. Am I eligible to get IT exemption by contributing to NPS. If not, is their any other method of saving tax for me? I have already taken cover under Sec 80 C full benifit.

NPS account can be opened only by people with age less than 60 years. Unfortunately not many other tax saving avenue is available. However you can download the Tax Planning Guide for FY 2016-17 and check if you have missed any tax benefit.

AMIT I AM a govt. employee and in a tax slab of 30%. is it wiser to invest Rs50000/- in NPS than investing Rs35000/- in a good mutual fund for 30 years?

Well the calculation is in front of you. The only thing that has changed is the taxation in NPS. Investing in NPS to save tax would keep you disciplined, if you can do the same for Mutual fund, go ahead. Also remember this NPS tax break is given to make it popular investment and the tax break may not last forever.

Hello Amit,

I have a question… Assume below case :

My 80 C Investment = 1,50,000 ;

Thus, Tax Deduction under 80C (including 80CCD (1)) = 1,50,000.

My 80 CCD(1B) NPS Investment = 80,000 ;

Thus Tax Deduction under 80 CCD(1B) = 50,000.

What is Tax implication to the remaining Rs 30,000 in NPS ?

Are the returns on that Rs.30,000 taxable. Or it remains invested in the account and Tax is Applicable at the Time of Corpus Withdrawal (Pre-Retirement or Post-Retirement).

Pl. Clarify.

Karthik,V

The treatment of your excess 30,000 investment in NPS is same as rest of NPS. So no worries here!

I have query regarding 80CCD (2)

For deduction under section 80ccd(2), i.e. contribution of my employer towards NPS, the same is to be considered first as my income and then I avail the same amount as Deduction u/s 80CCD(2). Then my tax remains the same? What difference does it make, i did not understand. Will you please explain in detail or with example. please. My case is mentioned below.

I am a Govt. employee & I have CPF account that falls in NPS. For year 2015-16 my NPS contribution is Rs. 60,000, the same amount Rs. 60,000 has been contributed by my employer. I have made investment is LIC & ELSS.

My investment is : LIC + ELSS + NPS (MY CONTRIBUTION) = Rs. 1,50,000. Now the question is can I avail Tax benefit of Rs. 60,000/- of my emplyer’s contribution or not. If i first add it as my income and then get deduction under 80CCD(2). Then my tax remains the same. Please clarify.

Your understanding is correct. The amount contributed does not generally reflect in Form 16 and hence you do not need to take separate tax exemption u/s 80CCD(2). But ultimately this is your money contributed by your employer which is tax free!

Hi Amit,

Through GPF and other investments (LIC+SIP+MF+PPF, etc) I am already availing income tax benefit up to Rs. 1,50,000/- under section 80C. My question is that can I avail additional exemption under section 80CCD(1) under NPS. If so, how much I should invest? I am under 30% income tax slab.

Section 80CCD(1) is already considered in 1.5 Lakh limit with Sec 80C, so there would be no additional benefit. However you can invest up to Rs 50,000 in NPS to get tax benefit u/s 80CCD(1B). This is above the Rs 1.5 lakh limit in Sec 80C.

Hello Mr. Amit, I am salaried person. My annual income is 12,00,000/- but basic salary is 5,16,000/- I am invest for tax saving Rs.1,50,000/- in 80c & Rs.50,000/- in NPS Tier-I. Please suggest after that how to save more tax in 80CCD(2)

You cannot invest in NPS to claim benefit u/s 80CCD(2). This benefit is only possible if your employer contributes in your account!