In last few weeks I have got several mails and comments asking about the tax benefit on NPS. This post explains the tax deduction availa/ble for NPS under 3 sections: 80CCD(1), 80CCD(2) and 80CCD(1B).

Tax Benefit on NPS Tier 1 and/or 2?

NPS has two Tiers – 1 and 2.

NPS Tier 1 is the long term investment, which has restricted withdrawals and meant primarily for retirement planning. On maturity, you can withdraw maximum of 60% of corpus as lumpsum and rest has to be used for annuity purchase.

NPS Tier 2 is for managing short to medium term investment. You can invest and withdraw anytime as per your wish. This is an optional feature and you are asked if you need Tier 2 account while opening NPS.

All the tax benefit related to NPS is available to investment in NPS Tier 1 account only.

Also Read: When and How can Tax Benefits Claimed Earlier be Reversed?

NPS Tax Benefits:

NPS tax benefits are available through 3 sections – 80CCD(1), 80CCD(2) and 80CCD(1B). We discuss each below:

1. Section 80CCD(1)

Employee contribution up to 10% of basic salary and dearness allowance (DA) up to 1.5 lakh is eligible for tax deduction. [This contribution along with Sec 80C has 1.5 Lakh investment limit for tax deduction]. Self employed can also claim this tax benefit. However the limit is 10% of their annual income up to maximum of Rs 1.5 Lakhs.

2. Section 80CCD(1B)

Additional exemption up to Rs 50,000 in NPS is eligible for income tax deduction. This was introduced in Budget 2015.

Also Read: Should You invest in NPS to take tax benefit u/s 80CCD(1B)

3. Section 80CCD(2)

Employer’s contribution up to 10% of basic plus DA is eligible for deduction under this section above the Rs 1.5 lakh limit in Sec 80CCD(1). This is also beneficial for employer as it can claim tax benefit for its contribution by showing it as business expense in the profit and loss account. Self employed cannot claim this tax benefit.

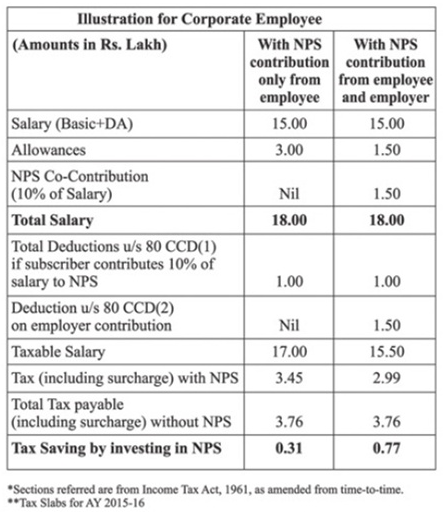

Below is the illustration on how introducing NPS can help you save tax under Section 80CCD(2).

Tax Benefit for Compulsory NPS deduction:

The earlier pension structure was replaced by NPS in most central and state government jobs since 2004. So anyone who joined after that has compulsory deduction for NPS. The deduction is 10% of basic salary and dearness allowance (DA) and the employer too contributes the matching amount. The confusion for most employees is how they take tax benefit on their compulsory NPS deduction?

Here is an example:

Amit is a government employee and his employer deducts Rs 62,000 per annum (which is 10% of basic + DA) from salary as employee’s contribution in NPS. It also deposits Rs 62,000 per annum as employer’s contribution in NPS. How and under which section should he claim tax benefit on NPS?

Let’s take the easy part first. Employee’s contribution in NPS would be eligible for tax deduction u/s 80CCD(1).

The employee has a choice as to which section [80CCD(1) or 80CCD(1B)] he wants to show his contribution. Ideally he should show Rs 50,000 investment in NPS u/s 80CCD(1B). The tax deduction on rest Rs 12,000 can be claimed u/s 80CCD(1). The section 80CCD(1) along with Section 80C has investment limit eligible for tax deduction as Rs 1.5 lakhs. So he should make additional investment of Rs 1,38,000 in Section 80C to save maximum tax. In all he can save Rs 2 lakhs tax u/s 80C and 80CCD(1B).

I hope this would have cleared the confusion on how NPS helps you save tax.

MY AGE 55 YEARS, STATE GOVT. EMPLOYEE, I AM IN OLD PENSION SCHEME, MY 80C SAVINGS EXCEED TO RS.2,30,000/- SHALL I SAVE 80CCD (1B) RS.50000/- HOW AND WHERE?

Iam a Govt.servant of53 years.my total taxablle income for the financial year 2019-20 is 505530/-.can i get tax reduction by investing Rs.6000/- in NPS.My 80C investment exeeds Rs.150000/-

Iam a Female Govt.servant of 53 years.my total taxablle income for the financial year 2019-20 is 505530/-.can i get tax reduction by investing Rs.6000/- in NPS.My 80C investment exeeds Rs.150000/-

If I have received HRA. can I claim with section 80GG for rent paid.

My salary is 10lakh 40k per annum. My CTC (Cost to company) is 11 lakh 40k

I have invested 1.5 lakh in lic as lic premium

I have invested 50thousand in nps as my contribution

Over and above 10 lakh 40k, company puts 1 lakh in nps as company contribution under my name.

Now

Standard deduction 40k

80c deduction 1.5lakh

80ccd(1b) deduction is 50k

80ccd(2) deduction is 1 lakh

What is my taxable income?

7 lakh or 8 lakh

i am Employee for one company and 10% NPS Contributions is deducted per annum 3 lack , I am also having my own business. can i take benefit of this 80CCD(2).

You are already getting benefit of 80CCD(2) from employer contribution!

Sir

My officer added govt contri on cpf in income. I hv to pay tax on govt contri too or this amount will be deducted from salary

No tax on government contribution. Its exempted u/s 80CCD(2)

80ccd(2) is only applicable for Gov. employee / employer ?

can Private sector company give 80ccd(2) benefits to their employees ?

Its applicable to all employers (both private & government)

Sir I am a government employee n nos holder too….. I have 1.5lakh saving under 80 cc now can show another 50k under 80ccd 1B

Yes

What is the maximum limit of deduction under section 80CCD(2)

10% of basic salary. No upper cap for amount

For Govt employees, its flat 14% of Basic + DA (updated this year) and for Pvt. sector employees, the contribution is upto 10% of basic under section 80 ccd(2)

Hello Sir

Read your complete guide on NPS .

I am a government employee, employer deducts NPS ₹72K, I don’t have any other 80c investments , I want to contribute 50k in NPS. Do I need to fill my 80C completely for 80CCD(1B) contribution, or I can contribute and directly claim 50k and claim tax benefit , but under which section I need to, show my investments while filing my ITR.

Kindly help me out with your guidance .

Both 80C & 80CCD(1B) are unrelated. Its your choice on how you want to show your NPS investment split. And anyway it would not impact your overall taxes.

Hi sir. I am a GPF subscriber and m investing in NPS tier 1 can i avail tax exempted benefit under 80CCD(1B)?

meri saving

ppf 80000

lic 76813

mera NPS CONTRIBUTION 62803

GOVT NPS 62803

80C 80CC1 B

80CCD2 ME KESE BATAYE OR

FORM 16 M GOVT APNA JAMA YA 80CCD2 NAHI HO TO PHIR 80CCD2 KA LABH KESE LE

Sir I m nps employee . I have save 128000 under 80c and my nps contribution is 59000…total amount is 187000 can I get 1.5 lac ded. Under 80c and remaining 37000 under 80ccd1b….pls reply

Dear Sir,

I am a Government Teacher under New Pension Scheme and I my employer deducted Rs. 53079/= as employee’s contribution towards NPS and Rs. 53079/= as employer’s contribution. My other investment for Tax Saving under Sec 80C is Rs. 109136/= excluding Rs. 53079/= as my contribution towards NPS,

Kindly guide me my Tax savings.

Sir I m investing 130000 rs in ppf.my employee share towards NPS is 72000.can I put my NPS share up to rs50000 in 80ccd(1b) and rest AMMOUNT of 22000rs in section 80c along with my saving 130000…

Yes you can

Sir, pl inform whether the employees covered under General Provident Scheme can enroll themselves in NPS scheme Ann can avail deduction s under Sections 80 CCE.

Yes they can

In my new organisation which I joined in July 2018, there is no NPS. For April to June, 15000 has been deducted by my previous employer with matching contribution and paid into my NPS account.Now, can I continue contributing in my existing account. Where I have to contribute. In Tier- I or Tier-ii.

In Tier one u can contribute. U just need to contribute Rs. 1000 a year to keep your PRAN active.