In last few weeks I have got several mails and comments asking about the tax benefit on NPS. This post explains the tax deduction availa/ble for NPS under 3 sections: 80CCD(1), 80CCD(2) and 80CCD(1B).

Tax Benefit on NPS Tier 1 and/or 2?

NPS has two Tiers – 1 and 2.

NPS Tier 1 is the long term investment, which has restricted withdrawals and meant primarily for retirement planning. On maturity, you can withdraw maximum of 60% of corpus as lumpsum and rest has to be used for annuity purchase.

NPS Tier 2 is for managing short to medium term investment. You can invest and withdraw anytime as per your wish. This is an optional feature and you are asked if you need Tier 2 account while opening NPS.

All the tax benefit related to NPS is available to investment in NPS Tier 1 account only.

Also Read: When and How can Tax Benefits Claimed Earlier be Reversed?

NPS Tax Benefits:

NPS tax benefits are available through 3 sections – 80CCD(1), 80CCD(2) and 80CCD(1B). We discuss each below:

1. Section 80CCD(1)

Employee contribution up to 10% of basic salary and dearness allowance (DA) up to 1.5 lakh is eligible for tax deduction. [This contribution along with Sec 80C has 1.5 Lakh investment limit for tax deduction]. Self employed can also claim this tax benefit. However the limit is 10% of their annual income up to maximum of Rs 1.5 Lakhs.

2. Section 80CCD(1B)

Additional exemption up to Rs 50,000 in NPS is eligible for income tax deduction. This was introduced in Budget 2015.

Also Read: Should You invest in NPS to take tax benefit u/s 80CCD(1B)

3. Section 80CCD(2)

Employer’s contribution up to 10% of basic plus DA is eligible for deduction under this section above the Rs 1.5 lakh limit in Sec 80CCD(1). This is also beneficial for employer as it can claim tax benefit for its contribution by showing it as business expense in the profit and loss account. Self employed cannot claim this tax benefit.

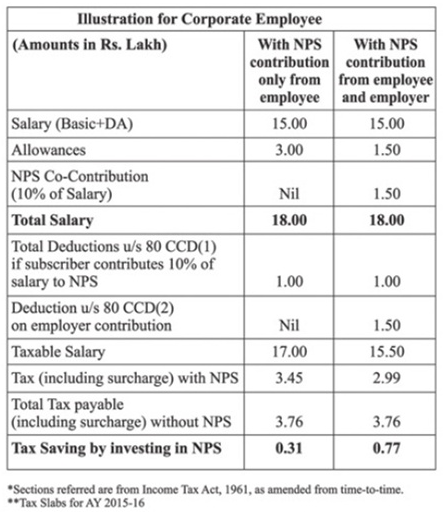

Below is the illustration on how introducing NPS can help you save tax under Section 80CCD(2).

Tax Benefit for Compulsory NPS deduction:

The earlier pension structure was replaced by NPS in most central and state government jobs since 2004. So anyone who joined after that has compulsory deduction for NPS. The deduction is 10% of basic salary and dearness allowance (DA) and the employer too contributes the matching amount. The confusion for most employees is how they take tax benefit on their compulsory NPS deduction?

Here is an example:

Amit is a government employee and his employer deducts Rs 62,000 per annum (which is 10% of basic + DA) from salary as employee’s contribution in NPS. It also deposits Rs 62,000 per annum as employer’s contribution in NPS. How and under which section should he claim tax benefit on NPS?

Let’s take the easy part first. Employee’s contribution in NPS would be eligible for tax deduction u/s 80CCD(1).

The employee has a choice as to which section [80CCD(1) or 80CCD(1B)] he wants to show his contribution. Ideally he should show Rs 50,000 investment in NPS u/s 80CCD(1B). The tax deduction on rest Rs 12,000 can be claimed u/s 80CCD(1). The section 80CCD(1) along with Section 80C has investment limit eligible for tax deduction as Rs 1.5 lakhs. So he should make additional investment of Rs 1,38,000 in Section 80C to save maximum tax. In all he can save Rs 2 lakhs tax u/s 80C and 80CCD(1B).

I hope this would have cleared the confusion on how NPS helps you save tax.

Sir i am a govt. teacher my 80C 134366/- and NPS contribution 59099/- please guide in which section and how much amount show in ITR.

Thanks

I am getting error on PartC in ITR1 Like Invalid data in 80C,80CCD1,80CCD2-User.

Please help how to file.

I am a banker having

LIC premium- 23732/-

NPS by me-43398.50

By Employer’s-43398.50

This is the data in Form16 partB

I am new to ITR..so please help to find out the error.

Please clarify that 80CCD2 will come under salary or allowances not exempt in new ITR1. Please help urgently because it’s last hours to fill it.

Regards

hello sir

my form 16 shows 80ccd amt as 48394/- ( this is total contribution employee and employer),,, so should i write 24197 in 80ccd(1) and 24197 in 80ccd(2) …right??????????????? guide me

yes

Sir,

I am a government employee

My 80C contribution is 1,14634

My company contribution in NPS is 55234

My personal contribution to NPS is 55234

Please guide me the sections and the limits of each section where the deductions will be shown

Sir pls guide me

I am central government employee. A contribution 50000 rs in nps account . And government also contribution 50000 rs in this account. How take benefit under sec 80C .Both amount income tax show which under sec. Already I invest in lic and other scheme 100000 rs sec 80 C. How take benefit in income tax under sec .

Sir,

Can a OPC utilize benefit of sec 80ccd(1) ?

Hello Sir,

I am public sector emp for maharashtra govt. In my salary slip, there are two contributions shown from my employer.i.e Rs 6132 for CPF and Rs 1250 for EPS. is this EPS contribution eligible for tax saving ? if yes, under which section?

Sir,

My PPF+PF contribution is 1,50,000

My company contribution in NPS is 30,000

My personal contribution to NPS is 20,000

Please guide me the sections and the limits of each section where the deductions will be shown

80C – 1.5 L

80CCD(1B) – 20,000

80CCD(2) – 30,000 (take this exemption only if its included as income in Form 16)

I am a govt offcial.

I want some clarification on section 80ccd (1) (b) of income tax act.

I wish to know:

1. I have invested Rs. 1.20 lakhs approx under section 80c and have also invested Rs. 63518 in NPS. Can I claim tax rebate of my deposited amount in NPS under Sec. 80 ccd (1) (b).

NOTE – Though the Form 16 given by my employer does not show section 80ccd (1) (b) in it. My employer has added all my investments under 80c.

2. My second question is if suppose, i have invested Rs. 1.40 lakhs in 80c then can i divide my Rs. 63518 of NPS amount between 80ccd(1) and 80ccd (1) (b).

Hope u resolve my clarification.

very good and informatics topic.thank u.

Hi Amit,

I work for pvt. co. My employer deducts Rs.4200pm as PF contribution out of which Rs.1250 is transferred to Pension fund as per the pf passbook.

My employer is declaring the entire 4200pm under pf contribution in form 16.

Can I claim the Rs.1250 as part of 80CCD(1). Also will this be part of the overall 1.5 lac limit under chapter VI or above that.

Thanks

I am an NRI having income only from Intrest of bank FDRs. I efiled my return for AY 2018-19 on dt 20-06-2018 on form ITR-1 instead of ITR-2 for getting my due refund. Is it correct or should I revise my return on form ITR-2 ?

How the rent income from one house property of an NRI is to be taxed,please give simple formula.

Can an NRI is entitled for section 80 C rebate for PPF a/c subscription up to Rs 1.50 Lakhs. PPF a/c is old one opened prior to be the date becoming NRI.

Sir i am a govt employee. My total NPS subscription is 80000.00 which is 10 % of my basic and DA. Can i show 30000 in 80c and 50000 in 80ccd1

Dear sir

Im state employee. My NpS is 55000 under ccd1. Ccd 2 and ccd(1b) not shown in form 16. Can i deduct same amount under ccd2 or ccd(1b) by self..

My total saving with NPs under 80 c is less than 1.5 lakh

Dear Sir my 80c investment is 138000 and my nps contribution is 45000. can i show 12000 in 80ccd1 and 33000 in 80ccd1b