Several NPS subscribers received SMS on April 27 from NSDL stating – “As a regulatory requirement, submit FATCA self-certification for your PRAN to CRA, else account will be frozen. For more details visit www.npscra.nsdl.co.in”

FATCA declaration for NPS can be done Online now – Click to Read!

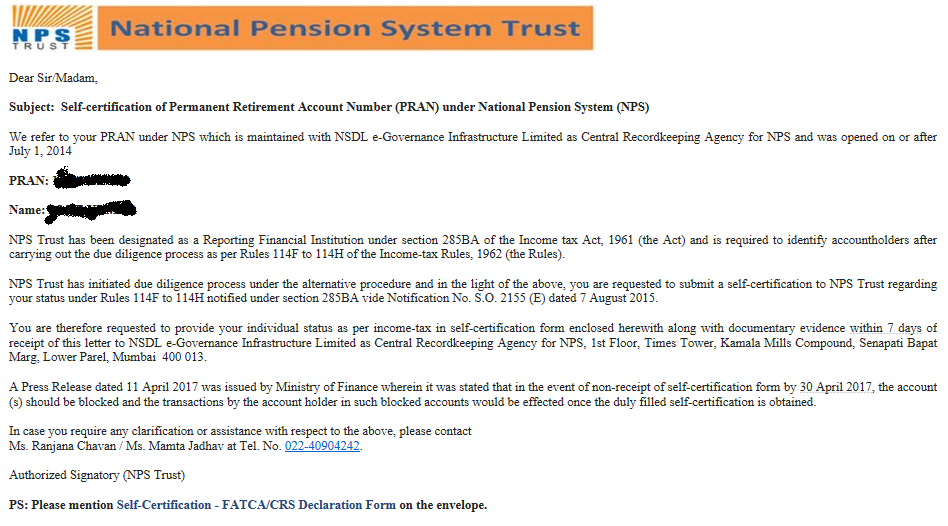

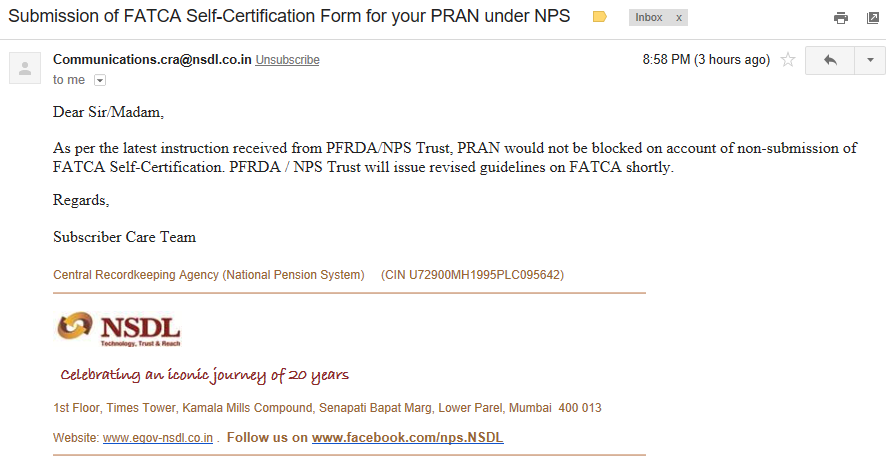

Later in the day subscribers also received from NPS [email protected] on their registered email with Subject: “Submission of FATCA Self-Certification Form for your PRAN under NPS”. Have reproduced the mail below.

New email from NSDL:

A few hours back received below mail from NSDL. The accounts would not be blocked on account of non-submission of FATCA Self-Certification. PFRDA / NPS Trust will issue revised guidelines on FATCA shortly. So NPS subscribers should wait until further instructions.

NSDL handled this entire thing in worst way possible – some heads should roll!

What is FATCA?

FATCA is Foreign Account Tax Compliance Act, a law enacted by USA in 2010. According to this law, any individual who is resident of USA (citizens or green card holders) or financially connected to the US or have any tax residency in US have to declare all their foreign income and investment details to US Tax Authorities. The law was enacted to prevent tax evasion through offshore investments by US residents.

India is signatory of the above law and hence all the financial entities like Banks, Insurance Companies, Mutual Funds, Brokerages, etc have to furnish their client information to the Indian Government, which in turn would share it with US Government. In case you have no income connection with USA, you are not impacted but still need to give the declaration.

NPS FATCA Declaration:

Unfortunately PFRDA the regulator for NPS did not bother to inform its subscribers about the FATCA requirement until the very last minute. But regulations being regulations this is what we need to do.

Only people who have opened NPS Account on or after July 1, 2014 are impacted.

But with tax incentive on NPS coming in 2014 there would lot of people who opened NPS account and would be impacted!

Also Read: Should you Invest Rs 50,000 in NPS to Save Tax u/s 80CCD (1B)?

To comply subscribers would have to submit a self-certification (i.e. FATCA/CRS Declaration) to NPS Trust.

Step 1: You can download the NPS FATCA Self Declaration Format by clicking here or from the email you received.

Step 2: Fill up the form (How to fill the form has been shown below) and send it to Central Recordkeeping Agency (CRA) for NPS at the following address:

NSDL e-Governance Infrastructure Limited,

1st Floor, Times Tower, Kamala Mills Compound, Senapati Bapat Marg,

Lower Parel, Mumbai – 400 013

Also mention Self-Certification – FATCA/CRS Declaration Form on the envelope

In case the above filled self declaration NPS FATCA form is not received before April 30, 2017 the NPS account would be blocked. The account can be activated only after subscriber submits the above form.

Also Read: 5 Steps to Transfer EPF to NPS

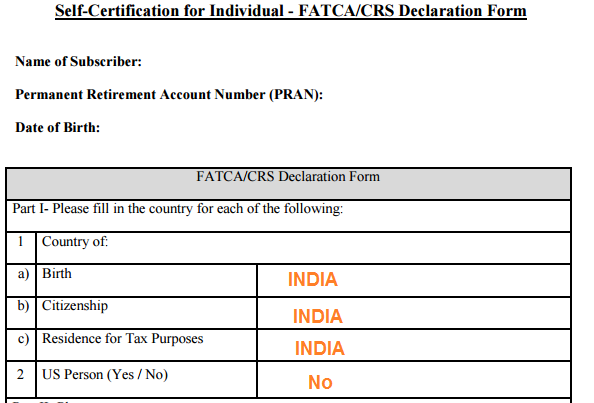

How to fill NPS FATCA Self Declaration Form?

The FATCA form is 3 page form divided in 4 parts.

Part I:

Part 1 asks for following information:

Name of Subscriber:

Permanent Retirement Account Number (PRAN):

Date of Birth:

1. Country of:

a) Birth

b) Citizenship

c) Residence for Tax Purposes

2. US Person (Yes / No)

In case the answer for 1 above Country of Birth, Citizenship and Residence for Tax Purposes is INDIA, you just need to move to Part 3 for signature. This hopefully would cover majority of NPS subscribers.

Also Read: NPS Tax Benefit u/s 80CCD(1), 80CCD(2) and 80CCD(1B)

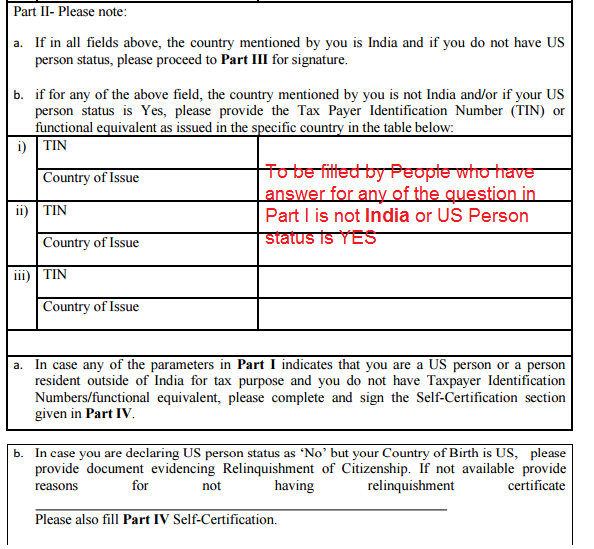

Part 2:

In case the answer for any of the above is not India or US Person status is YES, you need to provide Tax Payer Identification Number (TIN) or functional equivalent as issued in the specific country in the table.

Also Read: 6 Changes in NPS Rules in 2016 & How it Impacts You?

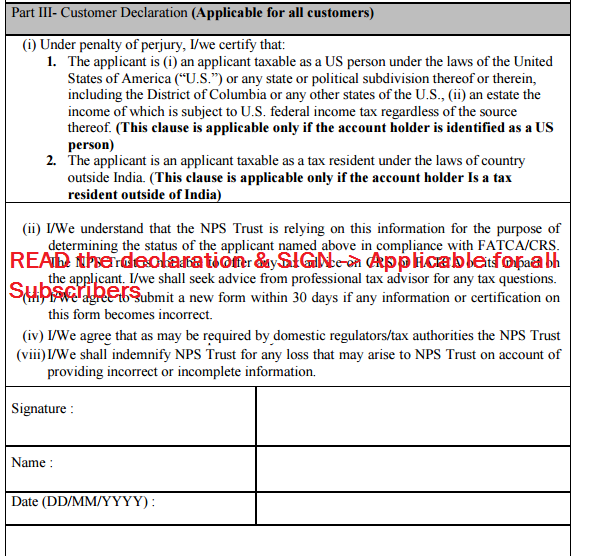

Part III:

Part III just requires your name, signature and date and is to be filled by everyone.

Also Read: NPS – Maturity, Partial Withdrawal & Early Exit Rules

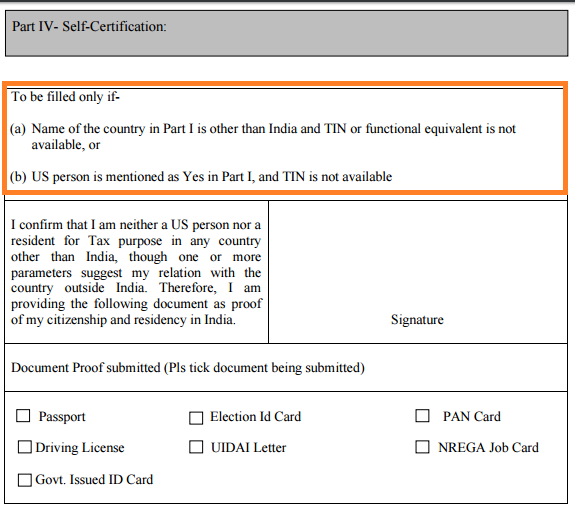

Part IV:

Fill this part only if you satisfy conditions below:

Name of the country in Part I is other than India and TIN or functional equivalent is not available, or

US person is mentioned as Yes in Part I, and TIN is not available

Download: Ultimate Tax Saving ebook with tax calculator FY 2017-18

The subscribers would in this case have to provide any of the below mentioned as proof of citizenship and residency in India.

- Passport

- Election ID card

- PAN Card

- Driving License

- UIDAI Letter

- NREGA Job Card

- Govt. Issued ID card

In case you require any clarification or assistance with respect to the above, please contact Ms. Ranjana Chavan / Ms. Mamta Jadhav at 022-40904242.

The Problems:

The entire approach by NPS/NSDL to obtain FATCA declaration is going to create lot of issues for subscribers. I do not understand why this could not be done online as was done by Mutual Funds earlier. Also there is NO way subscribers would be able to send the FATCA self declaration forms on time. Even in case they do NPS CRA would not have the ability to process the deluge of forms! Anyway as subscriber send this FATCA Self declaration as soon as possible to prevent any problem in future.

Sir i forget to mention ”self certification frtca/cra form” on the envelope

What to do I resend the form or not

Reciepent inboxis full written in delivery report what should be in dis case

With so much emails at a time, the inbox would have run out of memory. Wait for few days before mailing again

I have APY(2015) mutual fund (2016) started. From this year. Should I have to submit FATCA. I got mail for only APY.

Yes you should submit FATTCA for APY. In case of mutual fund, it might have been submitted at the time of KYC

Is there requre to put tick mark for document in part IV if answer for part one is India? Please reply.

As per instructions from NSDL its not required

Part 4 mein signature karne ki jrurat hai ya nhi or document proof bhi attach karna hai ya nhi aggar part 1 mein sabhi jaga india hi likha hai to

As per instructions from NSDL its not required

Sir i am not filled part 1 i am indian citizenship any problem

As Indian you have to fill Part 1 & 3

Sir i forget to sign on document like pan,adhar and govt id card what should i do now i am govt emly

Not required so realx

If self declaration form cannot send before April30 will it leads blocking the account that day itself?

Yes it would be blocked but once your form reaches they would activate it.

Part IV is required for US person, only if TIN number is not available right?

Yes

Sir if my answers are India in part 1 do I have to sign in part 4

No

i am a primary school teacher appointed under SSA scheme. i have opened my NPS account. yet there has been no subscription in the account so far for i have not been getting salary for the past 8 months. do i need to submit the fatca form. ( Manipur).

I am not sure if government employees with NPS need to submit this FATCA form. The reason being as they are employed by Government, they are bound to be Indian citizens. You may want to ask the same in your office from accounts or HR department.

Dear Amit,

I have received this self declaration form on 28/04/2017 so before 30/04/2017 has to submit which is sunday,will my account get bock,if i send it on 01/05/2017 or 02/05/217

The account would be temroraly blocked. You should not worry if you had not planned any transactions from account in this time period. Once they receive the form they would activate the same.

Karvy is supposed to be 2nd CRA for NPS as per news earlier.

Updating FATCA online on Karvy’s site will help or not?

No

As i am working Saudi Arabia, is it ok if i send a color scan copy of self-certification along with proof docs. via courier from my India address

Yes it does no matter from where you send it. It should reach them

Sir.

Several NPS subscribers received SMS on April 27 from NSDL stating – “As a regulatory requirement, submit FATCA self-certification for your PRAN to CRA, else account will be frozen but they give the submission last date april 30.

Hi Amit

EVerything Is Indian for me and I am not a US citizen, do I need to send any photocopy of PAN/Adhaar/Passport etc?

As per instructions from NSDL its not required