NBCC: Company Overview:

Incorporated in 1960 as a wholly owned Government of India undertaking under Ministry of Urban Development (MoUD), NBCC is engaged in the in the business of providing:

- Project Management Consultancy (PMC) services for Civil Construction Projects for Central and State Governments (formed 93.36% of Total Operating Income of FY11)

- Civil Infrastructure for Power Sector (2.02% of total operating income of FY11); and

- Real Estate Development (formed 4.61%of Operating Income of FY11)

The Company is headquartered in New Delhi and in addition have 10 regional / zonal offices across India. The projects undertaken by the Company are spread across 23 states and 1 union territory in India. In addition, the company has also undertaken projects overseas. NBCC’s Consultancy and Project Management Division has been accredited with ISO 9001:2008. As of the date of the RHP (Red Hearing Prospectus), the President of India acting through the MoUD, GoI holds 100% of the company’s equity share capital.

[box title=”NBCC IPO: Review & Recommendations” color=”#f00″] Read Review & Recommendations about NBCC IPO here [/box]

NBCC IPO Issue Details:

- Issue Opens on: Thursday, March 22, 2012

- Issue Closes on: Tuesday, March 27, 2012

- Net Issue: 11,880,000 Equity Shares

- QIBs portion 50% of Net Offer: 5,940,000 Equity Shares

- NIBs portion 15% of Net Offer: 1,782,000 Equity Shares

- Retail portion 35% of Net Offer: 4,158,000 Equity Shares

- A Discount of 5 % on the Offer Price shall be offered to Retail Bidders and Employees

- Bids can be made for a minimum of 60 equity shares and in multiples of 60 equity shares thereafter

- Retail investors can bid for maximum of 2220 equity shares at lower end of price band and 1860 shares at higher end.

- IPO Grading: “IPO Grade 4/5” by CARE – indicating above average fundamentals

- Listing on: BSE & NSE

- NBCC Price Band: Rs. 90 – 106 (5% discount for retail & Employees)

- Book running lead managers: IDBI Capital Market Services Limited and Enam Securities Private Limited

- Registrar to the Issue: Bigshare Services Pvt. Ltd.

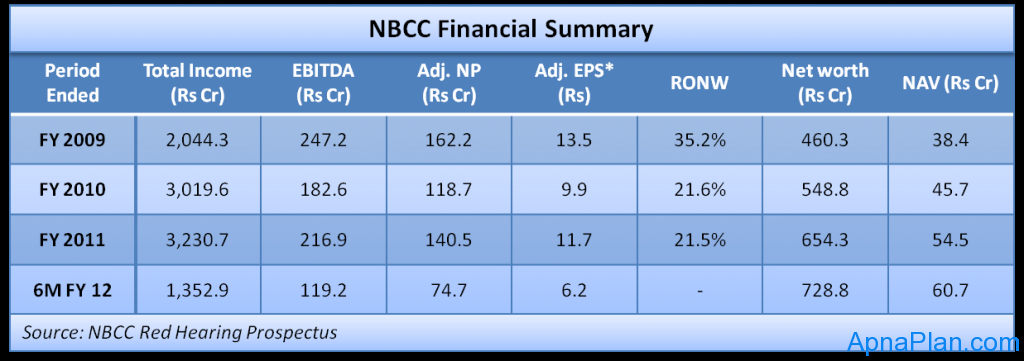

NBCC Financial Summary:

Why should you invest in NBCC IPO?

- IPO Grading: “IPO Grade 4/5” by CARE

- Established brand name and reputation.

- Operations in diverse sectors with strong Order Book position.

- Qualified and experienced management.

- Significant experience and track record.

- Vast Industry knowledge and technical expertise.

Risks in NBCC IPO:

- The company’s revenues are significantly dependent on PMC business. Any decline in PMC business, could adversely affect the company’s business prospects, financial condition and results of operations.

- Certain board of directors are involved in a number of legal proceedings, which may adversely impact the company’s business reputation.

- There could be cyclical risks associated with this industry.

NBCC IPO Price, EPS, PE, Book Value:

PAT (Profit After Tax) margin which used to be at close to 14% for FY08 fell to 4.5% for FY11. The issue is issued at a price-to-book of 1.5 as the book value is at Rs 60. At lower price band of Rs 90, it is issued at a price-to-book of 1.5. The expected EPS is of Rs 13-14 for FY11 and FY12. Extrapolating its six months performance, it is issued at a PE multiple of 7-8. As against that there are many private sector companies providing similar kind of services and are available at a price-to-book of 0.6-0.9 and a PE multiple of 4-6.

Currently, Infra and construction companies are reeling under pressure and going by the current scenario the issue is not a cheap one. Though the sector offers substantial growth, there are concerns and risk factors which could affect the company’s earnings. At the indicative offer price, the issue is for long-term investors only and for traders who want to sell on listing, it could be a tricky one.

You can read about NBCC IPO Daily Subscription Status here.