The government of India has made it mandatory to link your PAN card with Aadhaar Number. In case you do not do so by July 1, 2017 your PAN card would be invalid, which means you might not be able to file your tax returns. We had already written about How to link your PAN & Aadhaar if there was NO mismatch between the same. However there was linking issue in case the names did not match on PAN & Aadhar. Recently Income Tax Website has changed the linking form – so that it works for name mismatch cases too.

Step 1: Login to Income Tax efiling Website

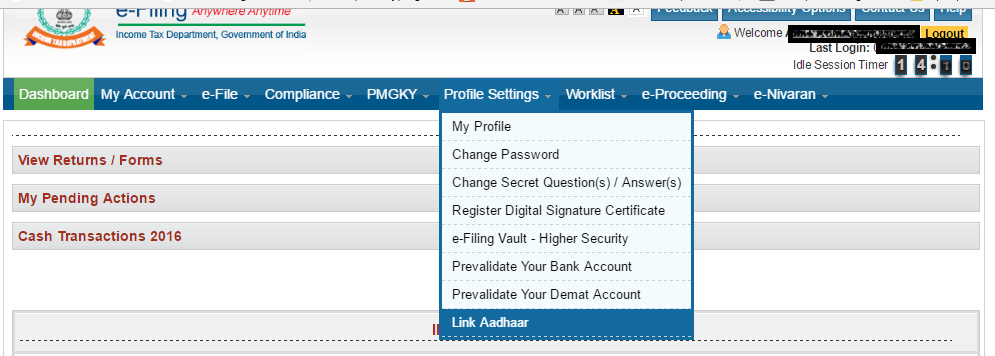

Step 2: Select Profile Settings > Link Aadhaar

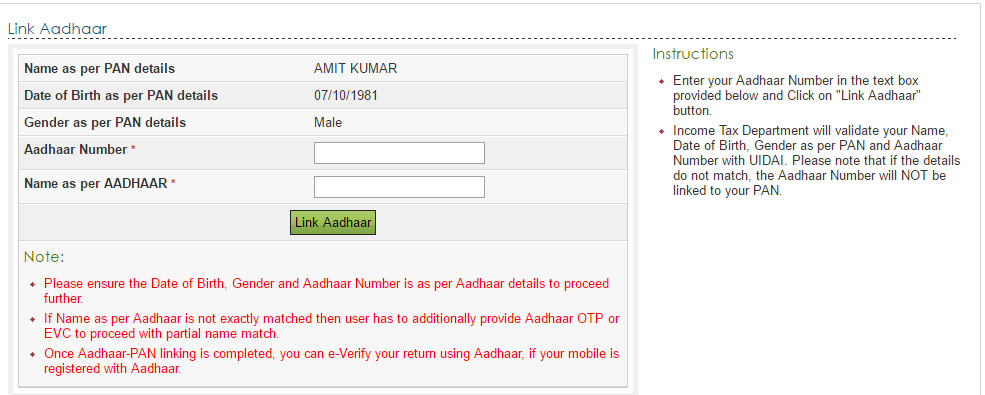

You get the below screen where you can fill in your Aadhaar Number and Name and submit “Link Aadhaar”

This would enable everyone with name mismatch to link there PAN card to Aadhaar number. However if you have problem with Date of Birth/gender mismatch you need to get it corrected in aadhaar/PAN.

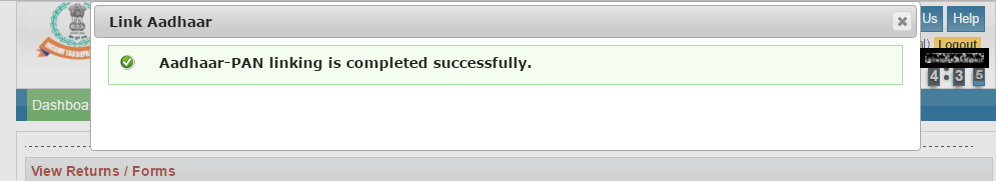

Acknowledgement:

Once this is done you would get an acknowledgement of the same as in the screen below.

Instructions:

Please ensure the Date of Birth; Gender & Aadhaar Number is as per Aadhaar details

If Name as per Aadhaar is not exactly matched then user has to additionally provide Aadhaar OTP or EVC to proceed with partial name match.

Once Aadhaar-PAN linking is completed, you can e-Verify your return using Aadhaar, if your mobile is registered with Aadhaar.

Also Read: Not able to Link PAN to Aadhaar – use offline method

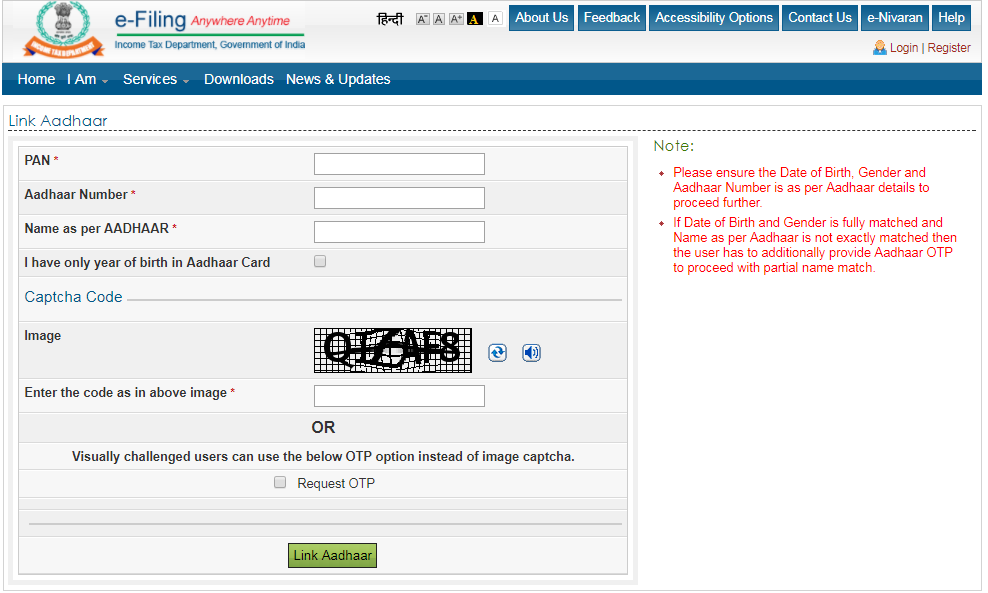

Method 2: without login in income tax website

You can also link your PAN & Aadhaar without login in income tax website. Click here to go to the relevant page.

You’ll get the form below. Fill and submit it.

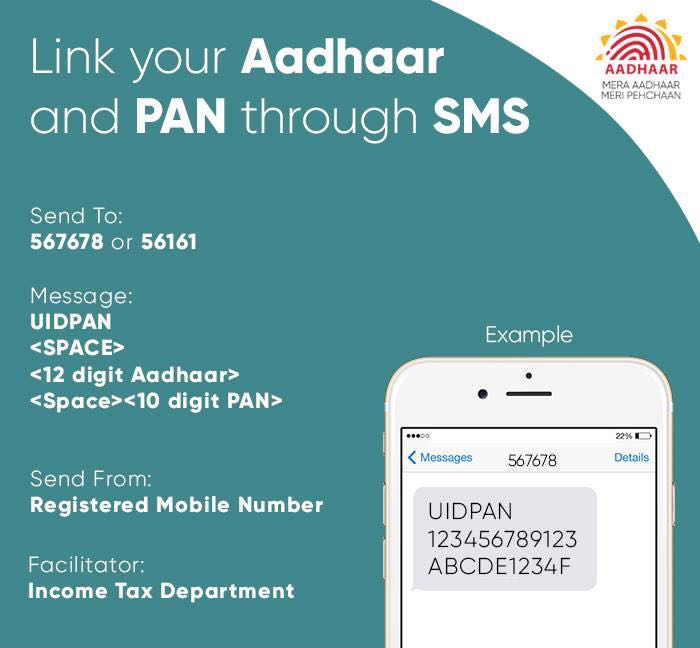

Method 3: Using SMS

Try linking PAN & Aadhaar using SMS as stated below

Some Issues:

At times some people are getting message “Technical Error at UIDAI. Please try again”. This may be due to overload on UADAI server. You can try after some time and you should be able to link your PAN to Aadhaar.

My wife is not able to link Aadhar and pan . I verified name, gender and DOB are all same. Not sure what the issue is…it says name mismatch.

Kannan

I try to link aadhaar with my pan 100 of time, but not successful nothing worked.. but these id*ts give time only upto june..

I agree with you sir. I tried to link my AADHAAR with my PAN for the past 2 months, and it never succeed. I filed a complaint regarding this in incometaxindiaefiling.gov.in but they say the same to change my name in PAN or AADHAAR. I applied for name change in PAN before 1 month, still it is under process with NSDL. Very poorly implemented AADHAAR PAN linking system. They should send OTP for everyone irrespective of name mismatch or not , to link these two.

Aadhaar card and pan card date no match………….

Yes…the linking does not work for me too..

Hi I have very different issue, my wife is a state gov employee, she started working before marriage and hence her name in PAN Card and all the gov docs has the name of her with her Father, while we get her passport and aadhar card with my name. So now her name on PAN card and aadhar card are different (middle name and surname). What should we do, if we change the name on PAN Card it will conflict with name in all her govt related documents including her CPF account. PLease advice I am sure I am not the first one facing the issue.

As I can see almost every financial and non-financial transaction in India is going to be linked to Aadhaar. If you could not link through this method, I would suggest you to link your savings account in any bank with Aadhaar. Income tax is automatically picking it from there. There is no official notification for the same but have seen many such cases, that the aadhaar was already lined to the PAN after it was submitted to bank account.

Also I am not sure how change in name on PAN card would impact you – for me this is quite common for women after marriage and is widely accepted!

I am facing same issue. C an you please let me know how can I link??

i have same name with same spellings in both aadhar and pan also the gender and date of birth are same still the linking fails.

message comes on mobile stating that – contact pan center for linking aadhaar using biometrics (this comes when i use SMS to link the aadhar)

Hi Amir, there is no otp option… Can you provide a screenshot if there is any otp option..

Many are not getting option for OTP, do not worry if the linkage happens without that.

The linking still doesnt work for partial name mismatch. My wife’s aadhar has my last name as surname whereas PAN has a different surname. There is no option to get OTP , it says Aadhar linking failed. DOB & Sex are all correct in both places. Dont know what the issue is.

Dear Friends,

I just figured out that there seems to be a problem in AADHAAR-PAN linking with some of the BROWSERS.

Initially, I tried doing this linking using the Internet Explorer browser. It failed to LINK. I got an ERROR message “Please enter a valid Aadhaar Number”. Also there was no option to provide Aadhaar OTP.

Then I tried linking using the Google Chrome Browser. And to my surprise, it worked ! Even with a name mismatch (I have middle name as my father’s first name in PAN and no middle name in Aadhaar) it worked without OTP or EVC.

So try changing your browser, if it fails in Internet Explorer !

Good Luck!

Thanks for sharing – it will for sure help our readers!

1) I am not in Tax bracket. So I have required to do the Aadhaar link?

If you have PAN card you have to link the same!

Dear Sir,

My native place and permanent address are at Thiruvananthapuram (Kerala). The address in my PAN Card (AEVPP3566K) and AADHAR CARD are different. Duplicate PAN was taken by me when I was working in Maharashtra State. AADHAR was taken from Maharashtra, but changed the address later on as that of my present address at Thiruvananthapuram.

What I should do for correcting the address ?

Address is NOT matched. Its only name, gender and date of birth. So go ahead and link your PAN & Aadhaar!

How to use evc number for linking pan with adhar owing to name mismatch

You can use EVC to everify your income tax return after you link your aadhaar to pan

I also face the problem. Name in PAN is xxxxx and name in Adhar is x.xxxxx (addition of one initial). Gender and date of birth matching. Same mobile registered with both. Neither they get linked nor do I get any OTP in my mobile.

Seems like its still not solved for some people!

My friend linked pan and ashar thaough name mismatch. But still i fail to link.

Yes, I am also facing the same problem. Lets hope for some solution soon

It seems name mismatch is not handled properly. There the instructions shows that for Name mismatch OTP will be provided. But it just shows the error message only. So IT dept didnt implement the functionality correctly. Not sure how they updated their site without even testing these basic things. I have tried for the past 4 days.

Sofry to hear that. A lot of people reported they were able to link even with variation in names! In fact a lot of them were able to do so without receiving any OTP.

I also face similar problem. The IT Web Site states that an OTP or EVC Number is to be entered. However, there is no provision in the web page to enter these details. The Income Tax Dept needs to modify the details to enable the linking.

Today’s press release by IT dept on their new provision also doesn’t help me. I think their software is doing very less no of possible name matches. I think it wont help all of the people & many will end up in name update in Aadhar. Though Indians are the backbone of major critical softwares in the world, the IT site is still lagging to provide some useful functionality for PAN-UID linking.

I am able to complete the linking successfully, though I have name mismatch issues. I think now they have enhanced the name matching well.

This is good news 🙂

It is not working for name mismatch (DOB and SEX are matched)

I am not sure why its not working for you as it worked for lot of people with slight variation in name!

Hi Amith,

I also have same issue. My Aadhaar and PAN also not linked with name conflict . I saw that below msg. What does it mean and is there any procedure to do below notes.

“If Name as per Aadhaar is not exactly matched then user has to additionally provide Aadhaar OTP or EVC to proceed with partial name match.”

Ideally you should get OTP on aadhar registered number if the names are different. But know a few cases where NO OTP was sent and still the linkage happened with slight variation in names.

MY SISTER HAS A DEMAT ACCOUNT WITH ICICI SECURITIES. SHE HAVE A PAN CARD BUT NOT AADHAR, WHETHER SHE CAN SELL THE SECURITIES WHICH SHE WAS HOLDING AFTER JULY 1 ST.

Your sister must get Aadhaar card before July and link it to PAN card. We are still note sure when the government says it will cancel PAN card for linkage – what impact it would have. If strictly enforced, it would totally disrupt common man’s life. Bank Accounts/ Demat accounts might also be frozen as a result of same. So you have No option but to get aadhaar – until supreme court decides otherwise.