NABARD (National Bank for Agriculture and Rural Development), a Government of India company is issuing its Tax Free Bond. It would offer coupon rate up to 7.64% for retail investors depending on tenure. You can choose between tenure of 10 and 15 Years. The bond issue would be open for subscription for March 9 to 16, 2016.

About NABARD:

NABARD is an apex development bank owned by Government of India and is responsible for upliftment of rural India by increasing the credit flow for elevation of agriculture & rural non farm sector.

Salient Features: NABARD Tax Free Bonds 2016

- Offer Period: March 9 to 16, 2016 (the offer can be pre-closed on full subscription)

- Annual Interest Rates for Retail Investors: 7.29% for 10 Years and 7.64% for 15 Years

- The interest rates are 0.25% less for HNIs and corporate subscribers

- NRIs and QIBs are not eligible to subscribe these bonds

- 60% of issue is reserved for Retail Investors

- Price of each bond: Rs 1,000

- Minimum Investment: 5 Bonds (Rs 5,000)

- Max Investment Limit for Retail Investor: Rs 10 Lakhs

- Can be applied both in Physical and Demat Form

- Credit Rating: “CRISIL AAA/Stable” by CRISIL

- Allotment: First Come First Serve

- Listing: Bonds would be listed on BSE and will entail capital gains tax on exit through secondary market

- Tax/TDS: As these are tax Free Bonds so no tax is to be paid and there is no TDS on interest

Also Read: PPF – A Must Have Investment

NABARD Tax Free Bond – Interest Rate:

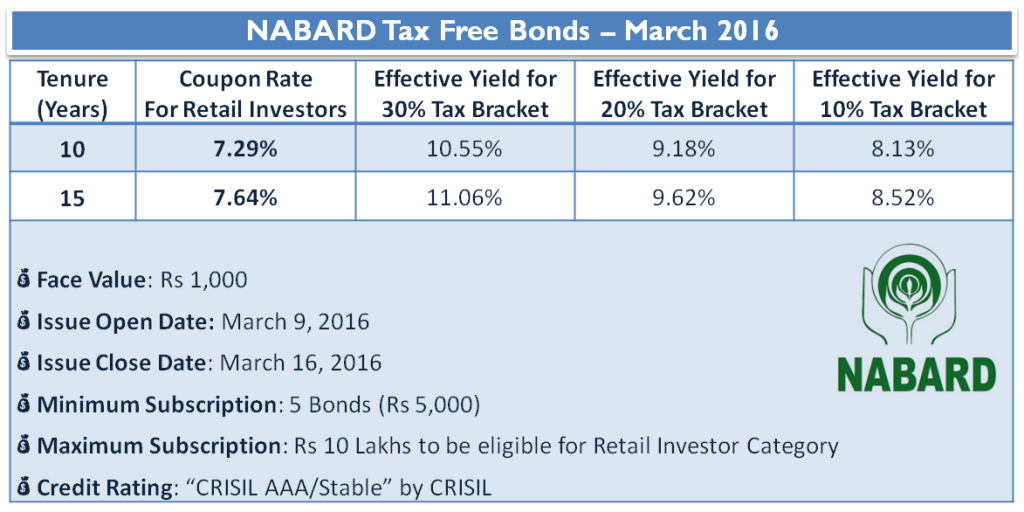

The NABARD Tax Free Bond offers the following interest rates. The interest would be paid every year.

The table also shows the effective interest rate for different tax slabs. For e.g. To earn post tax 7.64% interest on deposit a person in 30% tax bracket should actually get pre tax return of 11.06%.

Who should invest?

Tax Free Bonds are suited for people in the tax bracket of 20% or higher who are looking for regular and safe income. In case you do not want regular income you should first exhaust your Rs 1.5 lakhs PPF limit where the returns are 8.7% and tax free.

Also Read: What is the Maximum Income Tax You can Save for FY 2015-16?

Why you should invest?

- Almost “NO” credit risk. The bonds are rated “AAA” and the company is owned by Government of India. The bonds are secured to the full extent.

- For retail investors, the interest offered is higher than the offers on Tax free bonds in Secondary Market.

- Good for investors in the tax bracket of 20% or higher looking for safe and regular income for long duration.

- NABARD tax free bonds would be second last tax free bond offer for the financial year followed by IRFC. Budget 2016 has made no provision for tax free bonds in next financial year. This might generate premium for these bonds going forward.

Why you should not invest?

- PPF offer tax free interest rate of more than 8.7%. So you should first exhaust that especially if you are not looking for regular income.

- If you are in 10% tax bucket or pay no taxes, you would be better off with banks Fixed deposits or debt mutual funds.

Also Read: Highest Interest Rate on Bank Fixed Deposits [comparing 44 banks]

How to Apply?

The bonds can be issued both in physical and demat form.

You can apply online through ASBA or download the Physical Form from the Edelweiss Financial Services and follow the instructions.

To Conclude:

NABARD Tax Free Bonds 2016 suits investors who are looking for safe, regular income and are in the higher tax bracket. This is second last offering for this financial year followed by IRFC in coming days. There might not be any Tax free bonds issue next financial year.

Previous Tax Free Bond were over-subscribed before the formal closing date, so if you want to subscribe these bonds, invest early as these would be grabbed very soon and may close for subscription if it gets fully subscribed before closure date.