There are two things that have changed for mutual funds in budget 2013. We discuss both one by one.

I would start with the good news first.

Lower Securities Transaction Tax (STT) on Mutual Funds:

The securities transaction tax has been lowered substantially on redemption of Mutual Funds (MF) and Exchange Traded Funds (ETFs) from 0.25% to 0.001% effective from June 1, 2013. Also, MF/ETF purchase/sale on exchanges will attract 0.001% STT on seller, against 0.1% charged now.

If you redeem Rs 1 Lakh from Equity Mutual Fund, earlier you had to pay Rs. 250 as STT now that would come down to just Rs 1. This might not be great saving but definitely a sentiment booster.

Higher Dividend Distribution Tax (DDT) on Debt Mutual Funds:

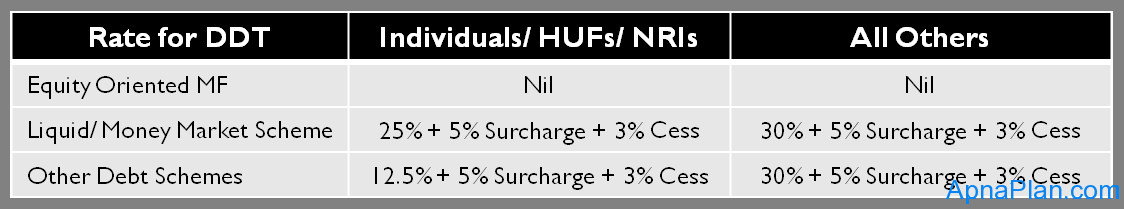

Dividends in respect of Mutual Fund units are tax free in the hands of the investor; however, there is a tax liability in the form of a Dividend Distribution Tax (DDT) to be paid by the Mutual Fund scheme. The rates of DDT are as follows:

The budget 2013 has changed the above 12.5% to 25% for all debt schemes effective June 1, 2013. The impact might not be very high on return but acts as sentiment dampener for debt mutual fund investors.

Also Read: Mutual Funds – Tax on Equity, Debt and International Funds

Solution: you might want to choose growth option for debt funds and use systematic withdrawal plan (SWP) to simulate dividend payout and pay less taxes effectively.