Paying taxes is painful and so we always want to avail all the tax saving options available. And related to this I often get this question – what is the maximum tax I can save?

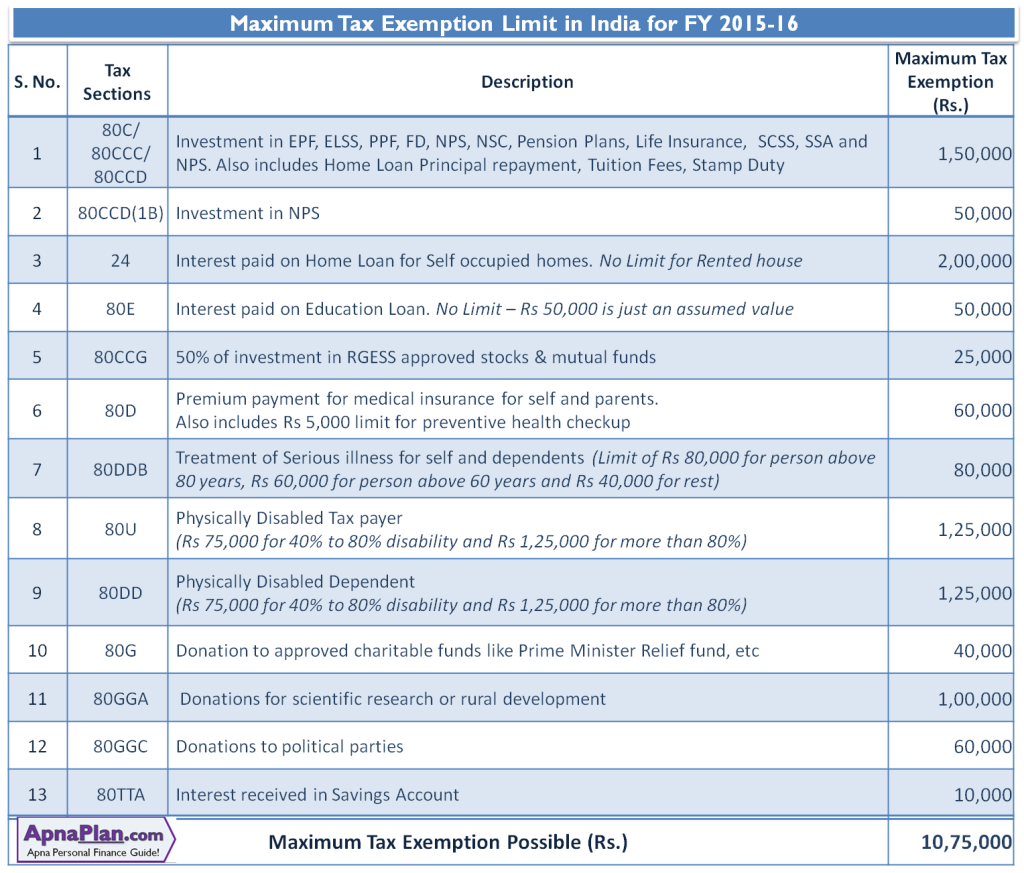

A few days ago we published an eBook on all Tax saving options available in India for FY 2015-16. The table below gives a summary of all the tax saving sections, investment options available along with the maximum tax benefit available for an individual tax payer.

If you are able to avail all these sections you can make close to Rs 10.75 Lakhs income tax free.

The Problem:

Though 10.5 Lakhs sounds big amount but most people would avail only few of the above. Here is the reason:

- Rs 2 Lakhs exemption for donation: Now people donate for a cause and their passion/empathy and not to save taxes. It’s just that tax exemption sweetens the deal!

- Rs 2.5 Lakhs exemption on account of tax payer or his dependent being physically disabled. This is a much needed exemption but applies to very few tax payers.

- Rs 80,000 deduction for treatment of serious illness is something that very few tax payers would take advantage of.

So out of Rs 10.5 lakhs, around 5.3 lakhs exemption would be claimed by very few tax payers and in special cases only.

Most tax payers even after using all the tax saving sections would be able to claim tax benefit up to Rs 5 to 5.5 Lakhs.

Tax Saving Sections Summary:

Below is the recap of all tax saving sections for FY 2015-16:

Section 80C/80CCC/80CCD: Investment in EPF, ELSS, PPF, FD, NPS, NSC, Pension Plans, Life Insurance, SCSS, SSA and NPS. Also includes Home Loan Principal repayment, Tuition Fees, Stamp Duty

Section 80CCD(1B): Investment in NPS

Section 24: Interest paid on Home Loan for Self occupied homes. No Limit for Rented house

Section 80E: Interest paid on Education Loan. No Limit – Rs 50,000 is just an assumed value

Section 80CCG: 50% of investment in RGESS approved stocks & mutual funds. Max investment limit is Rs 50,000

Section 80D: Premium payment for medical insurance for self and parents. Also includes Rs 5,000 limit for preventive health checkup

Section 80DDB: Treatment of Serious illness for self and dependents (Limit of Rs 80,000 for person above 80 years, Rs 60,000 for person above 60 years and Rs 40,000 for rest)

Section 80U: Physically Disabled Tax payer (Rs 75,000 for 40% to 80% disability and Rs 1,25,000 for more than 80%)

Section 80DD: Physically Disabled Dependent (Rs 75,000 for 40% to 80% disability and Rs 1,25,000 for more than 80%)

Section 80G: Donation to approved charitable funds like Prime Minister Relief fund, etc

Section 80GGA: Donations for scientific research or rural development

Section 80GGC: Donations to political parties

Section 80TTA: Interest received in Savings Account

Hi Amit,

Very nice article. I am 40% disabled and I got disability certificate from government doctors in a government hospital. However, the certificate was not signed by civil sugeon/chief medical officer(as mentioned in section 80u). Can I still claim the tax deduction under section 80u or should I still have to get form10-IA signed by civil surgeon/CMO for income tax benefit under section 80u. Please confirm. Awaiting your reply.

You need to have signature of any one of the following: Neurologist/Pediatric Neurologist/Civil Surgeon/Chief Medical Officer. If the doctor you talking about is Neurologist then your Form is valid for Tax exemption u/s 80U.

There s exemtion fr physically dsabld dpndnt …is there s exemption fr mentally dssbled dpndnt???

The tax exemption is applicable for mental disabled dependents too. YOu would need certificate stating the percentage of disability for any of the mentioned authorities:

A Neurologist with an MD in Neurology

For children, a Pediatric Neurologist having an equivalent degree

Civil Surgeon or Chief Medical Officer (CMO) of a government hospital

I am government employee with GpF scheme.I invested in 80ccD[1B),can I get additional Rs.50000 benefit. Is it compulsory to open account of tier 1 account of nps

GPF and NPS are different schemes. For getting benefit u/s 80CCD(1B) you need to invest in NPS Tier 1 account only.

Given information is very nice.

I am working as a Consultant in engineering field in monthly basis. So how much I can save for exemption IT.

All the exemptions are valid for you. Other than that you can deduct genuine expenses like Mobile/Internet bills, taxi fare, fuel expenses, etc which occur while fulfilling your duty as consultant.

Very good info.

Just one question: Is the full principal amount under SCSS exempted from tax?If my deposit amount is Rs.1,50,000,is the whole amount exempted from tax? I do understand that the interest earned is taxable.

Yes investment in SCSS is exempted u/s 80C to an extent of 1.5 lakhs

Thank You Amit. Is it same for donations made to registered NGO’s too? Is the tax benfit on the entire donation amount?

There are 23 organization, contributions to which are 100% tax exempted and 10 organizations where the contribution is 50% exempted. You can find the details in Tax Planning ebook – page 41.

Is investing in NPS and RGESS is worthwhile? suggestions

It depends on what would you do with the money if you do not invest in NPS or RGESS! I have my analysis on NPS as tax saving option. Hope it helps in deciding if you want to go for NPS or not?

Thanks for your suggestion it was useful, i have another question

I have missed submitting HRA to my Employer, how can i save it while filling Income tax return.

You can still submit to your employer – just talk to them. They might not adjust tax paid but it will reflect in your Form 16. This makes it easier to file income tax return. In case they do not accept Rent receipts now – you can directly deduct the rent as per HRA provisions while filing tax returns. You need not submit any rent receipt etc but should retain it for 7 years – in case you receive any notice or your case is opened for detailed assessment.

sir,L L

I am paying Rs. 56000/- under Contribution Pension Scheme in state service and managing to get Rs. 1.5L deduction with other MFs and LIC. Is it possible for me to avail NPS benefit of Rs.50000/- additional to 1.5L. Also I am having Demat account and trading equities from 2008. Is it possible for me to avail RGESS.

Saravanan, Tamilnadu

Defined Contribution Pension Scheme is actually NPS, which means you can get Rs 50,000 additional tax exemption u/s 80CCD(1B) over Rs 1.5 lakh exemption u/s 80C.

RGESS is for first time equity investors but since you are already trading in equities you would not get tax benefit under RGESS.

Dear Amitji,

Thanks for sharing fantastic tax-saving ideas through your website.

I have 2 points kindly clarify,

1) If I have sufficient money to buy a house, will there be any advantage of taking home loan, paying interest at much higher rate/processing charges etc. etc., and then claiming tax exemption on interest paid. So as I understand one can actually reducing rate of interest paid (upto 30%) by tax exemption. In this case only if I earn more than this balance interest % then only I am benefited. Correct me if I am wrong.

2) the Tax planning guide from your links is not getting downloaded fully after several try and stops midway.

Thanks

Shib

Thanks for your appreciation 🙂

1. Your understanding is correct. You only gain if your post tax loan rate is lower than post tax investment return.

2. Sorry for the inconvenience. It’s a 2.4 MB file and so it might not be working. Please try after sometime. In case it does not work I’ll email you the presentation on the yahoo address given by you.

For retail investors what is the maximum exemption available on tax free bonds?

There is no limit for amount of interest that is exempted for tax free bonds for retail investors. Retail investor concept is only valid while applying for new issues. To qualify as retail, you should apply for bonds value of less than Rs 10 Lakh. However you can further buy it from secondary market without any limit.

Thanks for giving us an detailed view of tax saving options

This is probably the best i have got across the internet

i want to ask you in your personal opinion, which are the top options to save tax under 80C/80CCC/80CCD?

Thanks for your appreciation.

The best tax saving option depends on your risk profile and overall goals. If you want low risk investment – EPF/PPF is good option but lockin is for longer period. If you are young and believe in stock market – ELSS is great option. In case of senior citizens – SCSS can also be considered. And if you are looking for no volatility option go for Tax Saving Fixed Deposit or NSC which has 5 years lockin.

All I would recommend is to avoid ULIPs, Endowment/Traditional Life Insurance Plans, NPS (if not compulsory).

So as you can see the best tax saving option depends on personal situation and preferences.

Sir i am a central govt. employee.

My employee contribution of around 60000 is deducted at source by office for NPS.

For claiming 80CCD(1B) exemption of 50000 do i need to invest another 50000 or the 60000 which is deducted at source from my salary can be considered under 80CCD(1B)

You can use your NPS contibution to get benefit u/s 80CCD(1B) up to Rs 50,000. For the remaining 10,000 you can get benefit u/s 80C.

sir, for f y 2015-2016 the tax benefit in investment in infrastructure bonds u/s 80ccf is available or not, if available what is the limit of investment.

with regards

M V G RAO CHOWDARY

Infrastructure bonds is no more available and does not give any tax benefit.

Hi Amit , Today (17th Dec2015 ) Tax saving Infra bond stated selling from NHIA . Please let us know How much we can declare as max for tax saving , If we had already invested 1.5 Lakhs in 80C .

Thanks

Manas

Manas – It’s Tax Free bonds from NHAI and not Tax Saving Infra bonds. Tax Saving infra bonds have long been discontinued. In case of tax free bonds the interest earned is tax free. You can refer to my post on NHAI Tax Free Bonds.

My another querry is I have opted for deduction from Employer for NPS under section 80CCD(II) , so I get deduction over and above of Rs 1.5 lac. Now my question is on maturity the gain will be taxable or not?

The rules for NPS withdrawal on maturity remains the same – irrespective of mode of investment or tax benefit offered. As of today the total withdrawal amount is added to the income and taxed at marginal tax rate applicable to you.

What benefits do I get paying tax… Will any magic happen??

Well that’s the question every tax payer asks and unfortunately we don’t get what we deserve! But then most people comply because it’s illegal not to…

Sir,

I am a tax payer. I have saving of Rs. 1.5 Lakh in insurance, PPF, etc. Also I claim interest paid towards housing loan around Rs. 2 Lacs, thus I am availing Rs, 3.5 Lac total exemption. Can I save some more amount in any other heads? which are they?

You are invested in most popular tax saving options. You can buy Medical Insurance (if required) for self or parents which can give benefit up to Rs 60,000. Though there is option to save additional Rs 50,000 by investing in NPS but I do not recommend it.

You can look at RGESS which can help you save some more on taxes (check your eligibility).

Sir, i am having DEMAT account whether I am eligible for RGESS.

You can check eligibility to invest in RGESS Scheme by Clicking here

(1) Is sec 80 CCD (1B) a part of 80 CCD (1) and hence investments under 80 CCD (1B) limited to the overall limit of 1,50,000 of 80 CCE ?

or

(2)Is sec 80 CCD (1B) outside the overall limit of 1,50,000 of 80 CCE (like 80 CCD (2) ?

NOTE (1) : In SWAMYS income tax book in pg no. 129, example 14, it is illustrated that 80 CCD (1B) is limited to the overall limit of 1,50,000 of 80 CCE .

NOTE (1) : BUT WHEN ASKED THE TOLL FREE NO. of NPS, they said that sec 80 CCD (1B) outside the overall limit of 1,50,000 of 80 CCE (like 80 CCD (2) ?

********************* WHICH IS CORRECT ??? !!!! ????

JAYA KUMAR, PGT,

KENDRIYA VIDYALAYA, TAMBARAM, CHENNAI.

Section 80CCD(1B) is outside the overall limit of Rs 1.5 lakhs tax exemption