The last date of filing ITR (Income Tax Return) without any penalty is July 31. There are chances that this date would be extended further as companies have been given extra time to furnish Form 16 as there were changes proposed by tax department at the last minute.

However people who have income from pension and/or fixed deposit can start filing their tax returns in next few weeks. (Read: Why you should not file your ITR before June 15)

For this particular post we have taken the following case:

ITR for Senior Citizen with Pension & FD Income

Here is the details of the tax payer and his income.

- Age of Tax Payer: 65 Years

- Pension Income: Rs 3,00,000

- Interest Income from Fixed/Recurring Deposit: Rs 4,86,956

- Interest Income from Savings Account: Rs 7,000

- Interest from Income Tax Refund: Rs 150

- Dividend from Shares: Rs 2,478

- Has only one house and has no loan on the same and is self-occupied

- Tax Saving Investment of Rs 1.5 Lakh u/s 80C

- Health Insurance Premium of Rs 40,000 & Preventive Health checkup for Rs 5,000 tax exempted u/s 80D

- TDS @ 10% has been deducted by banks & Post-offices on deposits and updated in Form 26AS

- No Tax Exempted donations have been made

If you look into the income sources and house property, he is eligible to file his tax returns using ITR Form 1. (Learn: Which ITR form to fill for Tax Returns for AY 2019-20?)

We take you through the entire process of filing the tax return and in case you have never done this before – its very simple.

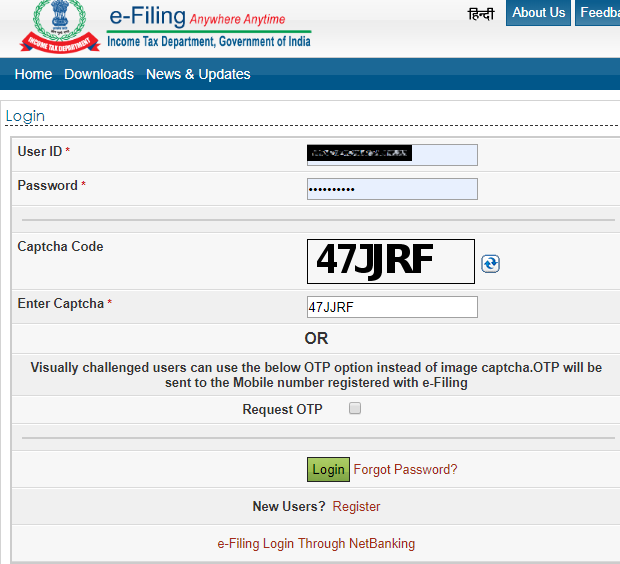

Login to ITR Website

The first step is to login to the income tax return website. Fill up your User ID and Password. User ID is the PAN Number of tax payer. In case you have forgotten your password, here is how you can reset it or login through different means or reset your password.

Choose Income Tax Return Form

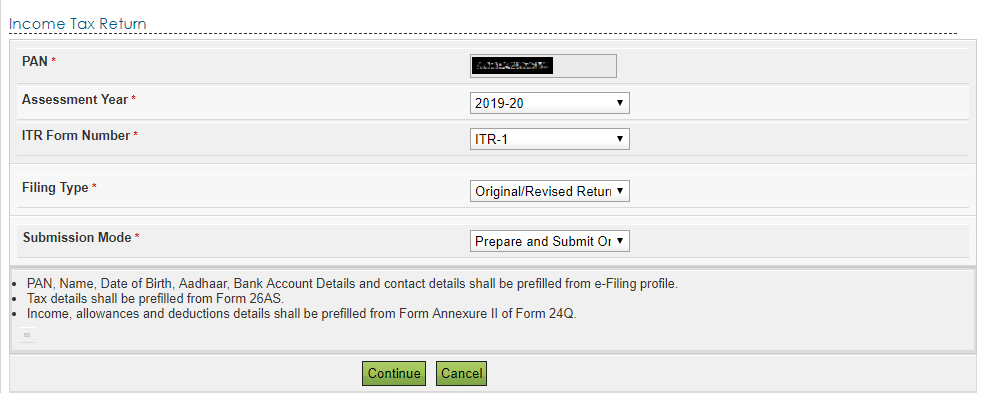

On successful login Go to e-file >> Income Tax Return.

You will get the form below – select options as suggested:

- Assessment Year -> Select 2019-20 (you see many past years but you cannot file earlier year returns without intervention of Tax Department)

- ITR Form Number -> Choose ITR-1 (as income is from pension and interest only – Read more about how to select which ITR Form to fill)

- Filing Type -> Choose Original/Revised Return (this is the only option)

- Submission Mode -> Choose “Prepare and Submit Online” if you want to file ITR online. Choose “Upload XML” if you want to download excel file and fill it offline and upload the ITR. The fields are same in both case, I would go with “Prepare and Submit Online”

Points to Note:

- PAN, Name, Date of Birth, Aadhaar, Bank Account Details & contact details shall be pre-filled from e-Filing profile.

- Tax Details shall be pre-filled from Form 26AS (TDS/TCS and any self-assessment tax would be pre-filled)

- Income, Allowances & deductions details shall be pre-filled from Form Annexure II of Form 24Q (this is applicable for salaried tax payers)

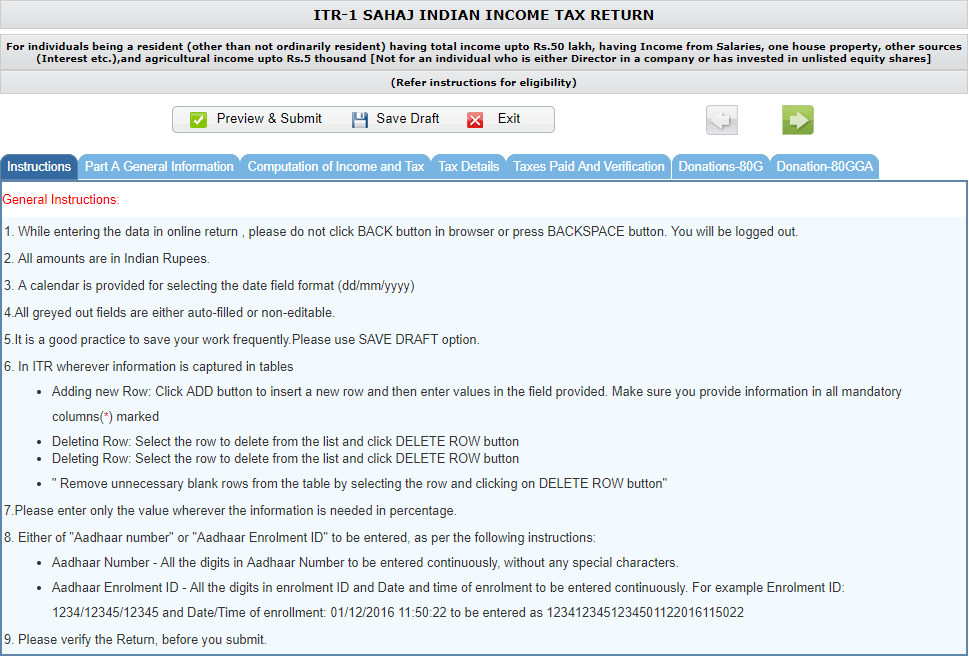

Instructions for ITR-1 (Sahaj)

On selecting the above options, you will get the screen as shown below. The ITR-1 eligibility is clearly mentioned.

Also there are multiple tabs, which we would go in more details later in the post. For this tab you should read the instructions very carefully.

The online ITR-1 Form has 7 tabs:

- Instructions

- Part A – General Information

- Computation of Income and Tax

- Tax Details

- Taxes Paid and Verification

- Donations-80G

- Donations-80GGA

We take you trough all the tabs (2 to 7) in the post below:

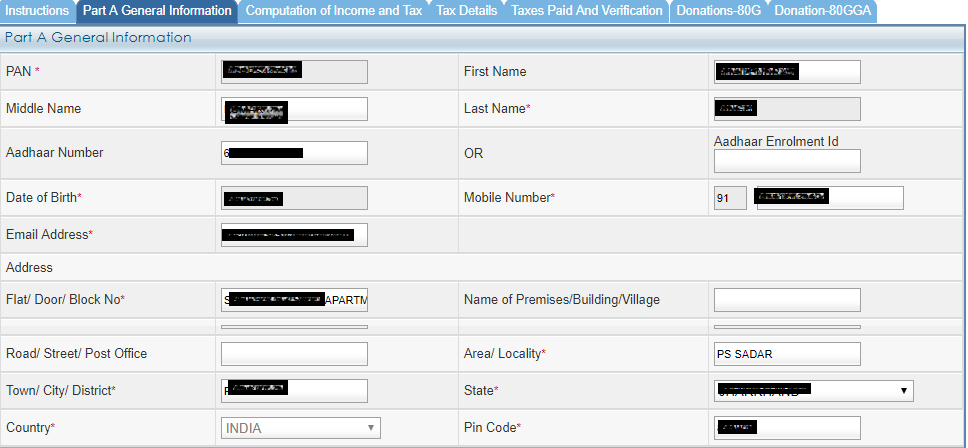

Part A General Information

As the name suggests this tab asks about general information about the tax payer like – Name, PAN, Address, Email, etc.

Some Pointers:

- In case you have filed your ITR in previous years most of the fields are pre-filled. Just go through and edit information which is not correct. For first time filers, you need to fill relevant fields.

- If this is your first time, some information may not be present which you need to fill up.

- PAN, Last Name and Date of Birth fields are not editable.

- You need to fill your Aadhaar Number or aadhaar enrollment ID in case you have applied but not received yours.

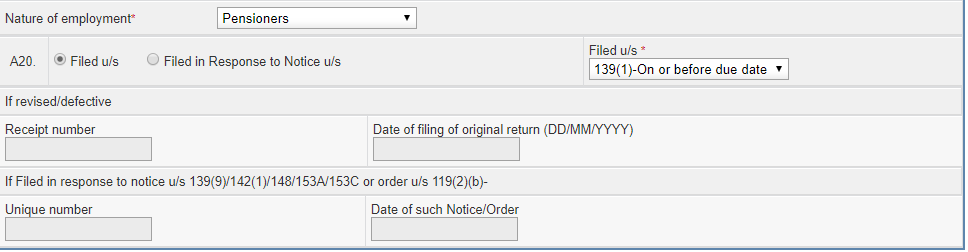

On the Second part of the form, you have to choose following:

“Nature of employment” – In our case the income is from Pension – we choose “Pensioners” from the drop down

A20 -> Filed u/s or Filed in Response to Notice u/s -> Choose Filed u/s.

Filed u/s -> Choose 139(1)-On or before due date from the following options:

- 139(1)-On or before due date (when filed before due date)

- 139(4)-Belated (when filed after due date)

- 139(5)-Revised (when filing revised ITR)

- 119(2)(b)- after condonation of delay (when filed for previous years after permission from IT Department)

The other fields are blank and nothing needs to be done. We move to the next tab.

Part B Computation of Income and Tax

This is the most important tab and so fill up all fields carefully. AS this is a big page we have divided the screen into respective sections:

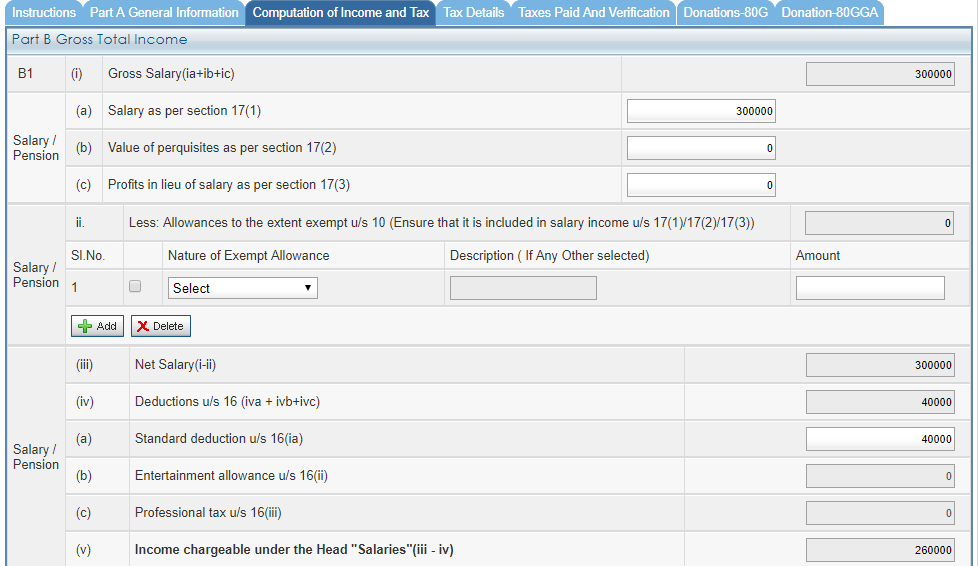

B1 – Salary/Pension

Salary as per section 17(1) – For pensioner enter the total Pension received for FY 2018-19 (April 1, 2018 to March 31, 2019). In our case its Rs 3,00,000.

There are various fields like Value of Perquisites, exempt allowance, etc. In case you have only income from Pension, you have to leave all those blank.

The Net salary is computed. You can take advantage of Standard deduction u/s 16(ia) as Pensioners get Rs 40,000 as standard deduction for FY 2018-19. This has been increased to Rs 50,000 from FY 2019-20.

B2 – House Property

In this section we need to enter details of any real estate we have. In our case the tax-payer has just one house which is self-occupied and has no loan running. In this case just select “Type of House Property” as “Self-Occupied” and leave everything as 0.

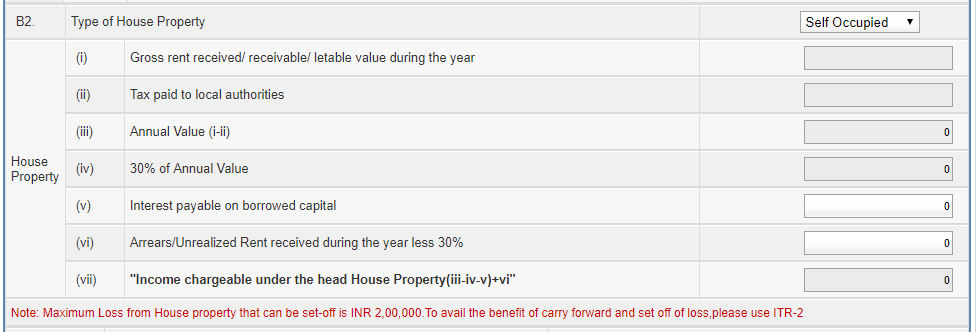

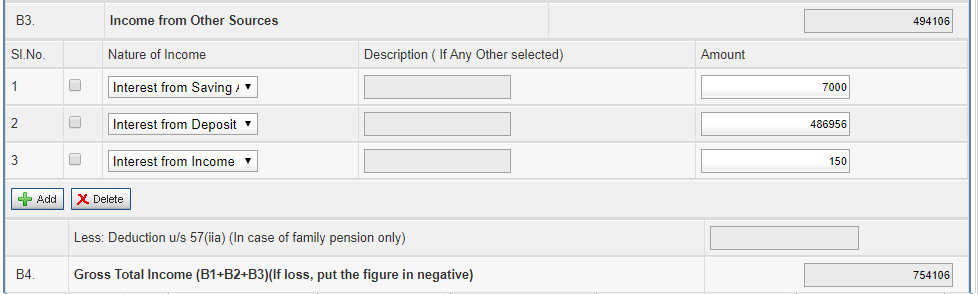

B3 – Income from Other Sources

Starting this year, ITR forms require more specifics about income from other sources. You can click ADD button to add rows.

In our case we had following:

- Interest from Saving Account: Rs 7,000

- Interest from Deposit (Bank/ Post Office/ Cooperative Society): Rs 4,86,956

- Interest from Income Tax Refund: Rs 150

- Family Pension: 0

- Any Other: 0 (income from insurance or interest income from Bonds, taxable gift, etc)

After you fill up the Income from other sources, you can see the Gross Total Income auto-calculated as Rs 7,54,106.

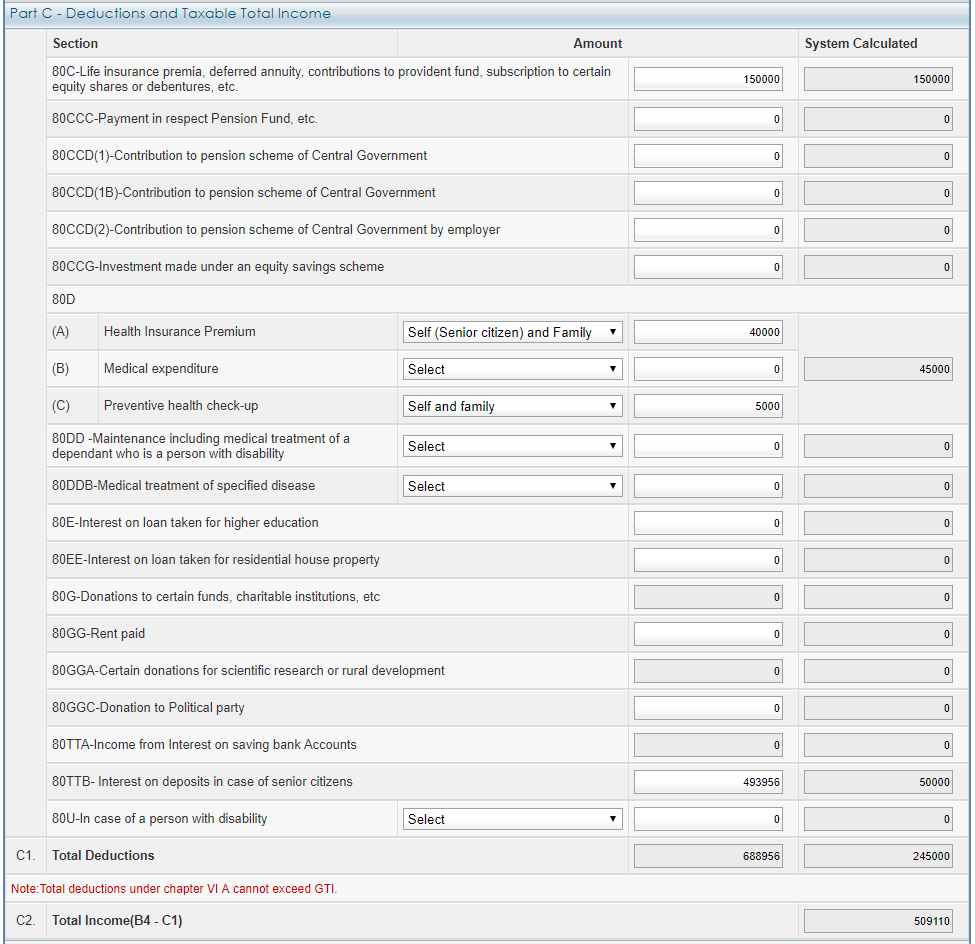

Part C – Deductions and Taxable Total Income

In this part we have to enter Deductions under Section 80C, 80D, etc.

In our case the tax-payer has following investments/deductions:

- Rs 1.5 Lakh in Senior Citizens’ Saving Scheme – this is eligible for deduction u/s 80C (Learn: 15 Investments to Save Tax u/s 80C – Which is the Best?).

- Rs 40,000 as premium of Health Insurance for self and his wife (eligible for deduction u/s 80D).

- Rs 5,000 as Preventive health check-up (eligible for deduction u/s 80D)

Other than the above, Senior citizens can take tax deduction u/s 80TTB on interest income on deposits up to Rs 50,000. This section was applicable from FY 2018-19 on wards.

We have filled the form accordingly and can see Total Deduction = Rs 2,45,000.

After this the Total Income = 5,09,110 ( 7,54,106 – 2,45,000).

The difference is actually Rs 5,08,106 but it has been rounded to the next 10. This is the figure on which income tax would be computed.

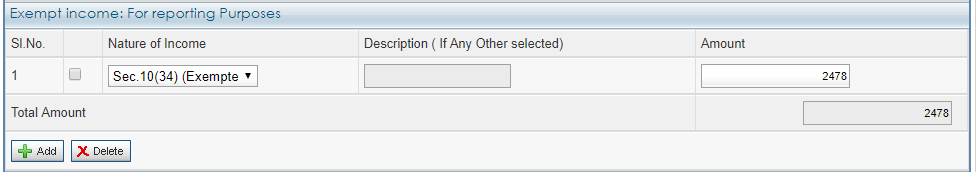

Exempt Income: For Reporting Purpose

There are some incomes which are not taxed but needs to be reported to IT department. In our case we had just one such income:

- Sec. 10(34) (Exempted Dividend Income): Rs 2,478

You may have other exempted income like EPF withdrawal, Life insurance maturity amount, etc. report it here.

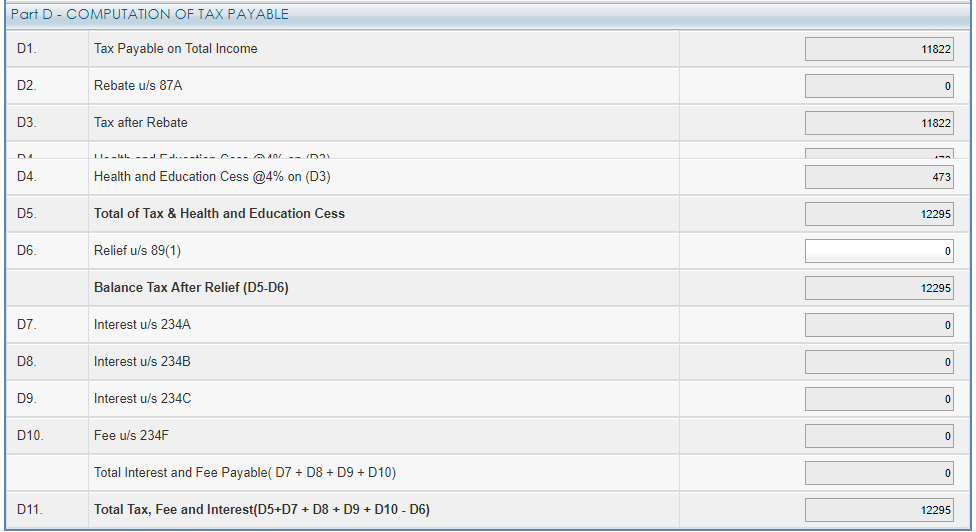

Part D – Computation of Tax Payable

This section just computes the total tax payable along with the Health and Education cess. The only fillable field is “Relief u/s 89(1)” – which is any tax benefit that you want to claim for arrears. (Learn How to Calculate Tax on Arrears in 7 Easy Steps)

At the end, Total Tax, Fee and Interest comes out to be Rs 12,295.

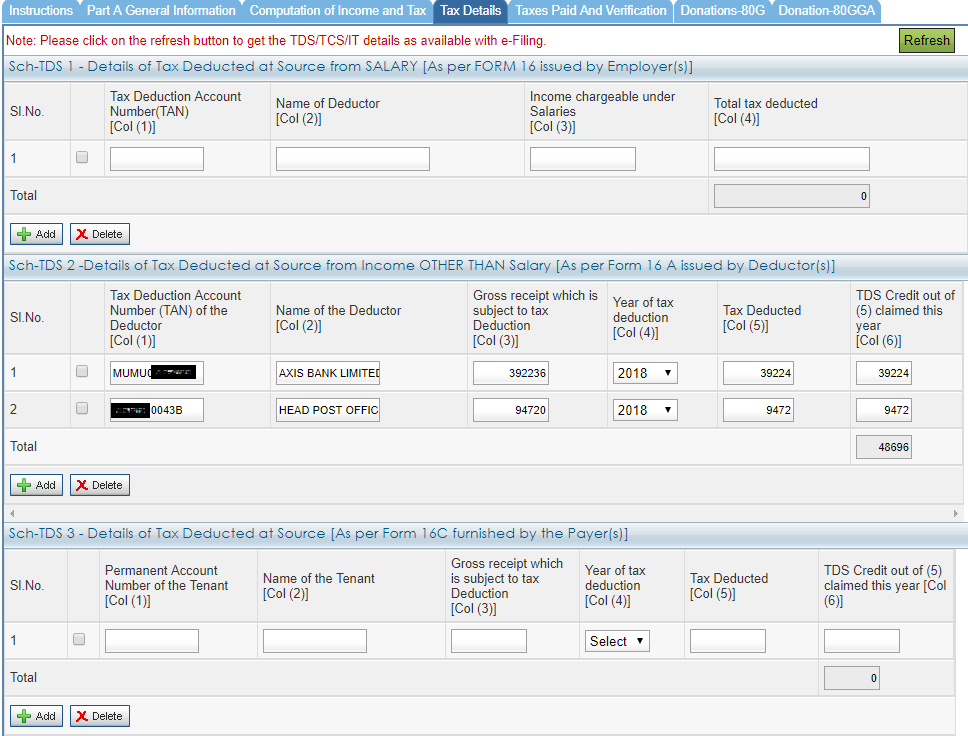

Tax Details

This section has details about TDS (Tax Deducted at Source), TCS (Tax Collected at Source) & Advance Tax and Self Assessment Tax Payments. This section is populated directly from Form 26AS. In case you feel it has older data, just press the REFRESH button (at top right corner in green) and it will pick the latest data from Form 26AS. We have split the page in 3 parts for convenience.

Details of Tax Deducted at Source

The Tax Deducted at Source has 3 schedules:

- Sch-TDS1 – Details of Tax Deducted at source from Salary (this number should match from Form 16 issued by your employer)

- Sch TDS 2 – Details of Tax Deducted at source from Other than Salary (this includes TDS from FD, RD, Post office deposits, insurance payouts, etc)

- Sch TDS 3 – Details of Tax Deducted at source (this includes TDS on rental income)

In our case there was NO TDS in Sch 1 & 3. However there was TDS from FD in Axis Bank & Post Office Deposits as shown in the form below. In most cases you will not need to edit anything here.

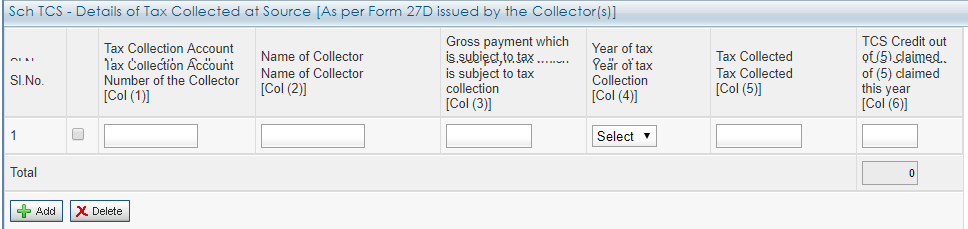

Details of Tax Collected at Source

In some cases such as when buying car of more than Rs 10 Lakh, a tax of 1% is collected by the dealer and deposited to Income Tax Department. The TCS amount is reflected in this section. In our case we do not have any such entries.

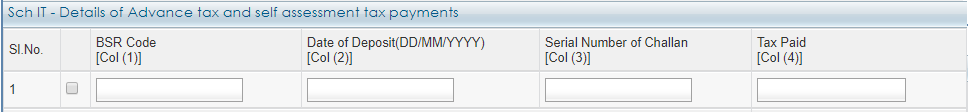

Details of Advance Tax and Self Assessment Tax Payments

Any payments of Advance Tax or Self Assessment Tax is reflected in this section. In our case its blank as the tax-payer did not have any additional tax payable.

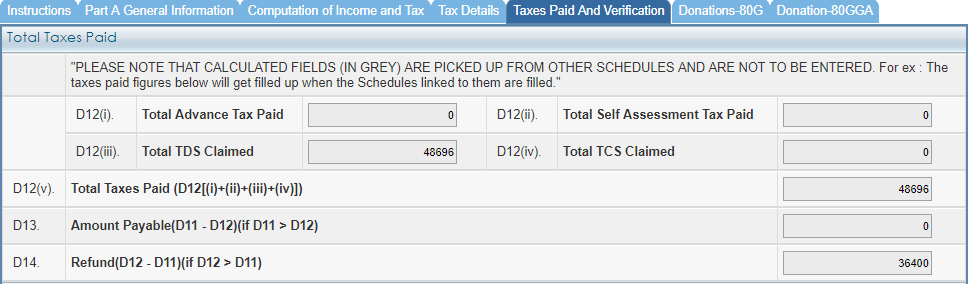

Taxes Paid and Verification

This is simple section with very less things to fill. You can see the computations, the final tax refund you would get, etc.

Total Taxes Paid

There are No entries to be made here. It just shows the total taxes paid in form of TDS, TCS, Advance Tax and Self-Assessment Tax. In our case the TDS was Rs 48,696 and the tax payable was Rs 12,295. Hence we would get tax refund of Rs 36,400 (again rounded off to nearest 10). You should always check this number to make sure all entries in previous forms are correct and on expected lines.

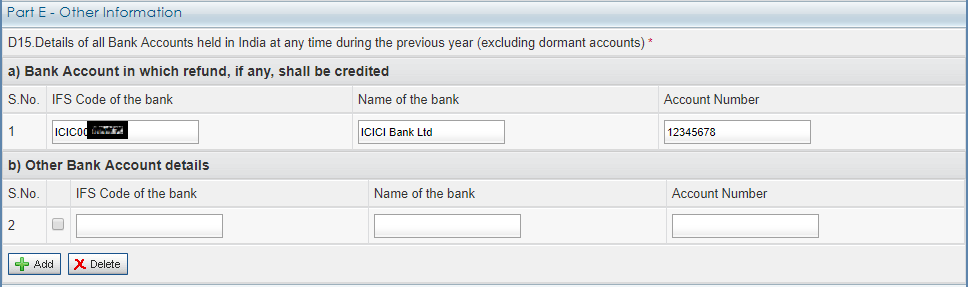

Part E – Other Information

In this section, you need to give your Bank account details. Mention the bank where you want to get the refund money in a).

Also make entities of all your bank accounts (including joint accounts) in b). This is compulsory to do so be careful not to miss any active accounts in the bank.

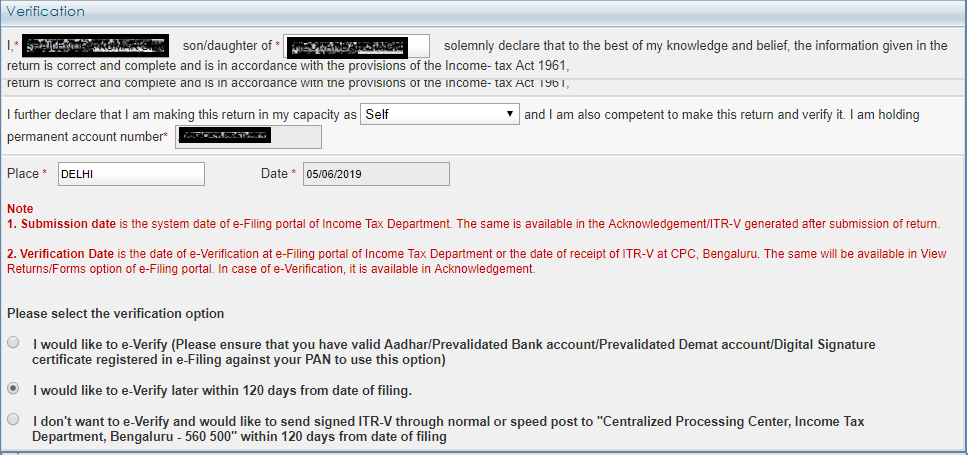

Verification

This is simple. You have to mention your name, fathers name and choose “Self” from drop down.

Just mention the place and date is auto picked up.

There are 3 options fro Verification:

- I would like to e-Verify

- I would like to e-Verify later within 120 days from date of filing

- I don’t want to e-Verify and would like to send ITR-V.

You can choose whatever is comfortable for you. We recommend to choose from option 1 or 2 to e-verify the ITR as its quick and can be done from your computer. (Read: 5 Ways to e-Verify your Income Tax Returns) Please note until you verify your tax returns its not valid and the processing does not start. In case you have not verified within 120 days of filing, the return is as good as you have not filed it. So verification of ITR is necessary step.

[box type=”info” size=”large” style=”rounded” border=”full”]

Here are some posts which can help you with e-filing of ITR 2019:

- 9 Most Important Changes in ITR Forms for AY 2019-20

- Calculate your Tax liability for FY 2018-19 (AY 2019-20)

- Download 44 page slideshow showing all tax exemptions

- Which ITR form to fill for Tax Returns for AY 2019-20?

- Filing ITR for Senior Citizen with Pension & FD (With Screenshots)

- How to Claim Tax Exemptions while filing ITR?

- Use Challan 280 to Pay Self Assessment Tax Online

- Form 26AS – Verify Before Filing Tax Return

- 5 Ways to e-Verify your Income Tax Returns

- What if You DO NOT file your Returns by due Date?

- Can I file my Last Year Tax Return?

- Why and How to Revise Your Tax Return?

- What does Intimation U/S 143(1) of Income Tax Act mean?

- What happens after you file your ITR?

[/box]

Donations-80G

There is a tab about donations u/s 80G. This has 4 sections:

- Donations entitled for 100% deduction without qualifying limit

- Donations entitled for 50% deduction without qualifying limit

- Donations entitled for 100% deduction subject to qualifying limit

- Donations entitled for 50% deduction subject to qualifying limit

In case you have made tax-exempted donations (like to political parties, some charities), you have mention the details here. You need to mention the following:

- Name of the Donee

- Address

- City or Town or District

- State

- Pin Code

- PAN of Donee

- Amount of Donation (in cash, in other mode)

- The eligible amount of donation (for tax deduction) is auto-computed

In our case we had no donations.

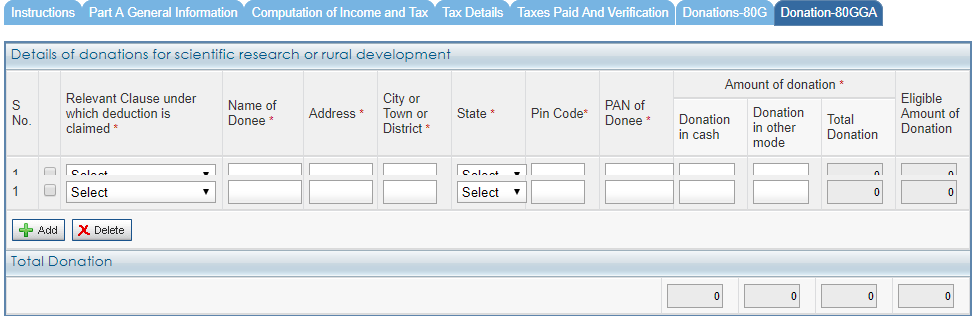

Donations-80GGA

This tab covers the donations made for Scientific Research or Rural Development and is eligible for tax benefit u/s 80GGA.

In our case there was no donation.

ITR-1 Online

We hope the post would have helped and encouraged you to file your ITR online through Income Tax Official website. If you see the steps its simple, a lot of data is auto-imported and you have to just scan through. Did you file your returns yourself and did you face any challenges? Do let us know and we would try to resolve anything related to filing of ITR – Income Tax Return.