Budget 2015 had introduced a new section 80CCD (1B) which gives deduction up to Rs 50,000 for investment in NPS (National Pension Scheme) Tier 1 account This new deduction can help you save tax up to Rs 15,600 in case you are in the 30% tax slab.

The question is should you take advantage of this new tax deduction and invest in NPS?

NPS has not taken off as expected and finance minister by giving this additional tax saving option is trying to give it a push. We all know how many people invest blindly in poor schemes just to save tax. This post is to analyze if it makes sense for us to invest in NPS to save additional tax.

Assumptions:

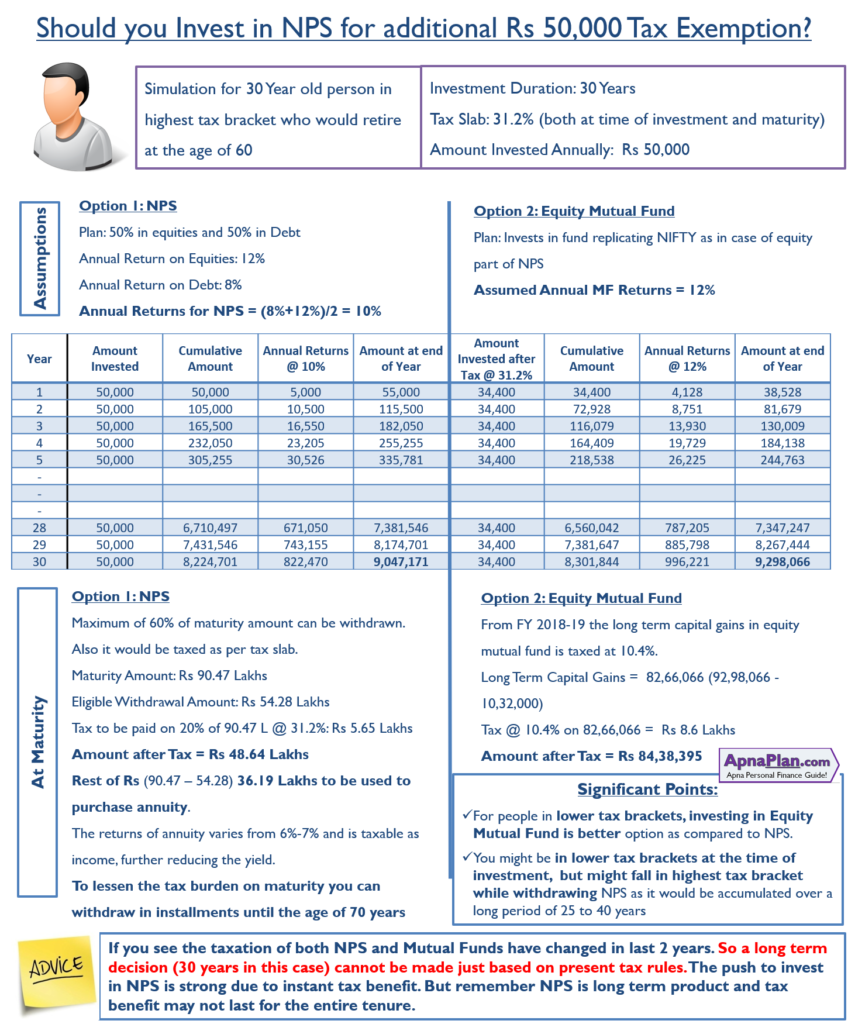

For our calculation we assume that Amit is 30 year old and would retire at the age of 60. So he would make investment for 30 years.

- NPS Investment Option: Most Aggressive i.e. 50% investment in equity and 50% investment in debt

- Amount Invested Annually: Rs 50,000

- Return on Equity: 12%

- Return on Debt: 8%

- Tax Bracket: 31.2% (surcharge revised in Budget 2018)

- Also the tax bracket remains 31.2% at the time of withdrawal at the age of 60.

Alternatively, Amit can pay tax on this Rs 50,000 and invest the remaining amount (i.e. 50,000 * (1-31.2%) = Rs 34,400) in Equity Mutual fund which gives return of 12% annually.

Also Read: NPS Tax Benefit u/s 80CCD(1), 80CCD(2) and 80CCD(1B)

Updated Comparison: After introduction of Long Term Capital Gains Tax on Equity Mutual Funds in Budget 2018

As can be seen in the calculation above, the final amount generated by NPS is 90.47 Lakhs while in case of equity mutual fund its 92.98 Lakhs.

Additionally, in case of NPS you can withdraw maximum of 60% of the total maturity amount which is 54.28 Lakhs. 20% of NPS corpus would be further subjected to 31.2% tax, which means you would be left with net amount of Rs 48.64 lakhs after tax. Rest Rs 36.19 lakhs should be used to purchase annuity.

The proceeds received from this annuity is again considered income and taxed according to marginal tax rate. Also annuities in India have not evolved and the return from varies in the range of 6% – 7%. This makes it a sub optimal investment choice.

In case of investment in equity mutual fund, the long term capital gains in equity mutual fund is taxed at 10.4% (from FY 2018-19). At maturity you have Rs 93.39 Lakhs which after LTCG tax would be Rs 84.38 Lakhs.

If you see the taxation of both NPS and Mutual Funds have changed in last 2 years. So a long term decision (30 years in this case) cannot be made just based on present tax rules.

Significant points:

- For people in lower tax brackets, investing in Equity Mutual Fund becomes much better option as compared to NPS. This is because the tax outgo is lesser and hence more money is invested in MF.

- As the duration of investment goes up the mutual fund option becomes even better due to compounding at higher return rates.

- You might be in lower tax brackets at the time of investment; but might fall in highest tax bracket while withdrawing NPS as it would be accumulated over a long period of 25 to 40 years.

- With the new rules you can split your withdrawal till the age of 70 – lessening you tax outgo.

- You need not purchase annuity if the NPS maturity corpus is less than Rs 2 Lakhs.

Should People nearing Retirement Invest in NPS?

I often get queries by people near retirement that if they can and should open NPS account to get tax benefit u/s 80CCD(1B). Below is my take and you can take your decision accordingly.

- Anyone who is below 65 years of age can open NPS account – so technically you can open your NPS account.

- Assuming you are 62 years or more and the tax exemption stays for next few years. You can invest 50,000 every year for 3 years. With 10% annual returns your NPS maturity amount would be less than Rs 2 lakhs.

- As per rules, you need not purchase annuity if the maturity amount is less than Rs 2 lakhs. So after retirement you can withdraw the amount without much tax burden.

- You can also time the withdrawal to a year (but before reaching 70 yeas of age) when the tax liability is lower or split the withdrawal in 10 installments.

Also Read: NPS – Maturity, Partial Withdrawal & Early Exit Rules

Even for lower age people you can start investing Rs 50K for tax saving until its provided for and keep account active by contributing minimum of Rs 1,000 per year.

Conclusion:

Budget 2016 had brought down the tax liability on NPS maturity to acceptable level while Budget 2018 introduced Long term capital gains on equity mutual funds. You get instant tax saving if you choose NPS. You may look to invest in NPS but keep the following in mind:

- The NPS tax benefit may be done away in future but you are ready to continue the same with minimum annual investment

- Tax on investments keep on changing and tax on both mutual funds & NPS can change in future

- Equity Mutual Funds would outperform NPS in most cases

- NPS would outperform if compared to fixed deposits (in most scenarios)

mr amit i am a government servant. from my salary nps is deducted total deduction in NPS is about 47000.00 and my saving in PPF is Rs 150000.00, total how much rebate i will get?

You can get 1.5 Lakhs u/s 80C and additional 47K u/s 80CCD(1B)

Dear Mr. Amit, I am a professional trainer (Freelancer) since Jan’2017. I have already opened the NPS account in March’2017. I am given to understand that I can invest 20% of my Gross income in NPS (I am not sure about the applicable section for this exemption) and I suppose this was 10% for the previous FY 2016-17. Additionally I can invest 50,000 under section 80CCC(1B). Can you confirm / guide me on this and confirm which section would apply for the 20%.

The increased limit of NPS to 20% for self-employed is u/s 80CCD(1) which forms part of 80C deduction. So combining both 80C & 80CCD(1) you can save maximum 1.5 lakhs.

However you can save up to Rs 50,000 for investment in NPS u/s 80CCD(1B).

please suggest which mutual fund is having maximum return if I want invest 2000 per month.

hi i am still confuse abt sec 80ccd(1B) …i am government servant and only having contribution in Tier-I acct but while filing returns dont get any clue which amt i have to enter in 80CCD(1B)..

plse address my this query.

thanking you in anticipation

You can split your NPS contribution u/s 80CCD(1) & 80CCD(1B). 80CCD(1B) can have max of Rs 50,000 rest would go in 80CCD(1).

Can I get Tax benefit for my contribution towards Atal Pension Yogana? If yes, is it equivalent to NPS Tier 1 benefit?

Yes

sir what is processor to get additional benifit in tax u/s 80ccd(1B) how we submit money per month or per year. please suggest me.

You can invest one time or multiple times in a year. Irrespective of ho much you invest in NPS you can get maximum tax benefit of Rs 50,000 u/s 80CCD(1B)

Sir, I m a govt empolyee. I have already a nps account. my per month deduction in this account 7100 Rs. Now, can I Invest 50000/-Rs in this account from my monthly salary for extra benifit as u/s 80ccd(1B)?

Yes you can

hi ,…. can i deposit different amount in different year, i am paying tax under 30% slab, shall i invest under Tire – 1 or 2, is it necessary to submit any documents in hard copy.

can i invest in NPS for my son’s,19 years age, perusing graduation and enjoy the tax benefit.

thanks

Debashis Majumder

You can deposit different amount in different year. The minimum contribution is Rs 1,000 every year to keep the account active.

For tax benefit you must invest in Tier 1 account only. Investment in Tier 2 NPS is NOT eligible for any tax benefit.

The NPS investment must be on tax payers name to take tax benefit. So you cannot invest in your son’s name.

MR. AMIT many2 thnx for giving information that NPS can only be done by the people between 18 2 60 years of age. Thus there has no scope for sr. citizen to have tax exemption of additional amount

I thought additional benefit of tax exemption can be available, if I invested in NPS.

Sorry for taking your valuable times

I AM A RETIRED GOVT. PENSIONER OF 62 YEARS OLD. WHETHER WILL IT BE ANY HELPFUL FOR ME TO INVEST IN NPS. I HAVE BELOW RS.FIVE LAKH TAXABLE INCOME AFTER INVESTING PPF UNDER 80C(FULL COVERAGE)

Sir you cannot invest in NPS as the age limit for opening & investing in NPS is below 60 years!

Sir, Is it mandatory to invest every year with same amount after entering into NPS under 80ccd-1b

No to keep NPS account active you need to invest minimum Rs 1,000 every year. So its NOT mandatory to invest same amount every year!

i am a haryana govt. employee.can i get additional tax benefit over 150000 if my contribution is more than this amount.

Yes you can get tax benefit up to Rs 2 lakh on investment in NPS if you take both 80CCD(1) & 80CCD(1B) together!

Sir my 80c investment is:- Lic=16949 ,PLI=62786,GIS=360,Tution Fee=34680,NPS=50521. Total=165296plesecalculate it

Is ELSS better than NPS if ELSS does not offer any tax benefit

Without any tax benefit, ELSS is better than NPS as you have more flexibility to use the maturity amount. In case of NPS you have to invest 40% in annuity which is not very good product. Also there is limited lock-in for ELSS while in case of NPS its hard to withdraw all amount before 60 years of age if you plan early retirement!

hey i m lalit.i recently got a gov. job…..pls recommmend me should i go for NPS or equity mutual funds

In case of government job you would anyway have NPS account (10% of basic + DA). So to diversify you should choose equity mutual funds. Also read 15 Personal Finance Tips for your First Job – might be useful for you!

sir my investment

80c

1-lic 50000,

2-ppf 100000

80ccd 1-nps my contribution 60000

total 210000 = 150000

80ccd2 govt.10% 60000= 60000

total 210000

so what about 80ccd1(b) 50000???????

the tax exemption limit for 80CCD(1) along with 80C is 1.5 lakhs. You can show your NPS contribution up to Rs 50K u/s 80CCD(1B)

I am a government employee. I have invested Rs 1.5 lakh 80C. I also contribute around Rs 64,000 per year to National Pension System (NPS). The government, my employer, also contributes a matching amount. I want to know whether I can claim my 80 C investment of Rs 1.5 lakh under Section 80C and the additional Rs 50,000 under Section 80CCD(1) on my contribution to NPS?

Yes you can show your contribution u/s 80CCD(1B)