Budget 2015 had introduced a new section 80CCD (1B) which gives deduction up to Rs 50,000 for investment in NPS (National Pension Scheme) Tier 1 account This new deduction can help you save tax up to Rs 15,600 in case you are in the 30% tax slab.

The question is should you take advantage of this new tax deduction and invest in NPS?

NPS has not taken off as expected and finance minister by giving this additional tax saving option is trying to give it a push. We all know how many people invest blindly in poor schemes just to save tax. This post is to analyze if it makes sense for us to invest in NPS to save additional tax.

Assumptions:

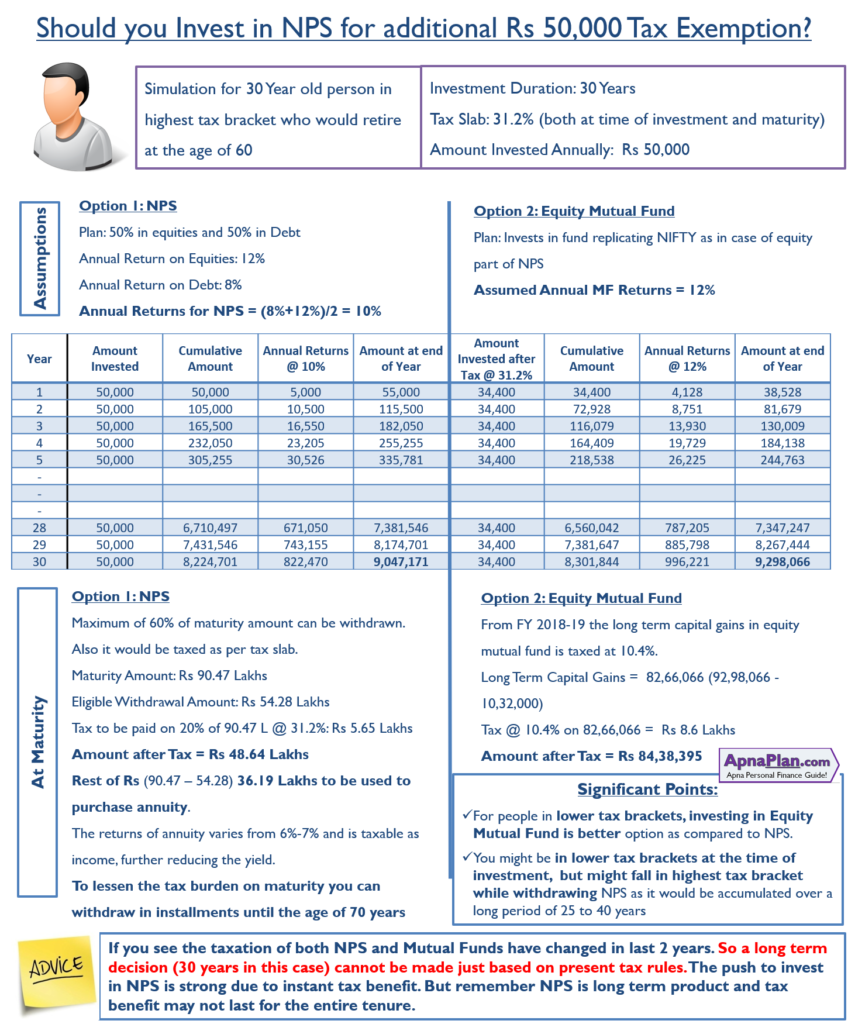

For our calculation we assume that Amit is 30 year old and would retire at the age of 60. So he would make investment for 30 years.

- NPS Investment Option: Most Aggressive i.e. 50% investment in equity and 50% investment in debt

- Amount Invested Annually: Rs 50,000

- Return on Equity: 12%

- Return on Debt: 8%

- Tax Bracket: 31.2% (surcharge revised in Budget 2018)

- Also the tax bracket remains 31.2% at the time of withdrawal at the age of 60.

Alternatively, Amit can pay tax on this Rs 50,000 and invest the remaining amount (i.e. 50,000 * (1-31.2%) = Rs 34,400) in Equity Mutual fund which gives return of 12% annually.

Also Read: NPS Tax Benefit u/s 80CCD(1), 80CCD(2) and 80CCD(1B)

Updated Comparison: After introduction of Long Term Capital Gains Tax on Equity Mutual Funds in Budget 2018

As can be seen in the calculation above, the final amount generated by NPS is 90.47 Lakhs while in case of equity mutual fund its 92.98 Lakhs.

Additionally, in case of NPS you can withdraw maximum of 60% of the total maturity amount which is 54.28 Lakhs. 20% of NPS corpus would be further subjected to 31.2% tax, which means you would be left with net amount of Rs 48.64 lakhs after tax. Rest Rs 36.19 lakhs should be used to purchase annuity.

The proceeds received from this annuity is again considered income and taxed according to marginal tax rate. Also annuities in India have not evolved and the return from varies in the range of 6% – 7%. This makes it a sub optimal investment choice.

In case of investment in equity mutual fund, the long term capital gains in equity mutual fund is taxed at 10.4% (from FY 2018-19). At maturity you have Rs 93.39 Lakhs which after LTCG tax would be Rs 84.38 Lakhs.

If you see the taxation of both NPS and Mutual Funds have changed in last 2 years. So a long term decision (30 years in this case) cannot be made just based on present tax rules.

Significant points:

- For people in lower tax brackets, investing in Equity Mutual Fund becomes much better option as compared to NPS. This is because the tax outgo is lesser and hence more money is invested in MF.

- As the duration of investment goes up the mutual fund option becomes even better due to compounding at higher return rates.

- You might be in lower tax brackets at the time of investment; but might fall in highest tax bracket while withdrawing NPS as it would be accumulated over a long period of 25 to 40 years.

- With the new rules you can split your withdrawal till the age of 70 – lessening you tax outgo.

- You need not purchase annuity if the NPS maturity corpus is less than Rs 2 Lakhs.

Should People nearing Retirement Invest in NPS?

I often get queries by people near retirement that if they can and should open NPS account to get tax benefit u/s 80CCD(1B). Below is my take and you can take your decision accordingly.

- Anyone who is below 65 years of age can open NPS account – so technically you can open your NPS account.

- Assuming you are 62 years or more and the tax exemption stays for next few years. You can invest 50,000 every year for 3 years. With 10% annual returns your NPS maturity amount would be less than Rs 2 lakhs.

- As per rules, you need not purchase annuity if the maturity amount is less than Rs 2 lakhs. So after retirement you can withdraw the amount without much tax burden.

- You can also time the withdrawal to a year (but before reaching 70 yeas of age) when the tax liability is lower or split the withdrawal in 10 installments.

Also Read: NPS – Maturity, Partial Withdrawal & Early Exit Rules

Even for lower age people you can start investing Rs 50K for tax saving until its provided for and keep account active by contributing minimum of Rs 1,000 per year.

Conclusion:

Budget 2016 had brought down the tax liability on NPS maturity to acceptable level while Budget 2018 introduced Long term capital gains on equity mutual funds. You get instant tax saving if you choose NPS. You may look to invest in NPS but keep the following in mind:

- The NPS tax benefit may be done away in future but you are ready to continue the same with minimum annual investment

- Tax on investments keep on changing and tax on both mutual funds & NPS can change in future

- Equity Mutual Funds would outperform NPS in most cases

- NPS would outperform if compared to fixed deposits (in most scenarios)

Is this Rs 50000 NPS saving option avaliable for govt employees who have joined before 1.1.2004?

Will they get tax benefit if they open NPS tier one account and save Rs 50000 only.

Kinldy calrify

Thank you.

Yes this is available to everyone. you can open NPS account and get this benefit!

I am TN Govt employee. I joined contributory pension scheme in TN Govt. Is it eligible for my contribution 10%(BP+DA )@ 80CCD(1B)?.CPS is equal to NPS?

yes CPS is equal to NPS and you can claim benefit u/s 80CCD(1B)

Thank you. what is meant by tier 1 plan?

NPS has two tiers.

Tier -I account is the primary account and the contribution to this account is locked till retirement.

Tier- II account is optional saving account and deposit and withdrawal to this account can be done anytime.

Hi Amit,

I am 40 years and in 30% tax bracket. Whether investing 50K in NPS for tax benefit under 80CCD(1B) is advisable?

This is something only you can answer or you might want to consult investment advisers. I can just tell about the product, you need to decide if it fits your risk profile and overall investment goals!

Thanks for the reply. I was seeking your advise as an investment adviser. I was wondering with only 40% tax exemption on maturity (rest of the amount will again be in 30% tax bracket) whether NPS will be beneficial?

Which equity mutual funds are good?

At maturity 40% amount has to compulsorily go to annuity purchase. Rest 60% can be withdrawn in lumpsum. Only 20% on NPS corpus is taxable at maturity. Also if you purchase annuity out of 60% corpus nothing is taxable at withdrawal. TO minimize tax you can also withdraw in installments. Know more – NPS – Maturity, Partial Withdrawal & Early Exit Rules

Equity Funds are good not only due to their tax treatment but also they can generate higher returns in the long run!

Hi Amit,

Is section 80CCD(1B) applicable for the financial year 2016-17 ( AY 2017-18) & FY 2017-18 ( AY 2018-19) to get tax rebate in investing Rs. 50000.00 in NPS tier 1 A/C.?

Yes

Sir,

I want to avail tax benefit under 80cc d 1 b,

Will i get tax benifit by investing 50 k in any endowment pension plan

No Sec 80CCD(1B) is only available for investment in NPS Tier 1

Hi Amit

It would be nice if u can advice in current tax secenario. Also give a illustration where in I invest ₹50000in nps and the amount of tax saved on nps that is ₹15450 is invested in equity fund compared to only investing in equity fund. A penne saved is a penne earned. What will be the expected corpus my age is 35yrs

Thanks

Any extra investment in Equity Fund for Long term would be GOOD for you. As the calculation is concerned the investment as of today remains Rs 50K an the maturity shown after tax. There is no instant redemption of Rs 15K when you invest in NPS ….

to get benefit of additional Rs 50000/- under 80ccd(1b) NPS, demat account mandatory ?

NPS does not require demat account. If you have aadhar you can open NPS account online.

I AM 48 YRS, WANT TO INVEST IN NPS FOR ADDITIONAL 50000/- TAX BENIFITS IN EQUITIES, CAN I WITHDARW THE TOTAL AMOUNT AFTER MY RETIREMENT AT ONE SHOT?

No you can withdraw maximum 60% of NPS corpus in lumpsum as you have to buy annuity using atleast 40% corpus. You can read more NPS – Maturity, Partial Withdrawal & Early Exit Rules

While calculating for NPS, the instant tax benefits also should be considered (as per present rules). Those benefits also should be added in the calculation as it saves the tax and is savings to individual pocket.

But the article is good taking into the assumptions and useful for people.

Hello Amit,

Nice article for awareness on NPS. However i have still query that i’m working in Private Sector where there is no pension and job security. In that case should i opt for NPS as disciplined way of saving for creating retirement corpus and pension ? Also currently my salary is above 10 Lacs and after claiming existing investments, i fall under 20% tax slab. What would be your suggestion for me whether to go for NPS or start SIP directly in equity mutual funds for next 25 years ? Also suggest good equity mutual funds for SIP if i have to spread my investment in diversified sectors.

Thank you very much.

Best Regards,

Sushil

You can continue NPS by minimum contribution of Rs 1000 every year. So to invest in NPS or NOT is your call.

As of today SIP in equity mutual funds seem to be better option than NPS – mainly due to the flexibility, higher returns and favorable tax treatment it offers.

can we do stp

Yes that would lead to lower taxation.

If I defer the withdrawal for up to 70 years…then also tax of 30.9% is applicable?? Or 60% of the total maturity amount then is totally tax free??

Deferment does not impact taxation. But at 70 years of age you might have lower income and hence the effective tax applicable to you would be lower!

I am 56+, can I invest in NPS to save tax u/s 80ccb

Yes you can open NPS account. But you can contribute only up to age 60. SO make a calculated move.

Nice article and quite helpful for people to decide.

Thanks

The treatment of NPS contribution towards Income Tax purpose does not seems to be correctly reflected by the author and the views given are suspect.

Under Section 80CCD (1) the statutory 10% of Emoluments (Basic + Dearness Allowance) contribution to NPS-Tier-1 Account amounting upto Rs.1,50,000 is counted towards Section 80C which can be deducted from Taxable Income. Additionally up to Rs.50,000 can be deducted from taxable income provided it is invested in NPS-Tier-2 Account. Thus, to claim additional Rs.50,000 deduction one need to invest in NPS-Tier-2 Account. For example, if one make say all Rs.2,00,000 contribution in NPS-Tier-1, the entitled deduction is only Rs.1,50,000. The same can be confirmed by using the Tax Calculator given on the website of Income Tax Department.

For more details please read http://www.pfrda.org.in/MyAuth/Admin/showimg.cshtml?ID=671

Hope the author can through more light on it.

Additional up to Rs.50,000 can be deducted from taxable income using NPS-Tier-2 Account under Section 80CCD(1B).

In effect, contribution to the NPS-Tier-1 Account can not be counted towards deduction under Section 80CCD(1B).

My understanding was wrong. In fact, in NPS Tier-1 account, contribution upto Rs.50,000 over and above the statutory 10% of emoluments (Basic + DA) is eligible for deduction under Section 80CCD(1B) from the taxable income.

There is some confusion among tax experts about the same and no clarification has been offered by income tax department. If you want to play safe you might want to deposit Rs 50K additional to claim sec 80CCD(1B) benefit.

Yes, Amitji that appears the correct position. Thanks.

But sir you may go through again the addtional tax benefit of amont 50000 is only on tier I and not in tirr tier II. It is mentioned that all tax benefit are on tier tier one only. Tier II is just like a mutual fund. No benefit in this

Hi Sir,

I have a question here, I have taken a house loan during 2013 (it was second hand home, but possession dint happened due to different reasons). Since all this 3 years i was claiming HRA exemption n. This year i have taken possession and planning to claim for Interest paid and Principal paid. Will this create a problem, since date of possession and date of loan sanctioned in 2 different years. Do i need to submit any other document ?

There is no problem in claiming interest/principal paid on home loan. In most construction linked plans the date of loan sanction and possession is different. The problem arises only if the difference is more than 3 financial years. In that case the interest exemption is limited to Rs 30,000 only for self occupied homes. This time frame has been increased to 5 years from FY 2016-17.

Thanks for the wonderful article and the debate with Anup. This helped me to clear my doubts on investment in NPS. I have one additional question relating to the exemption of actual house rent paid from income tax. I have no component of HRA in my account. I pay about 10000/- per month as house rent. Is there a way I can claim for income tax expemption on it or part there of. Please let me know.

In case, you do not receive HRA as a salary component, you can still claim house rent deduction u/s 80GG. But uou cannot claim this deduction if you or your spouse or your children own any home in India or abroad.

The House Rent deduction is lower of the 3 numbers:

Rs. 5,000 per month

25% of annual income

(Rent Paid – 10% of Annual Income)

Thanks for the response. I have three more questions.

1. Is this deduction is above the basic savings exemption of 1.5 lakhs or included in that?

2. My employer deducts a sum of 1800 per month and it is shown as “employee provident fund”. Can it be shown as employer’s contribution to provident fund?

3. Professional tax of 200 per month is being deducted by my employer. Is it exempted fully for income tax?

Here are responses:

1. Sec 80GG is not included in Sec 80C exemption.

2. Your contribution to EPF is eligible for tax deduction u/s 80C

3. Professional tax is exempted from income tax