Budget 2015 had introduced a new section 80CCD (1B) which gives deduction up to Rs 50,000 for investment in NPS (National Pension Scheme) Tier 1 account This new deduction can help you save tax up to Rs 15,600 in case you are in the 30% tax slab.

The question is should you take advantage of this new tax deduction and invest in NPS?

NPS has not taken off as expected and finance minister by giving this additional tax saving option is trying to give it a push. We all know how many people invest blindly in poor schemes just to save tax. This post is to analyze if it makes sense for us to invest in NPS to save additional tax.

Assumptions:

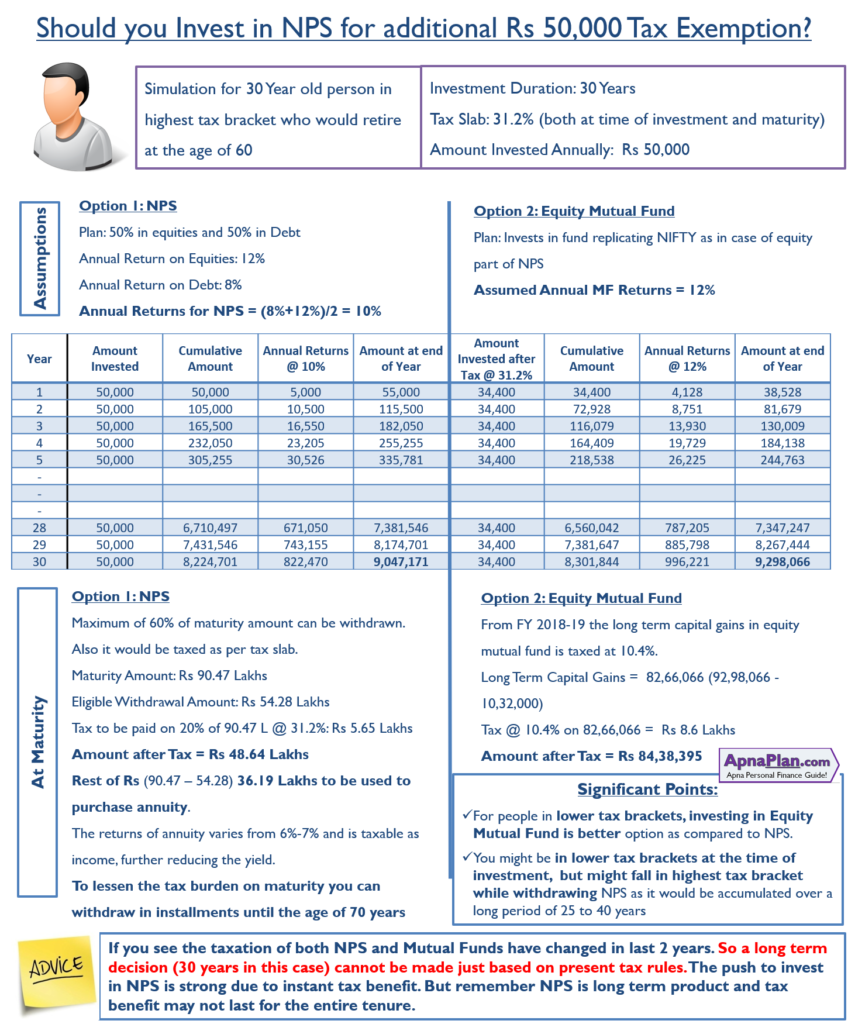

For our calculation we assume that Amit is 30 year old and would retire at the age of 60. So he would make investment for 30 years.

- NPS Investment Option: Most Aggressive i.e. 50% investment in equity and 50% investment in debt

- Amount Invested Annually: Rs 50,000

- Return on Equity: 12%

- Return on Debt: 8%

- Tax Bracket: 31.2% (surcharge revised in Budget 2018)

- Also the tax bracket remains 31.2% at the time of withdrawal at the age of 60.

Alternatively, Amit can pay tax on this Rs 50,000 and invest the remaining amount (i.e. 50,000 * (1-31.2%) = Rs 34,400) in Equity Mutual fund which gives return of 12% annually.

Also Read: NPS Tax Benefit u/s 80CCD(1), 80CCD(2) and 80CCD(1B)

Updated Comparison: After introduction of Long Term Capital Gains Tax on Equity Mutual Funds in Budget 2018

As can be seen in the calculation above, the final amount generated by NPS is 90.47 Lakhs while in case of equity mutual fund its 92.98 Lakhs.

Additionally, in case of NPS you can withdraw maximum of 60% of the total maturity amount which is 54.28 Lakhs. 20% of NPS corpus would be further subjected to 31.2% tax, which means you would be left with net amount of Rs 48.64 lakhs after tax. Rest Rs 36.19 lakhs should be used to purchase annuity.

The proceeds received from this annuity is again considered income and taxed according to marginal tax rate. Also annuities in India have not evolved and the return from varies in the range of 6% – 7%. This makes it a sub optimal investment choice.

In case of investment in equity mutual fund, the long term capital gains in equity mutual fund is taxed at 10.4% (from FY 2018-19). At maturity you have Rs 93.39 Lakhs which after LTCG tax would be Rs 84.38 Lakhs.

If you see the taxation of both NPS and Mutual Funds have changed in last 2 years. So a long term decision (30 years in this case) cannot be made just based on present tax rules.

Significant points:

- For people in lower tax brackets, investing in Equity Mutual Fund becomes much better option as compared to NPS. This is because the tax outgo is lesser and hence more money is invested in MF.

- As the duration of investment goes up the mutual fund option becomes even better due to compounding at higher return rates.

- You might be in lower tax brackets at the time of investment; but might fall in highest tax bracket while withdrawing NPS as it would be accumulated over a long period of 25 to 40 years.

- With the new rules you can split your withdrawal till the age of 70 – lessening you tax outgo.

- You need not purchase annuity if the NPS maturity corpus is less than Rs 2 Lakhs.

Should People nearing Retirement Invest in NPS?

I often get queries by people near retirement that if they can and should open NPS account to get tax benefit u/s 80CCD(1B). Below is my take and you can take your decision accordingly.

- Anyone who is below 65 years of age can open NPS account – so technically you can open your NPS account.

- Assuming you are 62 years or more and the tax exemption stays for next few years. You can invest 50,000 every year for 3 years. With 10% annual returns your NPS maturity amount would be less than Rs 2 lakhs.

- As per rules, you need not purchase annuity if the maturity amount is less than Rs 2 lakhs. So after retirement you can withdraw the amount without much tax burden.

- You can also time the withdrawal to a year (but before reaching 70 yeas of age) when the tax liability is lower or split the withdrawal in 10 installments.

Also Read: NPS – Maturity, Partial Withdrawal & Early Exit Rules

Even for lower age people you can start investing Rs 50K for tax saving until its provided for and keep account active by contributing minimum of Rs 1,000 per year.

Conclusion:

Budget 2016 had brought down the tax liability on NPS maturity to acceptable level while Budget 2018 introduced Long term capital gains on equity mutual funds. You get instant tax saving if you choose NPS. You may look to invest in NPS but keep the following in mind:

- The NPS tax benefit may be done away in future but you are ready to continue the same with minimum annual investment

- Tax on investments keep on changing and tax on both mutual funds & NPS can change in future

- Equity Mutual Funds would outperform NPS in most cases

- NPS would outperform if compared to fixed deposits (in most scenarios)

I am in a govt.job, my employer deducts 36000 p.a total from salary as employee’s contribution (NPS) on which I get tax benefit under 80 ccd(1) and also deposits 36000 p.a. under NPS as employer’s contribution on which I get tax benefit under 80 ccd(2)

I have deposited 1,50,000 in PPF on which I get tax contribution under section 80 c

Now what I want to ask is, I have exhausted my limit under section 80c by investing in PPF, to get extra deduction of 50,000 under section 80 ccd(1b) can I use my employee contribution 36000 which is deducted from my salary [ 80 ccd(1) ], means can I use that 36000 not under 80c and can I use it under 80 ccd(1b) ?? 😀 😀

Yes you can use your part of NPS contribution to claim tax benefit u/s 80CCD(1B) and invest additional Rs 1.5 Lakh in PPF to take benefit u/s 80C.

This artical realy a good comparison

I was also confusing between these two

but now clear

my govt organization deducts Rs. 45,000 p.a as NPS employee contribution under 80ccd(1) from my salary

i have saved tax by contributing Rs. 1,50,000 to PPF

can i show that rs. 45000 p.a under 80ccd(1b) column or I need to contribute extra Rs. 50000 for it

Pls tell?

I HAVE JUST OPENED NEW nps ACCOUNT IN ALL CITIZEN MODEL AND I HAVE INVESTED IN TEAR2 ACCOUNT RS 50000, SHOULD I GET TAX BENEFIT U/S 80 CCD 1B OR I HAVE TO INVEST IN TEAR1 ACCOUNT ONLY ??????

The tax benefit is only for investment in NPS Tier -1 account. So invest accordingly.

Hi Amit, the article is indeed very good, yet NPS is offering a big security too by investing in debt, in case equity market fluctuates too much and gets slow down for years which we saw in past too.

The comparison is with Equity Mutual Fund. But if you compare it with Fixed Deposits or bonds then NPS might turn out to be better option for Retirement planning.

If someone has already taken the policy for pension scheme through LIC is also eligible for this deduction under this section

No Only NPS is eligible for Sec 80CCD(1B)

Excellent Article. I was considering investment under NPS scheme to avail the additional tax benefit. But your article helped me to take a decision to not invest in NPS at this moment. Thanks a lot.

Thank You 🙂

If i invested Rs. 50,000/- . Will it deduct from total income just like interest on home laon.

I want to invest Rs. 50,000 amount in NSP will it deduct from total income like 80D

Yes, the amount invested would be eligible for tax deduction

Yes

Very good article. Keeping in view all aspects, I also think M F is better option.

Thanks 🙂

sir i am psb employee . i have a pran no of nps tier i scheame . aditional 50000 rs invest in also tier i sheame directly

Yes you can invest directly in your Tier 1 account in the existing NPS account for additional tax benefit u/s 80CCD(1B)

how do i invest Rs. 50000 in TIER I, since this totally governed by Govt and it does not have any role of Govt employee. Therefore, I would like to know how do i invest additional Rs. 50000 to get income tax benefit on over all savings Rs 2 lakhs

Ashok I could not find any notification from PRFDA regarding your issue, but you might want to ask your accounts department that how you can do additional contribution in the existing NPS account. Also you can take benefit of your mandatory NPS contribution u/s 80CCD(1B) and invest in better options u/s 80C.

Is it madatory to continue the investment i.e Rs 50K every year. Already myself & my employer getting exepmption under 80ccd1 & 80ccd2. I’m an employee of PSB. Can i only invest Rs 50K for this year & get additional exemption.

No it’s not mandatory to deposit Rs 50K every year in NPS account, but the minimum contribution every year is Rs 6,000. You can make Rs 1.5 lakh investment u/s80C to save tax and take advantage of NPS for additional exemption u/s 80CCD(1B).

Amit,

One key point missing in your analysis what does the investor do with the money saved due to tax deduction. If one assumes that Rs.15,450 saved because of reduced tax burden is spent partying, then, like you said NPS would be a bad choice. However, if investor is careful enough to invest that Rs.15.450 in a mutual fund that returns 12% per year like you have considered, NPS turns out be a much better option. NPS remains better even if we consider the returns after 30 years are taxed, and only 60% of the maturity can be withdrawn.

So the key differentiator is what one does with the money saved due to tax deduction.

The calculation above shows investing Rs 50K in NPS and Rs 35K in Mutual Fund. So it takes care of amount saved in tax.

Hi Amit,

Also I would like to highlight this case is in favour of Mutual Fund only because the rate of return you expected is 12% if that comes down by just 1% also then in that case the return on NPS would be 9.5% and Mutual Fund would be 11% and in that case NPS would be better off… So I think its still better to go for NPS so that atleast we are reducing the risk for 8% of the return which is good…..

@Vinay the above calculation is true for the assumptions I made. No one can predict the future and we don’t know if the debt fund would be yielding 8% in future. Even today 8% is difficult for debt funds. Also we are not sure about taxation. In future the tax rates may go down or NPS may become tax free. All we can do is predict returns assuming different scenarios and then none of that may hold true in future 🙂

If you are convinced about the NPS, you must invest in the same. But also keep in mind, you would not be able to withdraw prematurely in case you plan early retirement.

How does the scenario change in case of NPS, if the person(spouse) is working currently, leaves the job say after 12 years, but still continues to deposit 50K annually and at the age of 60 years try to withdraw the amount. Is she still liable to pay Tax?

The tax on NPS is payable at the time of withdrawing on maturity irrespective of weather the depositor was paying taxes or not at the time of depositing. So the scenario is same for everyone. The only impact you might have is slightly lower taxation as you would not have any other income at the time of maturity.

This is good article. I was thinking of investing in NPS but giving it a second thought after reading this

Hello Amit !

I would like to share my point of view here. You havent considered the time value of money for the tax I save/pay today and the tax I pay at the time of maturity in the 1st option (assuming the tax rate remains same). This will totally change the calculation.

Jasgun I am comparing post tax returns for two investments at the time of maturity. According to me, time value of money should not matter. But would love to hear your perspective and how you think investing in NPS would be better option?