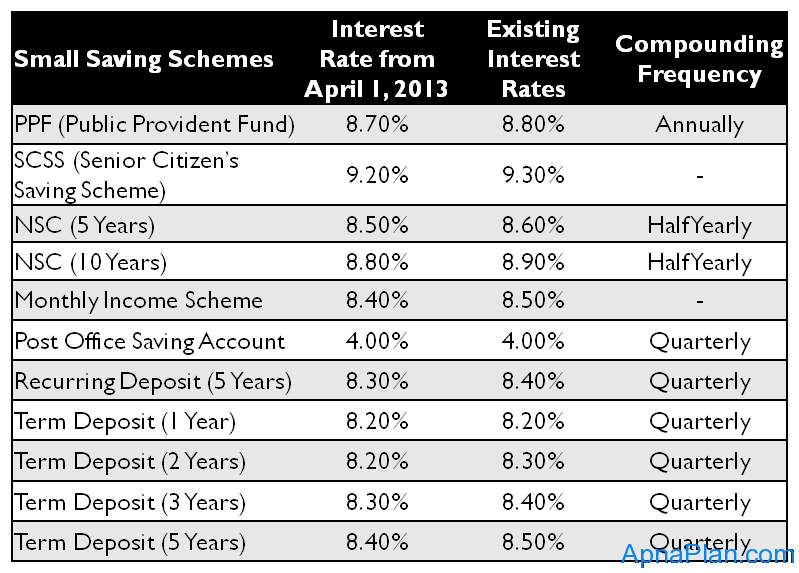

The Interest Rates on Small Saving Schemes like PPF (Public Provident Fund), SCSS (Senior Citizens Saving Scheme), NSC (National Saving Certificate), Monthly Income Scheme (MIS), Post Office Recurring Deposit (RD) and Post Office Term Deposits have been cut by 0.1%. However the interest rate on term deposit for 1 Year and the Post Office Savings account have remained unchanged. the new interest rates would be effective from April 1, 2013

Interest Rate Changes :

- PPF interest rates have been cut to 8.7% from 8.8% earlier

- Senior Citizens Saving Scheme would now yield 9.2%

- NSC would give interest rate of 8.5% for 5 Years maturity while 8.8% for 10 Years Maturity

- Post Office RD would give interest of 8.3% as compared to 8.4% earlier

- Post Office Term Deposit would give interest rates of 8.2% to 8.4% depending on tenure

- The interest rate on Post office Savings Account has been kept unchanged at 4%

- All these new interest rates would be effective from April 1, 2013

The table below has the summary of changes:

The above cut in interest rates was expected as we are in downward trend for interest rates.

You can know all about above Small Savings Schemes like NSC, PPF, etc by Govt. of India here.

Sir, I’m planning to put 4.5 lac in MIS for 5 years, So i will received 3150 IRS per month, Now my Q is, If i make Recurring Deposit of IRS 3150 in post, Do i need to pay TEX on the same or not? Please reply me. thank you

JB

The money you receive from MIS is basically income from interest paid which is taxable as per your tax slab. Next after investing this MIS income in Recurring deposit, the interest you earn on Recurring deposit is also taxable as per your tax slab.

Thank you Sir, Further to that i request you to suggest me how to invest so i can avoid the TEX, If you can suggest any Schemes.

You can download the Tax Saving Guide and it will help you decide on right investment options.

Hi,

Is there any option to pay the monthly installments for recurring deposit scheme of Indian Post office online?

Post offices still don’t offer online facility for its deposits!