Every year there are changes in the Income Tax rules of India in the Union Budget. Keeping these changes in mind we come up with our Income Tax Calculator India every year. The latest budget was presented in February 2021 and made the following changes.

Income Tax Changes in Union Budget 2021

There was No major changes in income tax in Budget 2021. The only change was the interest earned on contribution of more than Rs 2.5 Lakh in a year through EPF or VPF would be added to the income and taxed at marginal tax rate.

Also the biggest change in Budget 2020 regarding income tax was introduction of new tax slabs in case you do not want to take benefit of various tax deductions like standard deduction, Chapter VI A deductions, HRA benefit, LTA, home loan interest for self-occupied homes etc. continues.

From last year you have the option to choose on what you want to follow:

- New Tax Slabs but forgoing all tax deductions

- Continue with old tax slabs with all tax deductions

Are you Paying Too much Taxes? Download your free presentation

Are you worried that you are paying too much in income tax? Are you aware of all the changes in the tax laws? Where should you invest to save taxes? Do you know all tax sections that you can use to save your tax. Download a concise 43 page presentation free to answer all the above questions and save your taxes – legally.

The income tax calculator India calculates the tax outgo using both the above tax slabs and you can choose what suits you.

Sukanya Samriddhi Account + PPF + SCSS Calculator

Sukanya Samriddhi Account, PPF, Senior Citizens’ Savings Scheme are part of small saving scheme sponsored by Government of India. These schemes are quite popular and rightly so because of the safety, higher interest rate offered among other things. We have built calculator for each of them where you can check the maturity amount, loan eligibility, partial withdrawal and more. Click on the links to get the relevant calculator – PPF Calculator, Sukanya Samriddhi Yojana Calculator, Senior Citizens’ Savings Scheme Calculator, NSC Calculator.

Download Income Tax Calculator in Excel

You can download the income tax calculator 2021 (for FY 2021-22) in excel by clicking the button below.

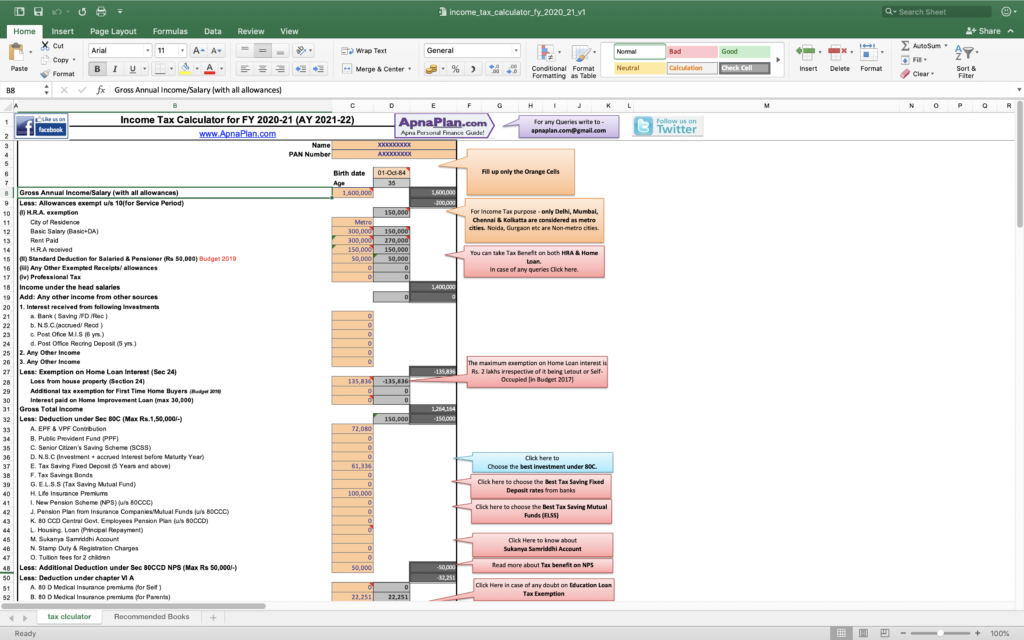

How to use the Income Tax Calculator India for FY 2021-22 (AY 2022-23)?

The picture below shows how the income tax calculator India for FY 2021-22 (AY 2022-23) looks like. You can edit all cells in Orange colour.

Section 1: Basic Details

The top cells ask for your name and PAN Number. It’s optional field and is meant in case you want to use it for multiple people.

Date of Birth is mandatory field as the tax slab is different for people aged below 60, between 60 to 80 years and more than 80 years.

Section 2: Salary Income

The next fields ask information about gross salary income.

- In case you are employed, get HRA and rent out do fill in the details

- Standard Deduction is Rs 50,000 from Budget 2019 onwards and is applicable to salaried and pensioners only.

- Do mention Any Other Exempted Receipts/ allowances like LTA, etc

- In case you have paid Professional Tax as happens in Maharashtra and some other states do mention that. This is tax exempt.

Tax Free Salary Components

There are components in salary which are fully or partially tax exempt. For example HRA is tax exempt if you satisfy certain conditions. You can have the complete list in the post: Must have Tax Free components in Salary.

Section 3: Income from other sources

Input all the other income like Interest income from fixed or recurring deposits. You can also include income from gifts received if its more than Rs 50,000 and from non-relatives.

Section 4: Loss from Home Loan Interest

In case you have home loan, fill up the columns to reflect the same. You get tax benefit on interest under section 24. Budget 2018 onwards there is additional benefit for first time buyers of affordable homes. You can also claim tax benefit on interest paid on home improvement loan.

HRA & Home Loan Benefit at same Time – Possible?

Many employer (& employers) are confused if they can take advantage of both HRA and Home Loan for saving tax. This seems intuitive as how can you pay for home loan and also live on rent. However just for your information its completely legal to take advantage of both HRA & Home Loan as there are multiple situations where you need to live on rent but still pay home loan. You can read more about this our post – Can I claim Tax Benefit on both HRA & Home Loan?

Section 5: Tax Deductions – Chapter VI A

Fill in the tax deductions you want to claim. It covers Section 80C for investments like EPF, VPF, PPF, SCSS, etc.

Additionally, you can claim tax deduction up to Rs 50,000 by investing in NPS u/s 80CCD(1B). this is in addition to Section 80C.

Best Investment to Save Tax

Section 80C offers more than 10 investments where you can invest to save tax, However many a times you need not actually do this investment as its already covered due to expenses like children tuition fee or automatic EPF deduction for salaried. In case you are new to taxes and investment do read our helpful guide on How to take maximum advantage of Section 80C and choose the best investment to save tax.

Section 6: More Tax Deductions

There are several cases where you can claim tax deductions like buying medical insurance, etc. Mention the same accordingly.

- Medical Insurance premiums (for Self or parents)

- Interest Paid on Education Loan

- Medical Treatment of handicapped Dependent

- Expenditure on Selected Medical Treatment for self/ dependent

- Donation to approved funds

- For Rent in case of NO HRA Component (Budget 2016)

- For Physically Disable Assesse

- In case your employer contributes to NPS account on your behalf, you can claim up to 10% of your basic salary as tax deductible.

- There is also tax deduction for interest paid on purchase of electric vehicles.

Section 7: Income Tax Calculation (Old Tax Slabs)

This section is auto-computed based on your inputs and displays your final tax outgo. There

Section 9: Calculating Income Tax with New Tax Slab under new Regime

This section computes the Income Tax with Lower Tax Slab under new Regime announced in Budget 2020. This would help you to determine which tax regime suits you.

How to Calculate Income Tax in India?

In case you want to calculate your income tax without using the Income Tax India calculator, it’s not very difficult. You need to follow following steps using the below example.

Amit is salaried employee with following salary structure.

- Basic Salary: Rs 6,00,000

- HRA: Rs 3,00,000

- Special Allowance: Rs 60,000

- LTA: Rs 40,000

- Total CTC: Rs 10,00,000

25 Best Tax Free Income & Investments in India

Everyone hates Taxes and go out in full force to save it – sometime legally and sometimes beyond the law. Fortunately there are still some tax Free incomes & investments. Learn about them here and use it to your advantage.

Step 1: Calculate Gross total income from salary:

The table below shows the calculation for gross taxable income from salary.

| Component | Amount (Rs.) | Exemption/ Deduction | Old regime | New regime |

|---|---|---|---|---|

| Basic Salary | 600,000 | – | 600,000 | 600,000 |

| HRA | 300,000 | 240,000 | 60,000 | 300,000 |

| Special Allowance | 60,000 | – | 60,000 | 60,000 |

| LTA | 40,000 | 40,000 (bills submitted) | 0 | 40,000 |

| Standard Deduction | – | 50,000 | – 50,000 | |

| Gross Total Income from Salary | – | – | 670,000 | 1,000,000 |

Step 2: Tax Deductions

Amit had made the following investments to save tax. These will be deducted from the gross income to arrive at net taxable income.

- EPF deduction from salary – Rs 60,000

- PPF Investment – Rs 1,50,000

- Medical Insurance Premium – Rs 25,000

- Total Tax Deduction = Rs 1,50,000 + 25,000 = Rs 1,75,000 (PPF & EPF both come under section 80C and have a tax deduction upper limit of Rs 1.5 lakh)

Step 3: Other Income

Amit also had Rs 20,000 from interest from fixed deposits with banks.

Step 4: Net Taxable Income

The table below shows the Net Taxable Income for Amit

| Nature | Old Tax Regime | New Tax Regime |

|---|---|---|

| Income from Salary | 670,000 | 1,000,000 |

| Income from Other Sources | 20,000 | 20,000 |

| Tax Deduction | -175,000 | 0 |

| Total Taxable Income | 515,000 | 1,020,000 |

Step 5: Calculating using Income Tax Formula

Old Regime:

| Tax Slab | Calculation | Tax |

|---|---|---|

| up to Rs 250,000 | Tax Exempt | 0 |

| Rs 250,000 to 500,000 | 5% || (5% * (500,000 – 250,000) | 12,500 |

| Rs 500,000 to 1,000,000 | 20% || (20% *(515,000 – 500,000) | 3,000 |

| Income Tax | – | 15,500 |

| Cess | 4% || (4% of 15,500) | 620 |

| Total Tax Payable | – | 16,120 |

New Regime:

| Tax Slab | Calculation | Tax |

|---|---|---|

| up to Rs 250,000 | Tax Exempt | 0 |

| Rs 250,000 to 500,000 | 5% || (5% * (500,000 – 250,000) | 12,500 |

| Rs 500,000 to 750,000 | 10% || (10% * (750,000 – 500,000) | 25,000 |

| Rs 750,000 to 1,000,000 | 15% || (15% * (1,000,000 – 750,000) | 37,500 |

| Rs 1,000,000 to 1,250,000 | 20% || (20% * (1,020,000 – 1,000,000) | 4,000 |

| Income Tax | – | 79,000 |

| Cess | 4% || (4% of 79,000) | 3,160 |

| Total Tax payable | – | 82,160 |

As you can see the tax liability changes hugely depending on what tax regime you choose. So you should plan carefully. You can also check the official Income Tax website for calculating your income tax.

How to Pay 0 Income Tax on Salary of Rs 20+ Lakh (FY 2021-22)?

As you can see with the above income tax calculation, salary components and salary structure plays a very important role in how much income tax you pay. We have come up with some optimised salary structure using which you pay NO income tax even with CTC of more than Rs 20 Lakhs.

Income Tax Calculator FY 2020-21 Excel

Budget 2020 had introduced the new Vs old tax slabs. Below are the tax slabs

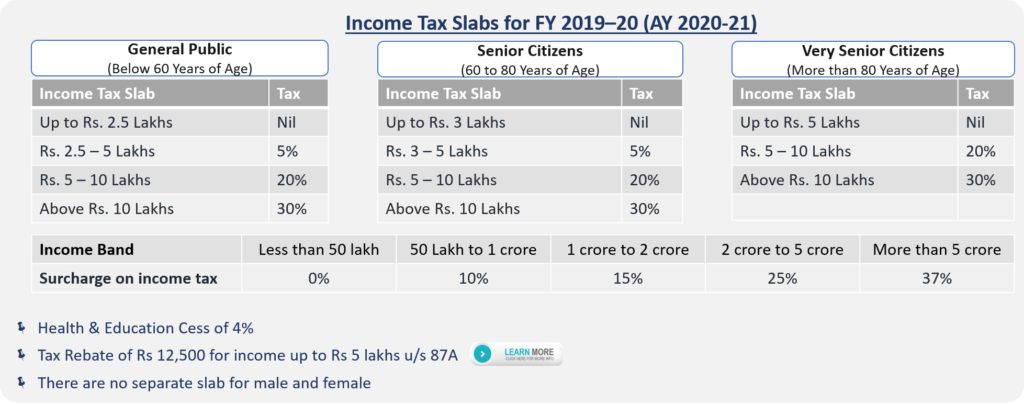

Income Tax Calculator FY 2019-20 Excel

Following changes were made in Budget 2019 applicable for FY 2019-20:

- Rebate under Section 87A changed from Rs 2,500 to Rs 12,500 or 100% of income tax (whichever is lower) for individuals with income below Rs 5 Lakhs (from Rs 3.5 Lakhs)

- Standard Deduction raised for Salaried & Pensioners from Rs 40,000 to Rs 50,000

- Increased Tax for super-rich: Surcharge increased to 25% for income between 2 to 5 crore & to 37% for income beyond Rs 5 crores

- Additional Tax Deduction of Rs 1.5 lakhs u/s 80EEA on home loans on purchase of affordable home

- Additional Tax Deduction of Rs 1.5 lakhs u/s 80EEB on Auto loans on purchase of Electric vehicles

- No Tax on Notional Rental Income from Second House

- Capital gains exemption on reinvestment in two house properties: Tax payers can now buy two houses on sale of 1 house if the capital gains are less than Rs 2 crore. This benefit can be availed only once in lifetime

- TDS threshold increased from Rs 10,000 to Rs 40,000 on Bank Interest Income

You can download the Income Tax Calculator in Excel for FY 2019-20 from the link below.

Income Tax Calculator FY 2018-19 Excel

Budget 2018 has made some changes to Income tax for individual. There has been no changes in the income tax slab, however there have been some changes related to salaried/pensioner tax payers and senior citizens.

- No Change in Income Tax Slabs

- 1% additional health cess taking total cess on income tax to 4% (2% education cess & 1% higher education cess continues). This will marginally increase income tax for every tax payer.

- Standard Deduction of Rs 40,000 to Salaried and Pensioners. However transport allowance (Rs 19,200 per annum) and medical reimbursement of Rs 15,000 has been abolished. So the net benefit for salaried would be Rs 5,800 only bringing marginal relief. However Pensioners would gain as they did not have transport & medical allowance.

- 10% Long Term Capital Gains Tax on Equity and Equity based Mutual Funds introduced.

- Medical Insurance premium exemption for senior citizen increased from Rs 30,000 to Rs 50,000 u/s 80D

- Medical expenses will see increased tax benefits for senior citizens. 100,000 on critical illness u/s 80DDB

- Rs 50,000 exemption for interest income from Bank or Post Office Fixed/Recurring Deposits for Senior Citizens

Income Tax Calculator FY 2017-18 Excel

In Budget 2017, the finance minister has made little changes to this. We highlight the changes and give you the new tax calculator for FY 2017-18 [AY 2018-19].

- Tax reduced from 10% to 5% for Income from Rs 2,50,000 – Rs 5,00,000 leading to tax saving of up to Rs 12,500.

- 10% surcharge on income tax if the total income exceeds Rs 50 Lakhs but less than Rs 1 crore

- For people with net taxable income below Rs 3.5 lakh, the tax rebate has been reduced to Rs 2,500 u/s 87A

- NO RGESS Tax exemption from FY 2017-18

- Interest deduction on rented property capped at Rs 2 Lakh

![Income Tax Calculator India in Excel★ (FY 2021-22) (AY 2022-23) 6 Income Tax Slab for FY 2017–18 [AY 2018-19]](https://www.apnaplan.com/wp-content/uploads/2017/02/Income-Tax-Slab-for-FY-2017–18-AY-2018-19-1024x441.png)

Income Tax Calculator FY 2016-17 Excel

In Budget 2016, the finance minister has made little changes.

- There has been no change in the income tax slabs.

- For people with net taxable income below Rs 5 lakh, the tax rebate has been increased from Rs 2,000 to Rs 5,000 u/s 87A. This would benefit people who have net taxable income between Rs 2.7 Lakhs to Rs 5 Lakhs.

- Additional exemption for first time home buyer up to Rs. 50,000 on interest paid on housing loans. This would be applicable where the property cost is below Rs 50 Lakhs and the home loan is below Rs 35 lakhs. The loan should be sanctioned on or after April 1, 2016.

- Tax Exemption u/s 80GG (for rent expenses who do NOT have HRA component in salary) has been increased from Rs 24,000 to Rs 60,000 per annum. This is a good move to align the exemption amount with today’s rent and keep the section relevant.

- For people with net taxable income above Rs 1 crore, the surcharge has been increased from 12% to 15%

- Dividend Income in excess of Rs. 10 lakh per annum to be taxed at 10%

- 40% of lump sum withdrawal on NPS at maturity would be exempted from Tax. This rule now also applies to EPF. So now in case of EPF income tax would be applicable on 60% of the corpus on maturity.

- Presumptive taxation scheme introduced for professionals with receipts up to Rs. 50 lakhs. The presumptive income would be 50% of the revenues.

- Exemption to employer’s contribution to recognized provident funds limited to 1.5 lakh. Earlier, the cap was up to 12% of salary

![Income Tax Calculator India in Excel★ (FY 2021-22) (AY 2022-23) 7 Income Tax Slabs for FY 2016–17 [AY 2017-18]](https://www.apnaplan.com/wp-content/uploads/2016/02/Income-Tax-Slabs-for-FY-2016–17-1024x426.png)

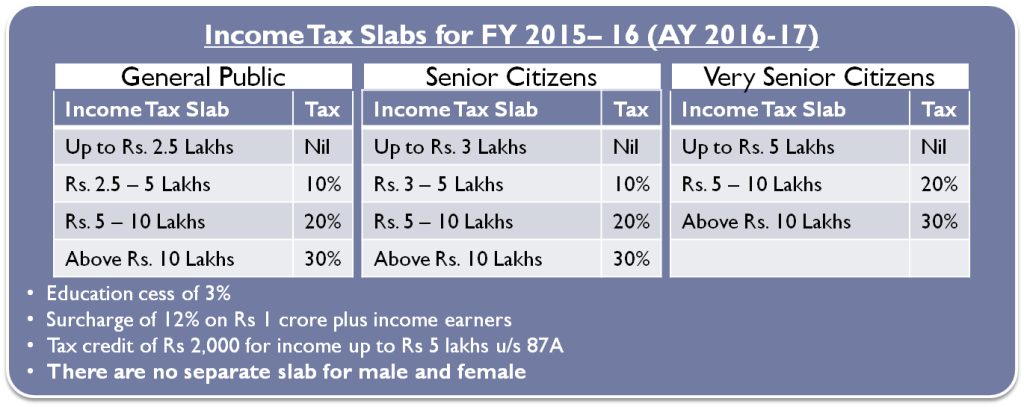

Income Tax Calculator FY 2015-16 Excel

The tax slabs have remain unchanged but there have been some changes in terms of Transport Allowance, Medical Insurance benefits and exemption for Physically challenged tax payers.

- Transport Allowance increased to Rs 1,600 from Rs 800

- Increase in Medical Insurance Premium exemption limit from Rs 15,000 to Rs 25,000 u/s 80D (up to 30K for Senior Citizens)

- Sukanya Samriddhi Account a new investment option u/s 80C

- Very Senior Citizens (above 80 Years of age) to be allowed deduction of Rs 30,000 for medical expenditure in case they do not have health insurance

- Additional exemption of Rs 50,000 under sec 80CCD for investing in NPS (New Pension Scheme)

- Increase in the limit of deduction available for treatment of chronic diseases u/s 80DDB from Rs 60,000 to Rs 80,000

- Rs 25,000 increase in deduction available to persons with disability and severe disability u/s 80DD and 80U

- 2% surcharge on Super rich (i.e. individuals with income > 1 crore)

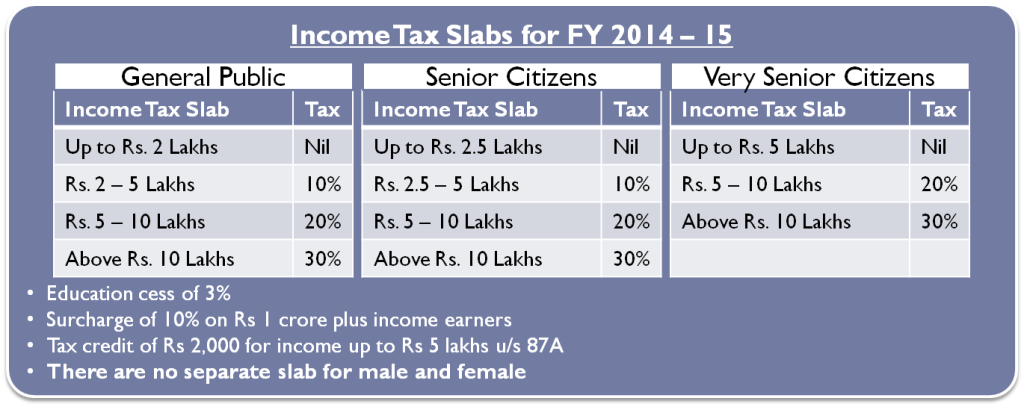

Income Tax Calculator FY 2014-15 Excel

We have incorporated the 3 changes that happened in Budget 2014 (presented on July 10, 2014)

- Income up to Rs 2.5 lakhs for General Public and up to Rs. 3 lakhs for Senior citizens are now exempted from paying Income tax. Earlier this limit was Rs 2 Lakhs for General Public and rs 2.5 Lakhs for Senior Citizens.

- The exemption limit for investments under section 80C has been raised from Rs 1 Lakh to Rs 1.5 Lakhs.

- The exemption on paying interest on Home Loan has been raised from Rs 1.5 Lakhs to Rs 2 Lakh.

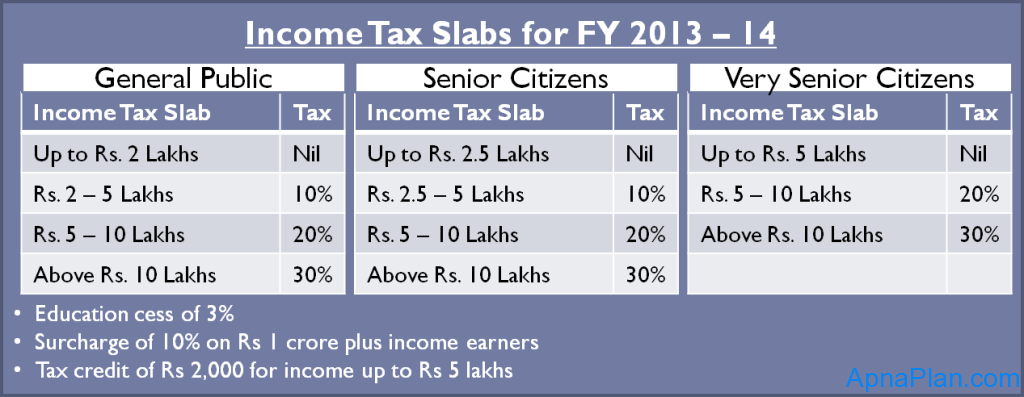

Income Tax Calculator FY 2013-14 Excel

The finance minister, P Chidambaram in his Budget 2013-14 kept the income tax rates unchanged. The table below shows the summary of tax slabs for FY 2013-14.

There are two minor changes:

- Super rich have to pay more taxes. A surcharge of 10% on Rs 1 crore plus income earners have been imposed. This is for one year only and would impact about 42,800 people only

- The middle class with income of up to Rs 5 lakhs would receive tax credit of Rs 2,000 for FY 2013-14. This essentially means people with income up to Rs 5 lakhs have reduced tax burden of Rs. 2,060 for FY 2013-14.

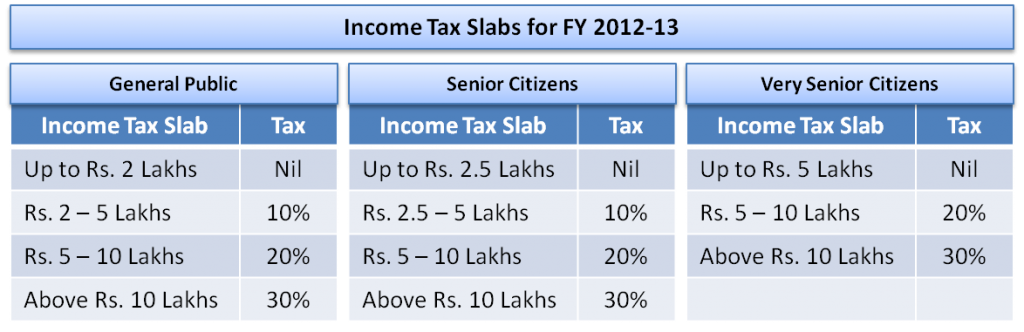

Income Tax Calculator FY 2012-13 Excel

Below is the Income Tax Slab for FY 2012-13. A significant difference is there is no more distinction between men and women as far as taxes are concerned.

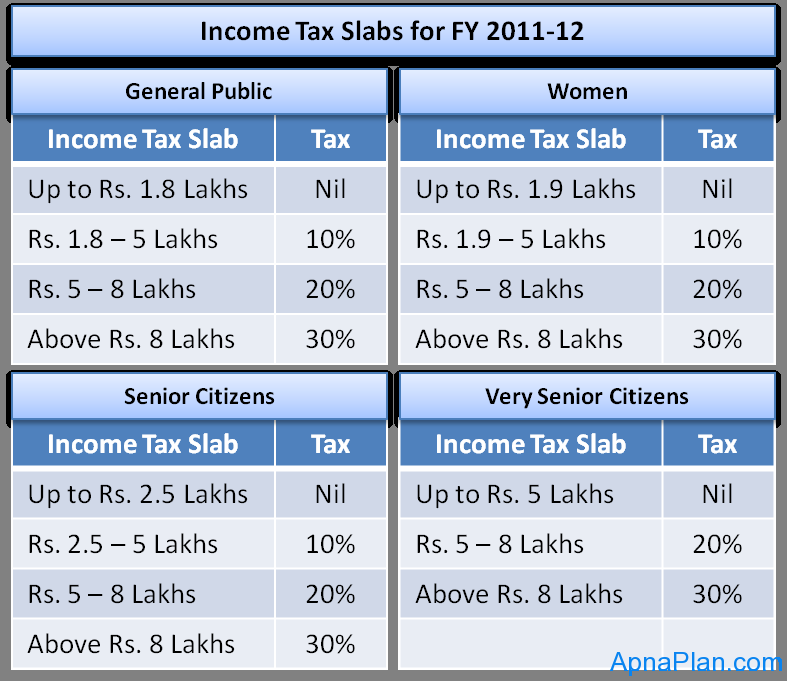

Income Tax Calculator FY 2011-12 Excel

Below is the Income Tax Slab for FY 2011-12.

Income Tax Calculator India FAQs

✅ Should I go with New or Old Tax Slab?

You should do the calculation using our income tax calculator and check yourself. In most cases if you do tax saving investments and get salary components tax deduction, you should follow the old tax slab.

✅ Is Tax Deduction different than Tax Exemption?

You may find both Tax Deduction and Tax exemption terms used interchangeably. But technically both terms have different meaning.

Tax Deduction means you can deduct those from your income. This could be investments like PPF, etc that you do under section 80C. This is tax deducted up to Rs 1.5 lakhs.

Tax Exemption means the income is not taxable like interest earned on PPF.

✅ Do NRIs need to pay Income Tax in India?

NRIs (Non-resident Indians) and foreigners have to pay income tax in India on income accrued in India.

✅ What is surcharge on Income Tax?

For certain high-income tax payers, the government of India has introduced surcharge. As of FY 2021-22 the surcharge is as follows:

Less than Rs 50 Lakh – No Surcharge

Rs 50 lakh to 1 crore – 10%

Rs 1 crore to 2 crores – 15%

Rs 2 crores to 5 crores – 25%

More than Rs 5 crores – 37%

✅ What is Cess on Income Tax?

All tax payers have to pay 4% of Income Tax as health and Education cess. This cess is said to be used for the above purpose.

New Post! Very helpful information and thanks for sharing.

Adhiban Nidhi offers a wide range of Fixed Deposit (FD), Recurring Deposit (RD) & Monthly Investment Schemes Fixed Deposit in Coimbatore at attractive interest rates with assured returns.

Good Article! Useful for read and thanks for sharing.

Adhiban Group is a leading Financial Services in Coimbatore, India which offers Loans without/less Documents for Corporate Companies & Entrepreneurs.

Is this a free tool? And can we use it for multiple employees?

SIR, HOW CAN I CALCUTATE 20 EMPLOYEE IT IN SINGLE SHEET

Sir please Explain about State Govt Employee Contribution in NPS .Tax Exemption all 3 sections.. Please sir..