ICICI Bank has recently launched its new Home Loan Product – Extraa Home Loans. The idea is to offer enhanced loan amount (up to 20%) to first time home buyers, who otherwise would not be eligible for such an amount if opting for normal home loans.

ICICI Extraa Home Loans Highlights:

Following are the salient features of the loan:

1. The Extraa Home Loan can enhance the normal home loan amount by up to 20%

2. This loan can be taken for first home purchase only

3. The maximum home loan amount is Rs 75 lakhs

4. Both salaried and self-employed are eligible for this loan

5. The maximum loan tenure can go up to 67 years of age. Usually the banks limit the loan tenure to the person reaching the age of 60 years or retirement, whichever is earlier. In this case the loan tenure can be extended up to 67 years of age. For e.g. A person with 37 years of age can get maximum loan tenure of 23 years (60 – 37); in case of Extraa Home Loan the maximum loan tenure can go up to 67 years of age i.e. 30 years (67 – 37).

6. This loan is currently offered in Greater Mumbai, National Capital Region, Bengaluru and Surat.

7. As per RBI, the maximum home loan amount cannot exceed 80% of the property value. The same applies to this loan.

Also Read: Home Loans: Housing Finance Company Vs Banks? Choose Wisely

8. The extended loan is backed by “Mortgage Guarantee” by India Mortgage Guarantee Corporation (IMGC). This means that the extended part of the loan is insured by IMGC. India Mortgage Guarantee Corp. (IMGC), a joint venture between National Housing Bank, International Finance Corp., US-based Genworth Financial Inc. and Asian Development Bank.

9. The borrowers have to pay “Mortgage Guarantee” fee of 1.5% to 2.5% of entire loan amount to avail this loan. This fee would vary depending on the gap to be finance and the risk that bank foresees.

10. In case of default, the bank still has the right to auction the property to recover the home loan amount.

Variants:

Depending on the profile of customers the Extraa Home Loan has 3 variants:

For middle aged, salaried customers: Salaried borrowers up to 48 years of age. The maximum tenure can be extended to 65 years of age. In case of normal home loans the maximum home loan tenure is up to the age of retirement.

For young, salaried customers: Salaried borrowers up to 37 years of age can avail extended home loan tenure of 30 years.

Self-employed customers: Self-employed customers who earn higher income in some months of the year due to seasonality of the business they are in. Extraa Home Loan would consider borrower’s higher seasonal income to calculate home loan amount eligibility.

Review: Axis Bank Happy Ending Home Loan

ICICI Extraa Home Loan Review:

ICICI bank has published an illustration of how this Extraa Home Loan would be useful to the 3 segments identified above. We review each of them.

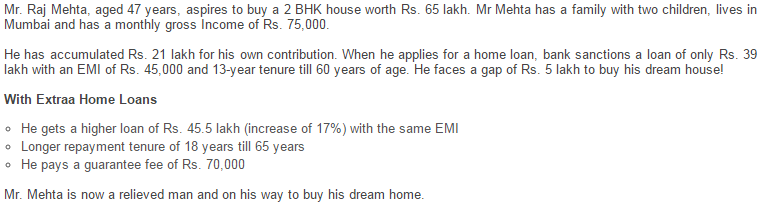

For middle age, salaried customers:

- Extra Loan Sanctioned: Rs 6.5 Lakhs (45.5 – 39)

- Guarantee fee: Rs 70,000

- So Mr. Raj would be paying 10.8% (70,000/6,50,000) of enhanced amount as upfront Guarantee fee.

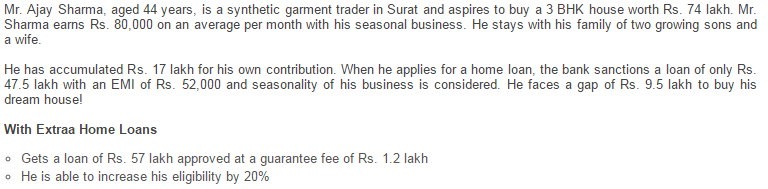

For Self Employed customers:

- Extra Loan Sanctioned: Rs 9.5 Lakhs (57 – 47.5)

- Guarantee fee: Rs 1,20,000

- So Mr. Ajay would be paying 12.6% (1,20,000/9,50,000) of enhanced amount as upfront Guarantee fee.

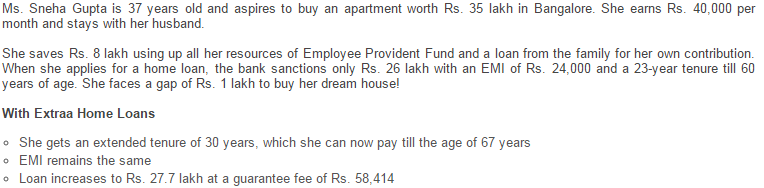

For young, salaried customers:

- Extra Loan Sanctioned: Rs 9.5 Lakhs (27.7 – 26)

- Guarantee fee: Rs 58,414

- So Ms. Shena would be paying 34.4% (58,414/1,70,000) of enhanced amount as upfront Guarantee fee.

The Guarantee fee is calculated on the entire loan amount and so when calculated on enhanced amount, it seems absurdly high.

Also due to this the Guarantee fee would be higher in case the enhancement is low. For e.g. if the bank charges 2% of loan amount as guarantee fee on loan of Rs 50 Lakhs, the fee turns out to be Rs 1 lakh. In case you take the enhancement at 20% i.e. Rs 10 lakhs, the guarantee fee works out to be 10% of enhanced loan while in case you take enhancement of 10% i.e. Rs 5 lakhs, the guarantee fee works out to be 20% of enhanced loan.

Checking out the illustrations and Guarantee fee charged I would not recommend opting for this loan especially if the gap between amount required and sanctioned is low.

Also you should get over your liabilities by the time you retire. So in case you are taking loan which extends beyond retirement, you will need to plan for the same.

To conclude, I would recommend going for ICICI Bank Extraa Home Loan only as last resort mainly due to high upfront Guarantee fee. What do you think?