The banks have started lowering their interest rates on fixed deposits. This hurts people who invest in them. However you can look into fixed deposits offered by companies.

Below are the details of 5 companies which have highest credit rating (AAA) and offering interest rate of more than 9% on their fixed deposit schemes.

In comparison SBI is offering 7.5% to 7.75% for 1 to 10 years fixed deposits while ICICI Bank is offering 7.75% to 8.00% on their FDs.

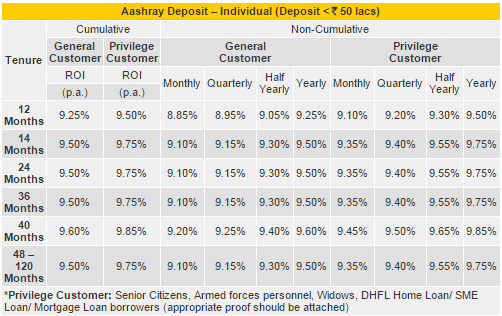

[dropcap]1.[/dropcap] DHFL Aashray Deposit Plus

DHFL is one of India’s leading housing finance companies.

Credit Rating: “AAA” by CARE and “FAAA” by BWR

Also Read: What does Credit Rating Mean?

Salient Features:

- 0.25% Additional interest rates for Senior Citizens, Widows, Armed Forces personnel, DHFL Home Loan/SME Loan/Mortgage borrowers

- Minimum Deposit Amount: Rs 2,000 and multiples of Rs 1,000 thereafter

- Loan up to 75% of the FD Principal and accrued interest is available

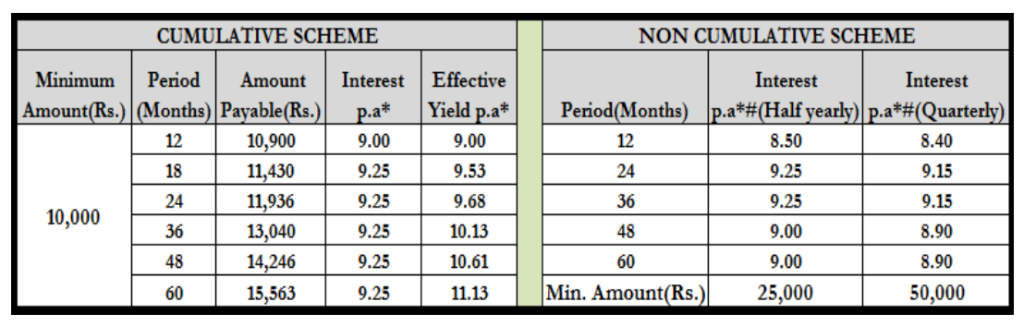

Interest Rates:

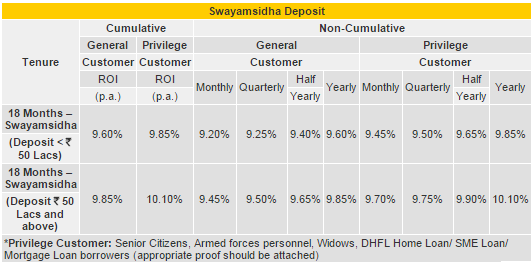

DHFL Swayamsidha Deposit for Women:

This FD is especially for women offering higher interest rates:

[box type=”info” size=”large” border=”full”]

Highest Interest Rate on Bank Fixed Deposits

Highest Interest Rate on Recurring Deposits

Highest Tax Saving Bank Fixed Deposit Rates U/S 80C

[/box]

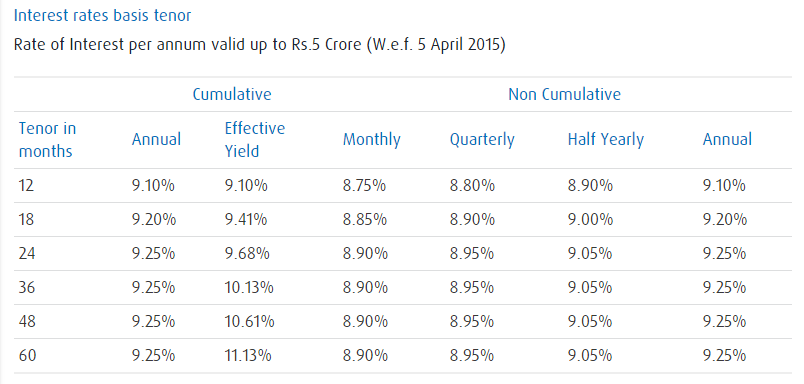

[dropcap]2.[/dropcap] Bajaj Finance Ltd Fixed Deposit

Bajaj Finance Ltd is a NBFC (non-banking finance company) dealing in all kinds of loans like Personal, Two/Three wheeler loans, car loans etc.

Credit Rating: “FAAA” By CRISIL and “MAAA” By ICRA

Salient Features:

- Additional 0.25% interest for Senior citizens

- Additional 0.10% interest for Bajaj group employees and existing customers for deposits up to Rs.1 Crore

- Can access FDs online through their customer portal

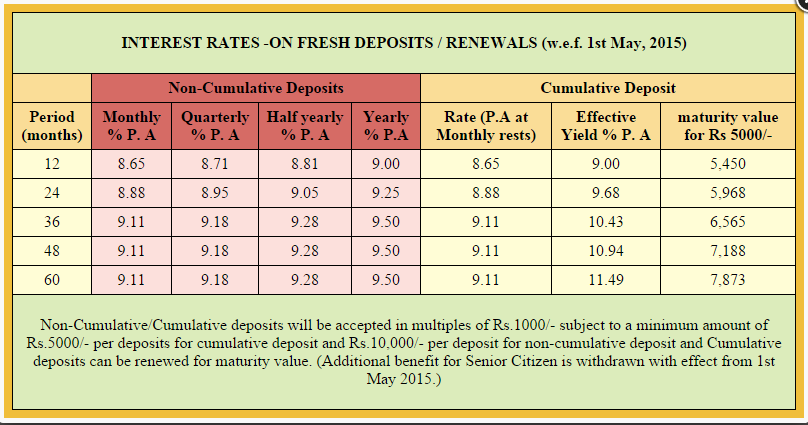

Interest Rates:

[dropcap]3.[/dropcap] KTDFC Ltd. Fixed Deposit

KTDFC (Kerala Transport Development Finance Corporation Ltd) is NBFC wholly owned by Government of Kerala and deals in Personal and Vehicle Loans among other things.

Credit Rating: KTDFC Fixed Deposits are fully guaranteed by Government of Kerala

Interest Rates:

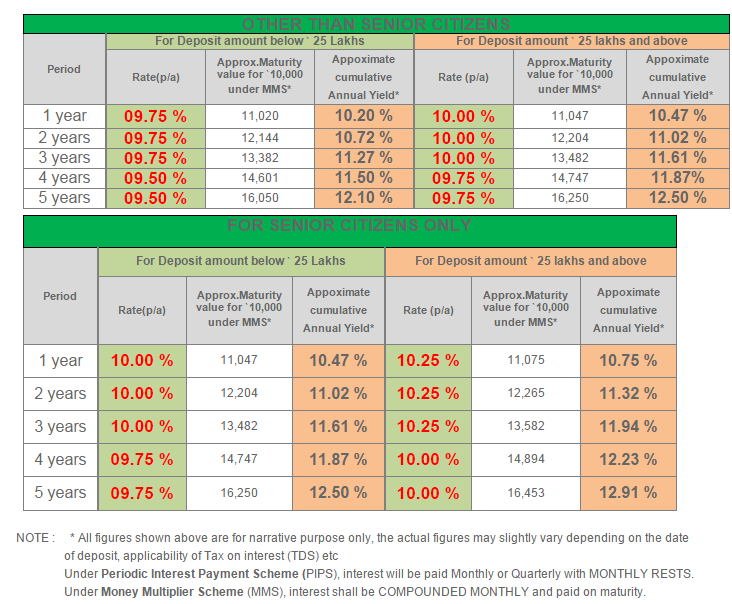

[dropcap]4.[/dropcap] Mahindra and Mahindra Financial Services Ltd FD

Mahindra and Mahindra Financial Services is leading NBFC with focus on rural areas and is top tractor financier in India.

Credit Rating: ‘FAAA’ by CRISIL

Salient Features:

- 0.25% additional rate for senior citizens.

- 0.35% additional interest for all Mahindra group company employees and Employees Relatives

Interest Rates:

[dropcap]5.[/dropcap] Shriram Transport Finance UNNATI FD Scheme

Shriram Transport Finance is NBFC mainly dealing in Commercial Vehicle Finance.

Credit Rating: ‘FAAA’ by CRISIL and “MAA+” by ICRA

Salient Feature:

Fixed deposits are accepted in multiples of Rs.1000/- subject to a minimum amount of Rs.10000/- per deposit account.

Interest Rate:

TDS on Company FDs:

Companies would deduct TDS at the rate of 10% of interest, if the interest earned is more than Rs 5,000 in a financial year.

Tax on Company FDs:

The interest received on Company Fixed Deposit is fully taxable. The interest would be added to your annual income and taxed at marginal tax rates.

Key Points before Investing:

Premature Withdrawal is possible on the above company fixed deposits but it requires much more paper work and follow ups. Even the penalty may be more severe as compared to banks

Opening Fixed Deposit is more tiresome as you need to fill forms, visit company branch or get hold of their agents.Also have to give fresh documents for KYC. Bank FDs can be opened online, which is much more convenient.

To Conclude:

The above companies are offering have the highest credit rating (which means very low chances of default) and are offering interest rates 1% to 2% higher than the bigger banks. You must look into them for your fixed income portfolio especially if they have easy approachable branches or agents near you.

have you invested in these companies FDs before? How was your experience? Please share in comments section…

Dear Sir,

I have invested in Helios and Matheson Information Technology Ltd, who were paying higher rate of interest, but now freezed all repayment of principal & interest. What is the fate of the said deposits ? Moreover, the Companies like Unitech Ltd., Jaypee Infrastructure Ltd . Jai Prakash Associates Ltd are also not paying the outstanding maturity amount & interest. I am a Senior Citizen and pl advise how to go ahead for getting the outstanding dues (maturity & interest).

Sir my Frnd sajest me to invest Sahara 15 years bond is this right for me my age 42 .,. 2 minor kids

I am sorry but I am not aware of any bond by Sahara! As far as I know they have not issued any bonds – check it may not be approved by SEBI and may be risky

Is there been a failure history of any company on records, which had been backed by any State Government in India, so far till today?

I can’t remember any but even if it fails government would service its debt or else it looses its credibility which is much more important!

My wife has retired from a PSU and has placed certain funds in Senior Citizens scheme of psu [email protected]% interest rate. would she be considered as senior citizen for above schemes. her age is less than 60.

Senior citizens means person with age more than 60 years. Certain schemes only for senior citizens have exceptions to enroll person with lower age under special circumstances. But for all other purpose senior citizen means person with age of more than 60.

Sir, I am a senior citizen (now). For the past ten years I am having fixed deposits in Tamil Nadu Power Finance, Sundaram Finance. Both are paying the interests in time. I did not faced any problem while closing the accounts.

Thats good news… thanks for sharing would help other investors as well

Many brokers/deposit collectors do not talk about KTDFC. May be commission is an issue. Also, much better than what is discussed are FDs of – Tamil Nadu Power and Infrastructure Corporation Ltd and Tamil Nadu Transport Finance Development Corporation Ltd, both being TN government undertakings and NBFCs. Investors should check out.

DEAR SHANKAR SIR,

WHAT IS THE REPUTATION OF THESE COS AS REGARDS TIMELY REPAYMENT INTEREST AS WELL AS PRINCIPAL, KEEPING IN MIND THAT I RESIDE IN KOLKATA

All these companies are AAA rated and historically they have been paying interest/principal regularly to their investors. Please recheck the current interest rates as the one in the post is dated.

FDs of – Tamil Nadu Power and Infrastructure Corporation Ltd do not have AAA star rating. Do u recommend investing in FDs of Tamil Nadu Power and Infrastructure Corporation Ltd. Is it regular in paying interest & Principal. Most brokers do not recommend it. Do u have any idea about the said Company. Current interest rate is 10.2% pa for senior citizens.

Personally I have not invested in TN Power Finance so I am not aware if there are any problems in payout but the company is backed by Tamil Nadu Government and so you can be sure of repayment of principal and interest.

Also you can search about TN Power Finance FD complaints on Google – not many results appear which means people are not complaining much. I would take it as positive for investment.