If you are an existing Mutual Fund investor, you might already have received communication about additional KYC

(Know Your Customer) and FATCA declaration that need to be completed by December 31, 2015. The post explains why and how you can complete this additional KYC.

Why additional KYC for existing investors?

KYC has become a pain point for mutual funds. Though it’s said that KYC is required only once but every 2-3 years there is additional information required for better monitoring and compliance. This time with the additional KYC, you also need to provide FATCA declaration.

What is FATCA?

FATCA is Foreign Account Tax Compliance Act, a law enacted by USA in 2010. According to this law, any individual who is resident of USA (citizens or green card holders) or financially connected to the US or have any tax residency in US have to declare all their foreign income and investment details to US Tax Authorities. The law was enacted to prevent tax evasion through offshore investments by US residents.

India is signatory of the above law and hence all the financial entities like Banks, Insurance Companies, Mutual Funds, Brokerages, etc have to furnish their client information to the Indian Government, which in turn would share it with US Government. In case you have no income connection with USA, you are not impacted but still need to give the declaration.

How to do additional KYC/FATCA declaration Online?

Thankfully this time it’s much easier to do additional KYC and FATCA declaration, as it’s online. The online service is being provided by the Registrars of Mutual Funds. So depending on which mutual funds you want to invest, you need to do KYC with their respective registrars.

Step 1:

Check which Registrar services your mutual fund from the list below

| CAMS | KARVY Mutual Fund Services |

| Birla Sun Life Mutual Fund DSP BlackRock Mutual Fund HDFC Mutual Fund HSBC Mutual Fund ICICI Prudential Mutual Fund IDFC Mutual Fund IIFL Mutual Fund JP Morgan Mutual Fund Kotak Mutual Fund L&T Mutual Fund PPFAS Mutual Fund SBI Mutual Fund Shriram Mutual Fund Tata Mutual Fund Union KBC Mutual Fund | AXIS Mutual Fund Baroda Pioneer Mutual Fund BOI AXA Mutual Fund Canara Robeco Mutual Fund Deutsche Mutual Fund Edelweiss Mutual Fund Goldman Sachs Mutual Fund IDBI Mutual Fund Indiabulls Mutual Fund JM Financial Mutual Fund LIC Nomura Mutual Fund Mirae Asset Mutual Fund Motilal Oswal Mutual Fund Peerless Mutual Fund DHFL Pramerica Mutual Fund Principal Mutual Fund Quantum Mutual Fund Reliance Mutual Fund Religare Invesco Mutual Fund Sahara Mutual Fund Taurus Mutual Fund UTI Mutual Fund |

Additionally Sundaram BNP Paribas Fund Services are registrars for Sundaram Mutual Fund and Franklin Templeton Investments for Franklin Templeton Mutual Fund

Also Read: How are Mutual Funds Taxed?

Step 2:

Click on respective links to visit the respective registrars additional KYC & FATCA page

Step 3:

The process is similar in all the 4 cases.

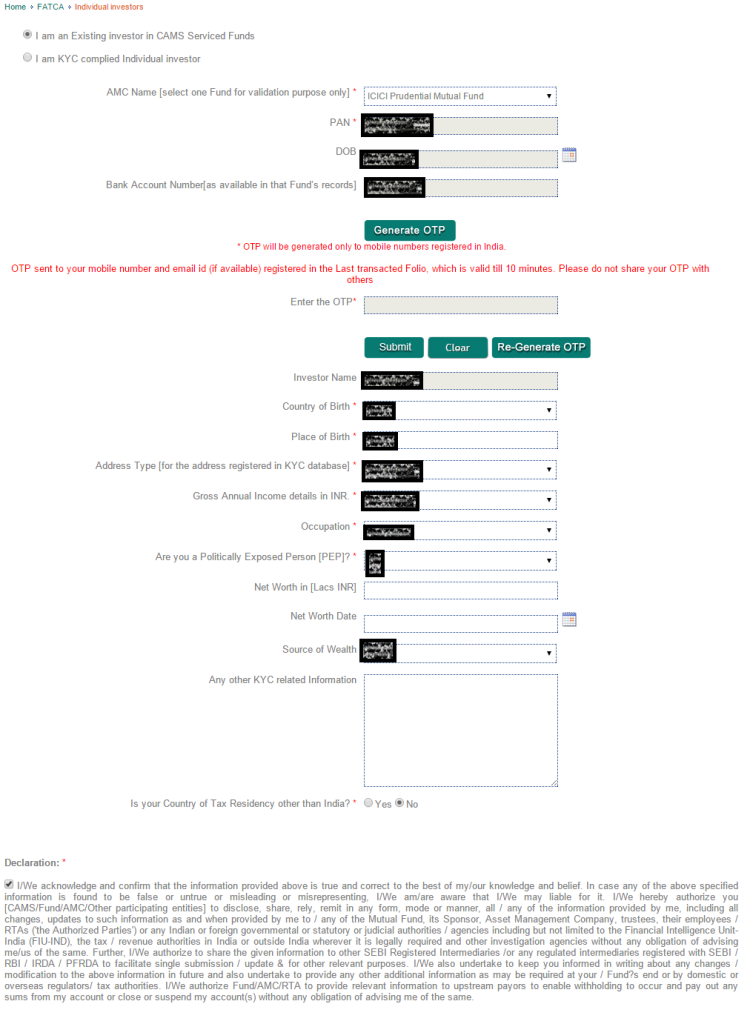

Below is the experience for CAMS:

- As I was an existing investor in CAMS fund, I selected “I am existing investor in CAMS Serviced Funds“

- Next select the AMC Name (select any mutual fund that you are invested), give PAN, Date of Birth, Bank Account number.

- CAMS sends OTP (one time password) to registered mobile number and email id.

- Once the OTP is verified, a detailed form is displayed as shown below

FATCA Declaration and Additional KYC Online – CAMS - Fill in the relevant details and submit

- You get an acknowledgement on the page, email and mobile that the KYC process is complete.

In case of KARVY, it starts with asking for PAN number and it sends OTP on the linked email and mobile number.

Thankfully the process was easy and hardly takes 2-3 minutes. The details asked are very basic. All your fund house needs to know is your country of birth, the country in which you live (yes, most of you will say India), and whether you pay taxes in any other country apart from India.

Also Read: Where to Park Money for Very Short Term [less than 6 Months]?

For instance, you could have stayed in the US for some years or might be a US citizen living in India for some years now, but paying taxes in both countries. If you have been paying taxes in any country apart from India, you need to provide the tax identification number or any such number equivalent to the Permanent Account Number (PAN) here.

Doing KYC/FATCA Offline?

In case you face problem with the online process you can download the FATCA declaration from the above websites. Fill up the form and send it to the respective Registrars address or visit their nearest centers as the case may be.

Deadline?

The deadline for existing investors to complete their new KYC is December 31, 2015. If KYC is not done by December 31, you would not be able to purchase fresh mutual fund units (both SIP and lumpsum). You would only be able to redeem the existing units.

The side effect of FATCA:

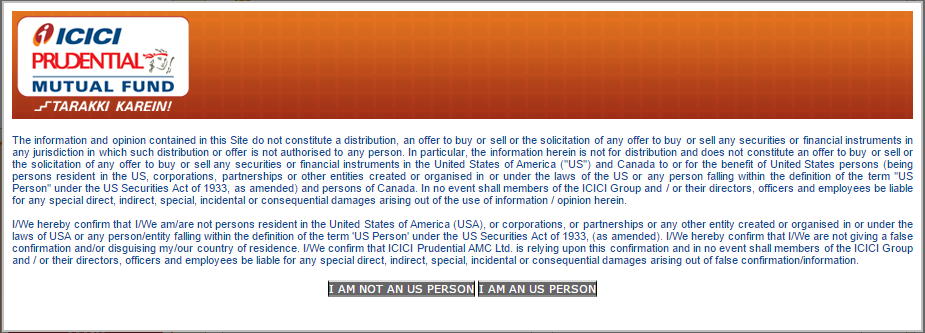

To minimize the compliance and reporting burden a few mutual funds like HDFC, ICICI, Birla, Reliance etc. have stopped taking investment from US/Canada residents and NRIs. So you get this pop-up on these mutual fund websites.

In case you invested in these mutual funds before becoming US/Canada resident, the fund houses disable the option of switching, dividend reinvestment, SIPs, etc after you become US/Canada resident. The only option left is to redeem the fund.

However all other (except for US/Canada residents/NRIs) can invest in all mutual funds in India.

Conclusion:

Do complete your additional KYC and FATCA declaration requirement by December 31, 2015 to avoid any disruption in your investment. It’s simple, easy to do and it helps to keep everything updated.

Thanks for sharing Amit. What would be the impact if the investment is made by a relative of US person’s money? For e.g. many Indians send their post tax savings to their parents in India. Hence if parents invest that money in MF, it would be the US person’s money invested in Indian MF but by parents name. How would it impact overall and is it allowed?

Transferring money to parents is gifting in terms of income tax. Gifting to some relatives including parents is tax free in India. So there is no tax implication on transfer of money to parents account. Now if parents invest it, all taxation would be liability of parents and have to be paid by them. No tax concern with person who gifted!

This is why I closed all my MF. No more investing in India. Done. BS nonsense. KYC headache and then this FATCA BS

Totally agree with the KYC headache. But the problem is Mutual Funds is one of the low cost, best available options for investment. Even mutual fund houses are against frequent change in KYC but bureaucrats do not think so. In comparison insurance products which mostly reap-off investors have relatively easier KYC.

Would suggest you to do the above FATCA declaration online and start reinvesting.

The process is same for even standalone mutual fund service providers like Franklin and Sundaram MF’s.

Yes it’s almost similar for Franklin and Sundaram MF’s. The KYC information is anyway mandated by SEBI, so it has to be same across funds.