Most banks are offering interests in the range of 6% to 7% on their fixed deposits. However some best rated companies and institutions are offering interest rates higher than banks. Below are the details of 7 companies which have high credit rating and offering interest rate more than banks on their fixed deposit schemes.

SBI is offering 6.1% for 1 to 10 years fixed deposits while ICICI Bank is offering 6.00% to 6.40%

Also Read: How SWP in Debt Funds generate higher returns than FD

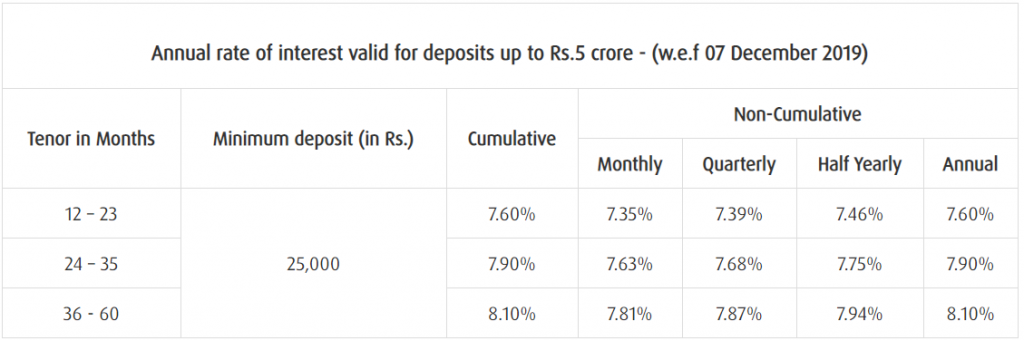

[dropcap]1.[/dropcap] Bajaj Finance Ltd Fixed Deposit

Bajaj Finance Ltd is a NBFC (non-banking finance company) dealing in all kinds of loans like Personal, Two/Three wheeler loans, car loans etc.

Credit Rating: “FAAA” By CRISIL and “MAAA” By ICRA

Salient Features:

- Additional 0.25% interest for Senior citizens

- Renewal: 0.10% over and above the rate of interest at which the deposit is booked

- Online Investment: Additional 0.10% over and above the rate of interest for using Online mode (not applicable for Senior Citizens)

- Only one benefit of additional 0.10% out of renewal or online investment would be applicable

- Can access FDs online through their customer portal

- Loan: Can take loan up to 75% of the deposit

Interest Rates:

Also Read: How to Fill Form 15G and 15H?

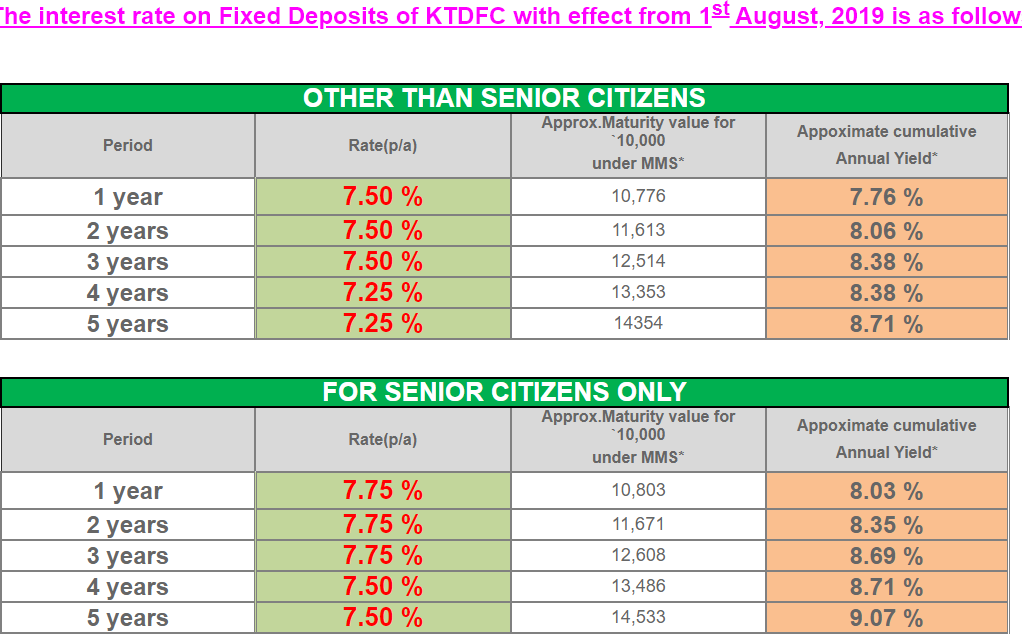

[dropcap]2.[/dropcap] KTDFC Ltd. Fixed Deposit

KTDFC (Kerala Transport Development Finance Corporation Ltd) is NBFC wholly owned by Government of Kerala and deals in Personal and Vehicle Loans among other things.

Credit Rating: KTDFC Fixed Deposits are fully guaranteed by Government of Kerala

Interest Rates:

Also Read: 11 Investments to Generate Regular Monthly Income

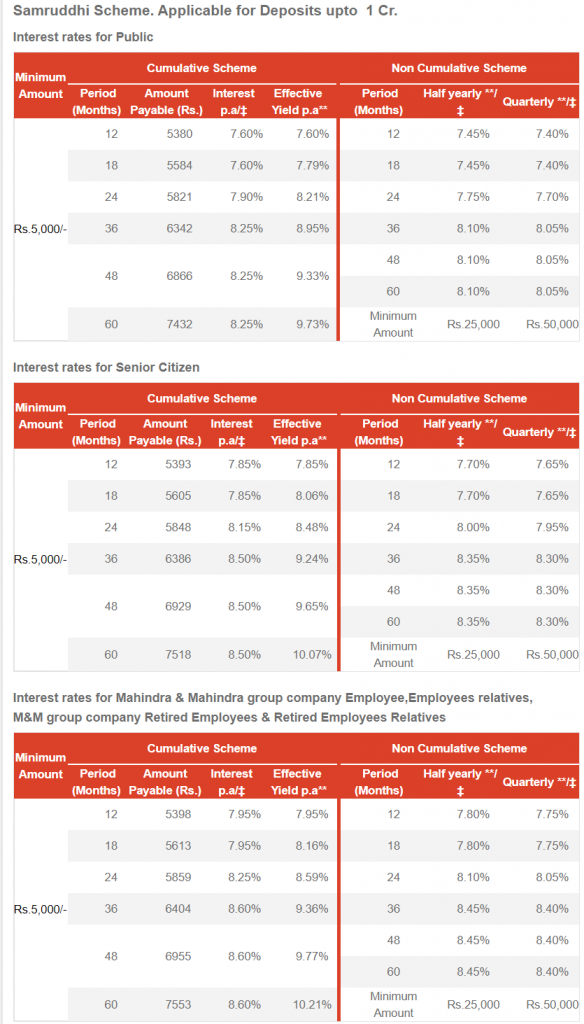

[dropcap]3.[/dropcap] Mahindra and Mahindra Financial Services Ltd FD

Mahindra and Mahindra Financial Services is leading NBFC with focus on rural areas and is top tractor financier in India.

Credit Rating: ‘FAAA’ by CRISIL

Salient Features:

- 0.35% additional interest for all Mahindra group company employees and Employees Relatives

- 0.25% additional rate for senior citizens.

- Dhanvruddhi Cumulative Scheme is new scheme which offers higher interest rate (additional 0.25%) and can only be invested through Mahindra and Mahindra Financial Services website

Interest Rates:

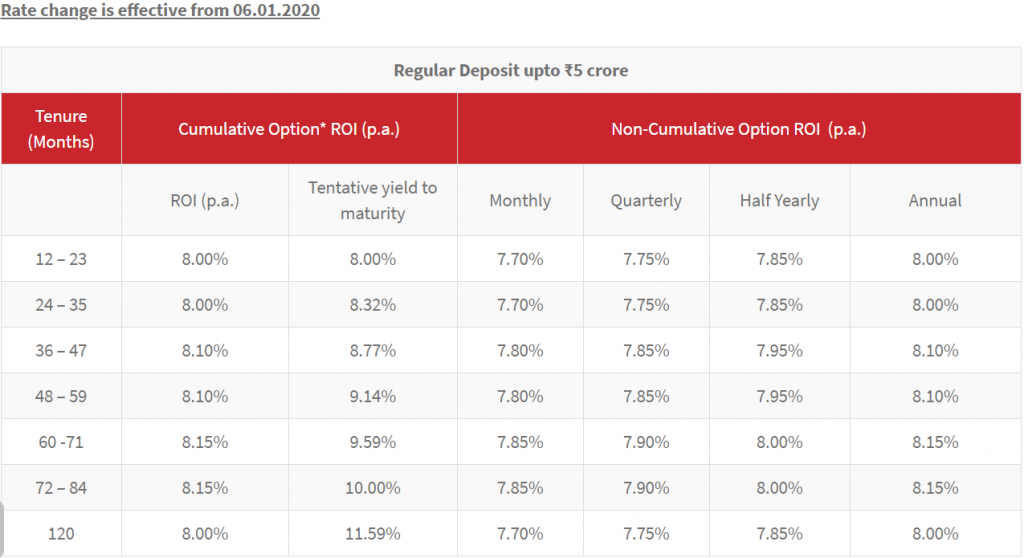

[dropcap]4.[/dropcap] PNB Housing Finance Ltd

PNB Housing Finance Limited (PNBHFL) is a public sector housing finance company (HFC) and is promoted by Punjab National Bank. The company provides housing loans & loan against property as a part of its product portfolio.

Credit Rating: “FAAA” by CRISIL and “AAA” by CARE

Salient Features:

- 0.25% additional rate for senior citizens.

- Loan up to 75% of the FD Principal and accrued interest is available

Interest Rates:

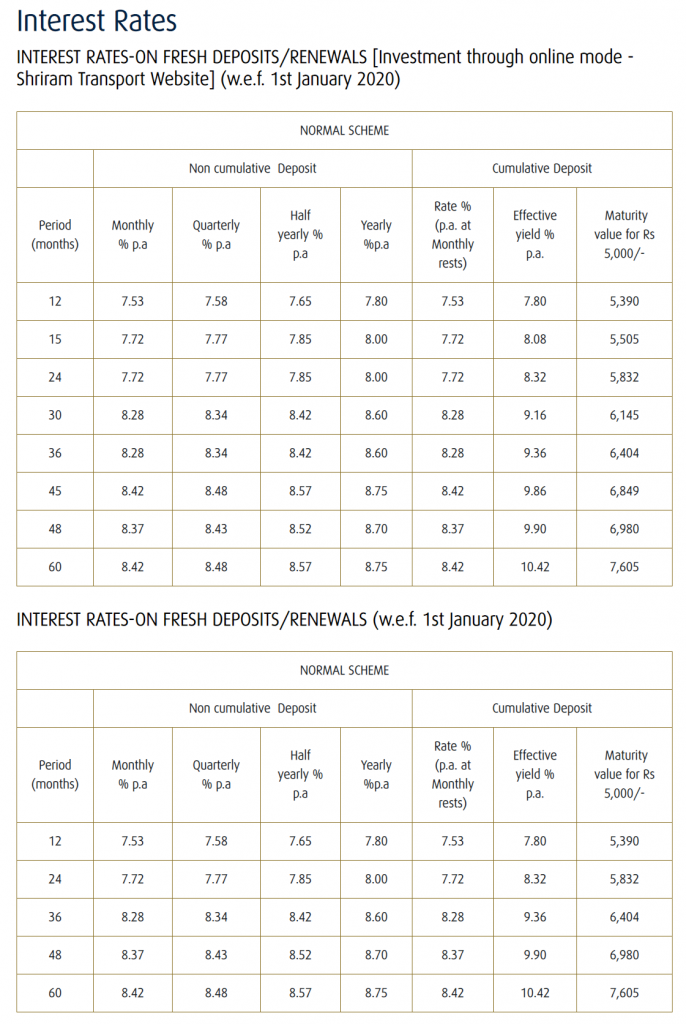

[dropcap]5.[/dropcap] Shriram Transport Finance UNNATI FD Scheme

Shriram Transport Finance is NBFC mainly dealing in Commercial Vehicle Finance.

Credit Rating: ‘FAAA’ by CRISIL and “MAA+” by ICRA

Salient Feature:

- 0.25% additional rate for senior citizens.

- Additional interest of 0.15% p.a to employees of Shriram Group Companies and their relatives.

- Additional interest of 0.25% p.a on all Renewals, where the deposit is matured on or after 1st November 2018.

- Fixed deposits are accepted in multiples of Rs.1000/- subject to a minimum amount of ₹5000/- per deposit for cumulative deposits and ₹10000/- per deposit for non- cumulative deposits.

Interest Rate:

Also Read: 5 Important Changes in Tax Rules from April 1, 2019

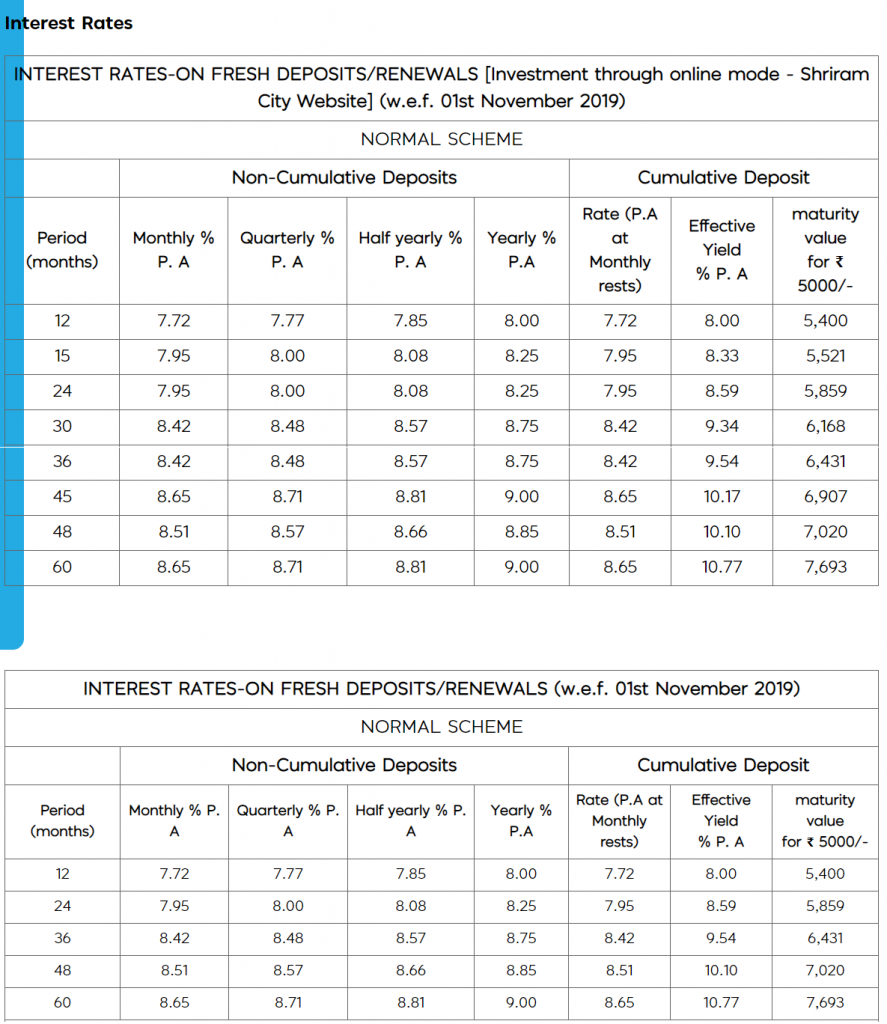

[dropcap]6.[/dropcap] Shriram City Union Finance Ltd FD Scheme

Shriram City Union Finance is NBFC mainly dealing in retail consumer finance and offers various secured and unsecured loans like home loans, personal loan, business loan.

Credit Rating: ‘FAA+’ by CRISIL and “MAA+” by ICRA

Salient Feature:

- 0.25% additional rate for senior citizens.

- Additional interest of 0.15% p.a to employees of Shriram Group Companies and their relatives.

- Additional interest of 0.25% p.a on all Renewals, where the deposit is matured on or after 1st November 2018.

- Fixed deposits are accepted in multiples of Rs.1000/- subject to a minimum amount of ₹5000/- per deposit for cumulative deposits and ₹10000/- per deposit for non- cumulative deposits.

Interest Rate:

Download: PPF Calculator for Maturity, Loan and Partial Withdrawal

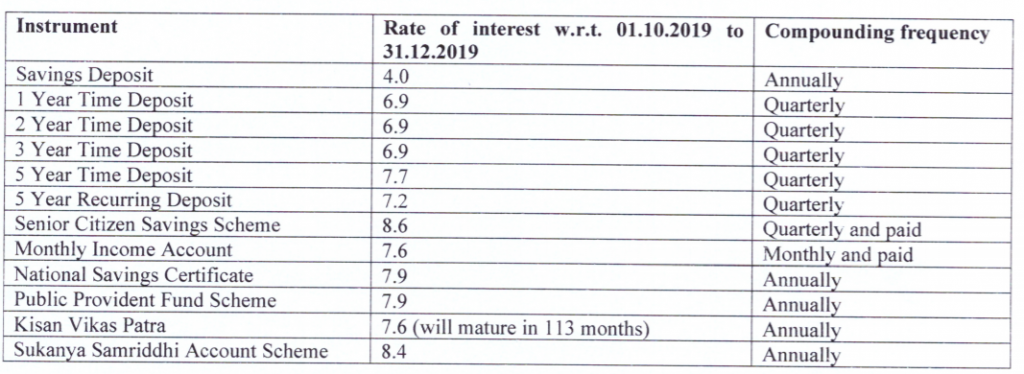

[dropcap]7.[/dropcap] Post Office Time Deposit

Post office Time Deposit (Fixed Deposit) Account can be opened in any post office. The interest rates are reset at the start of every financial year. As of today they are offering higher interest rates than most of the banks. Once you have deposited the money, the interest rate is locked.

Also Read: Impact of RBI Rate Cut on Your Investments and Loans

Credit Rating: backed by Government of India

Salient Feature:

- Fixed deposits are accepted in multiples of Rs.200/- and in multiples thereof

- No maximum deposit limit

Interest Rate:

Helpful Posts on Fixed Deposits

Which bank offers Highest Interest Rate on Bank FD?

13 Most Important things to know before investing in Bank Fixed Deposits

Section 80TTB: Senior Citizens can Save Tax on their Interest Income

TDS threshold on Bank FD increased to Rs 40,000 from April 1, 2019

Avoid TDS: fill Form 15G and 15H

Small Bank FDs offer interest up to 9% – Should you invest?

How SWP in Debt Funds generate higher returns than FD

How to increase bank deposit insurance through Joint accounts?

How Safe is Your Fixed Deposit in Bank?

How you loose Money in Fixed Deposits?

Fixed Deposits that you can use to save Tax

Highest Interest Rate on Recurring Deposits

Understanding Compounding and Yield in Fixed Deposit

How to get Credit card against Fixed Deposit?

7 High Rated Companies Offering more than Bank Fixed Deposits

TDS on Company FDs:

Companies would deduct TDS at the rate of 10% of interest, if the interest earned is more than Rs 5,000 in a financial year.

Tax on Company FDs

The interest received on Company Fixed Deposit is fully taxable. The interest would be added to your annual income and taxed at marginal tax rates.

Also Read: 21 Hidden Charges in Saving Bank Account

Key Points before Investing

Premature Withdrawal is possible on the above company fixed deposits but it requires much more paper work and follow ups. Even the penalty may be more severe as compared to banks

Opening Fixed Deposit is more tiresome as you need to fill forms, visit company branch or get hold of their agents.Also have to give fresh documents for KYC. Bank FDs can be opened online, which is much more convenient.

To Conclude

The above companies are offering have the highest credit rating (which means very low chances of default) and are offering interest rates 1% to 2% higher than the bigger banks. You must look into them for your fixed income portfolio especially if they have easy approachable branches or agents near you.

Have you invested in these companies FDs before? How was your experience? Please share in comments section…

Thanks for shareing this information it;s really help alot and also get to konw about how much high rate they were charge for fix deposit.Nice article!!

Hi Amit,

I was reviewing FD interest rates, & noticed that all the rates are lastr updated in October / November 2018.

Are these rates still prevailing or these are outdated.

Could you please confirm or share current rates.

Thanks

these are latest interest rates. The rates don’t change so frequently for companies.

What about DHFL company deposit………..

We used to recommend DHFL FD but they had ratings downgrade and also a major crash in their share prices. This may impact their ability to repay FD investors. Right now stay away and wait for things to stabilize.