Income Tax Return (ITR) Forms have been released by the Central Board of Direct Taxes (CBDT) a few days back. As it happens every year there are some major and minor changes in these forms. These changes are mainly due to 2 factors:

- To reflect the new tax law changes that were introduced/changed in FY 2018-19 (AY 2019-20)

- To collect more information about tax payer so that the IT department can have better assessment of them.

Tax Rules changes in FY 2018-19 (AY 2019-20)

Before we look at the changes in the form, lets briefly recall the rules that were changed/introduced in FY 2018-19.

- Standard Deduction of Rs 40,000 for Salaried and Pensioners. Transport Allowance & Medical Reimbursement No more tax exempt for salaried

- Cess hiked from 3% to 4% (renamed as Health & Education cess)

- Rs 50,000 interest income for senior citizens tax exempted u/s 80TTB

- 10% tax on long term capital gains (above Rs 1 Lakh) on stocks & equity based mutual funds

- Also 10% dividend distribution tax on dividend paid by equity mutual funds

- Health Insurance Premium Tax exemption limit increased to Rs 50,000 u/s 80D for senior citizens

- Increased deduction for medical treatment u/s 80DDB for senior citizens up to Rs 1 lakh

For more details: 13 Important Changes in Tax Rules from FY 2018-19

Changes in ITR Forms for AY 2019-20 (FY 2018-19)

We list down the important changes in the ITR forms to be used for AY 2019-20 (FY 2018-19)

1. Some Tax Payers cannot file ITR 1 this year

Following 2 categories of tax payers who used to file ITR 1 until last year have to file ITR 2 for AY 2019-20:

- Individuals being a director in a company

- Individuals who have investment in unlisted equity shares at any time during the FY

ITR 2 Form asks for more discloses from the above tax payers.

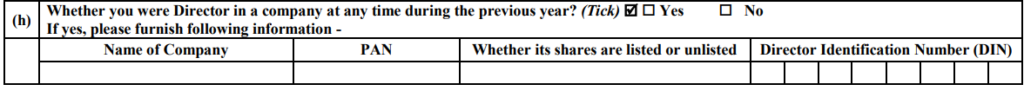

Director in a company has to provide name of company, PAN, DIN and if the company is listed or not as shown in the table below:

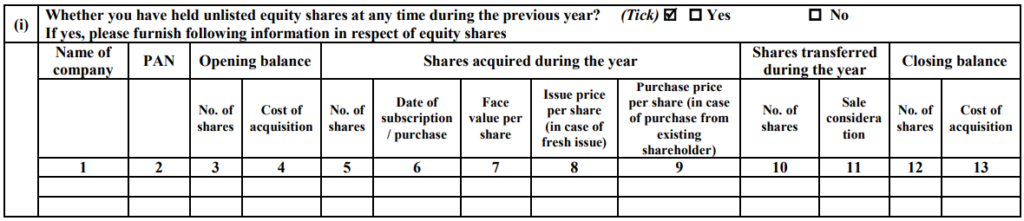

For investment in unlisted equity, people need to provide details of the company, PAN and transactions done in the financial year.

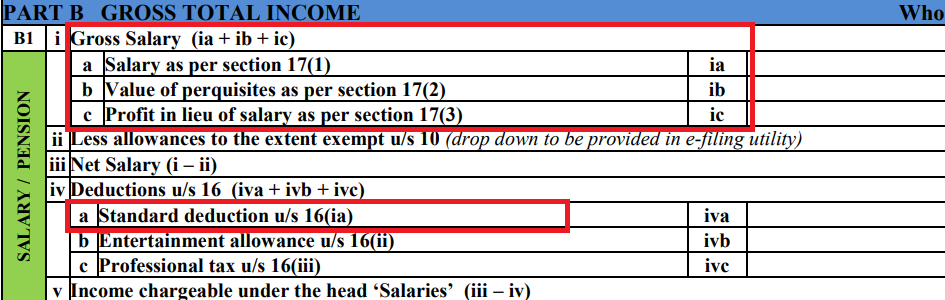

2. Salary Structure In ITR Form (Schedule S)

ITR Form asks for breakup of salary. Thankfully this time they have aligned it to Form-16 fields. Last year a lot of people found it difficult to understand and there were issues.

The row reflecting standard deduction also appears in the form as it was introduced in FY 2018-19. The limit for the same has been increased to Rs 50,000 from FY 2019-20.

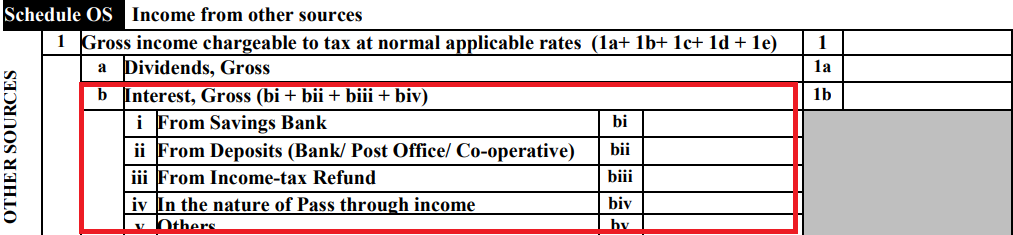

3. Additional disclosure for income from Other Sources (Schedule OS)

For income from Other Sources, the ITR Form asks for more details like income from Savings Account, from deposits (banks/post office), from income tax return, etc. This was required as Section 80TTA only exempts interest income up to Rs 10,000 from savings account but many people were misusing the same.

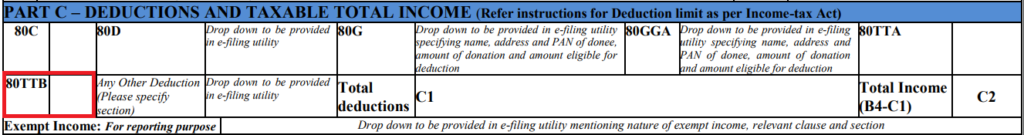

4. Additional Deduction 80TTB for Senior Citizens (Schedule VI-A)

Section 80TTB had been introduced in FY 2018-19 and it exempts Rs 50,000 interest income for senior citizens. The same is now reflected in ITR Form. Just to remind in case you take benefit 80TTB, you cannot take benefit of 80TTA.

Also Read: Highest Interest Rate on Bank Fixed Deposits

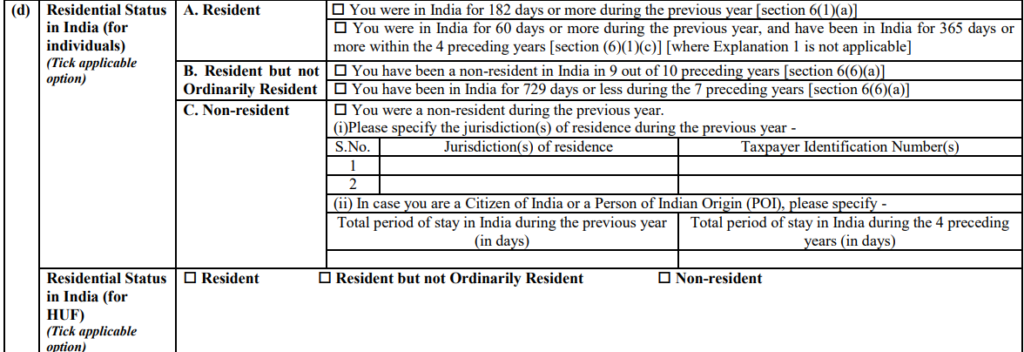

5. Residential/NRI Status

The new ITR Forms ask about the number of says individuals have stayed in India in last financial year. This is to determine the residential status – NRI, Resident Indian, etc. For NRIs, POIs he/she needs to report the total period of stay in India during FY 2018-19 and during the preceding four years.

Also Read: NRE Vs NRO Accounts for NRIs

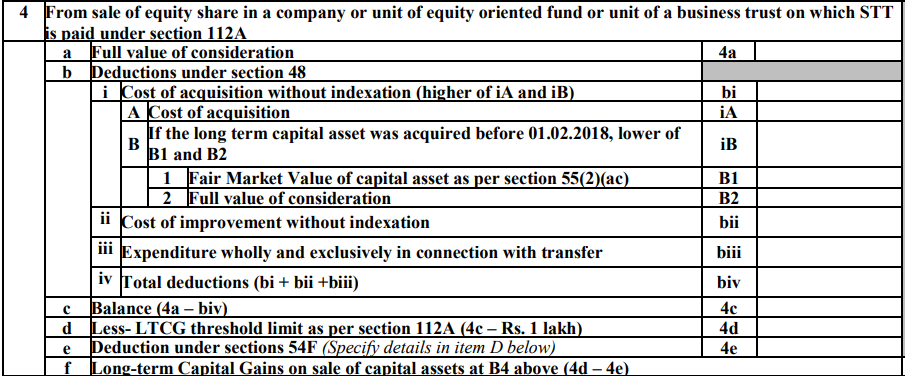

6. Long term Capital Gains on Shares/Mutual Funds (Schedule CG)

Long Term Capital gains on equites and equity based mutual funds were introduced in last financial year. The gains would be taxed at 10% in case it exceeds Rs 1 lakh. The ITR forms have been modified accordingly to mention these capital gains.

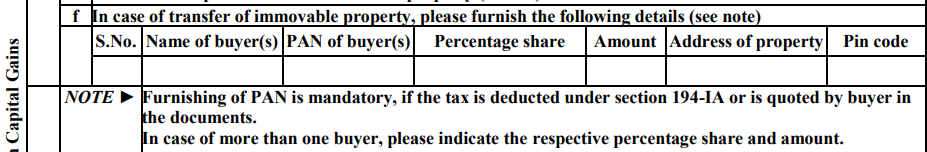

7. Details about Buyer of Property (Schedule CG)

In case taxpayer has sold any immovable property in the financial year, he needs to furnish the details of the buyer such as Name, PAN, Percentage share, address of the property, etc.

Download: Capital Gains Calculator for Property

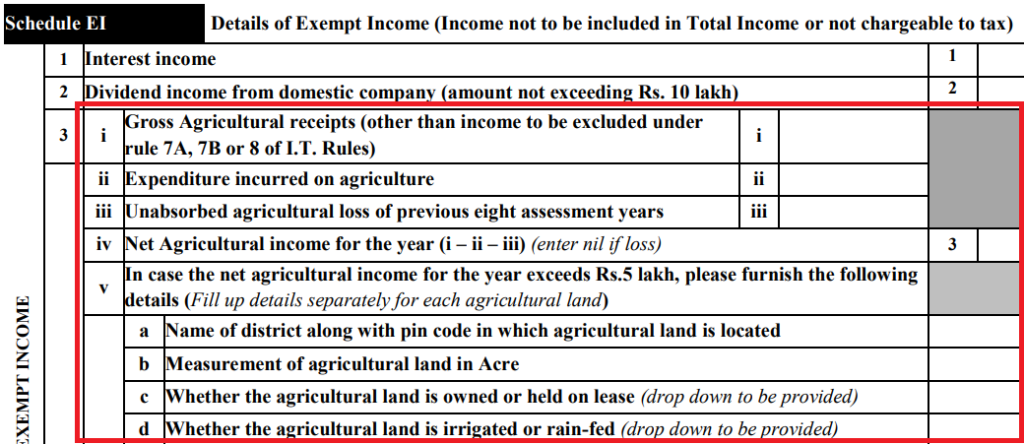

8. Additional disclosure of Agriculture income (Schedule EI)

Taxpayers with agriculture income of more than Rs 5 lakhs, have to fill up ITR 2. ITR 2 asks for additional details such as the name of the district with pin code, measurement of agricultural land, whether owned/leased, etc. under exempt income schedule.

Also Read: 25 Tax Free Incomes & Investments in India

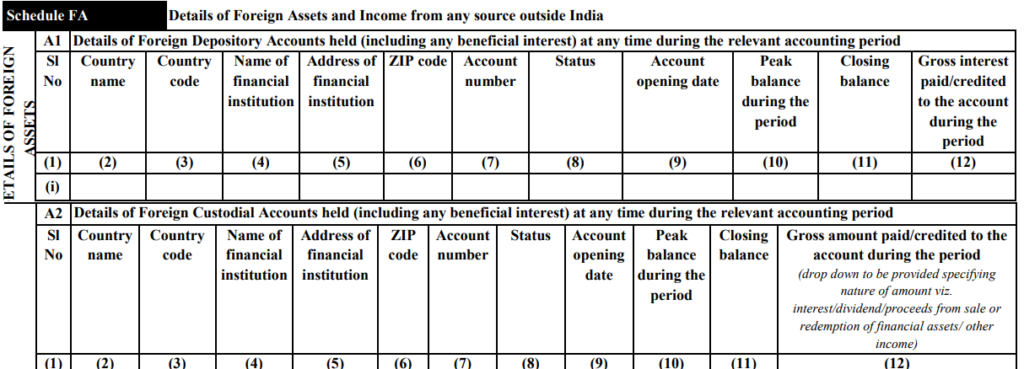

9. More detailed disclosure on foreign assets (Schedule FA)

This year the disclosures regarding foreign assets have increased in the ITR form. Now it also includes details of foreign depository accounts, foreign custodian accounts, equity or debt interest in a foreign entity and foreign cash value insurance contract or annuity contract.

[box type=”info” size=”large” style=”rounded” border=”full”]

Here are some posts which can help you with e-filing of ITR 2019:

1. 9 Most Important Changes in ITR Forms for AY 2019-20

2. Calculate your Tax liability for FY 2018-19 (AY 2019-20)

3. Download 44 page slideshow showing all tax exemptions

4. Which ITR form to fill for Tax Returns for AY 2019-20?

5. How to Claim Tax Exemptions while filing ITR?

6. Use Challan 280 to Pay Self Assessment Tax Online

7. Form 26AS – Verify Before Filing Tax Return

8. 5 Ways to e-Verify your Income Tax Returns

9. What if You DO NOT file your Returns by due Date?

10. Can I file my Last Year Tax Return?

11. Why and How to Revise Your Tax Return?

12. What does Intimation U/S 143(1) of Income Tax Act mean?

13. What happens after you file your ITR?

[/box]

New ITR Forms for AY 2019-20

Everyone filing their income tax return must be aware of the above changes in the form for ITR (Income Tax Return) AY 2019-20 and be careful while filling the same to avoid any complications/tax notices in future.

Dear AmitJi,

The posts are extremely useful , and extremely useful Tax calculator for senior citizens ,

The delayed update of 26AS, is missing TDS deducted on my receipts till March 17, Hopefully I can make use of the missing amount based on my individual invoice ( under GST of 18% consultancy as an individual) amount and the TDS done by companies , while paying my self assessment tax ( eventhough advance tax is exempted for pensioners senior citizens ) . Please correct me if my understanding is wrong.

DrGoms with immense thanks

sir i am us 194C as contractor and sub contractor but my salary is on commsion base as delivery partner for zomato company and i only want to file my tds refund and forthat which itr is best for me plz reply itr 3 is so big i am unable to understand it plz there is any alternate can i file 1 or 4?and if only 3 is applicable for me than how should i fill and what is mandatory for me to fill cause thats my only single income under 4 lakh

sir..incometax refund of previous fy 17-18 is also considered as our income.

not the refund but interest that is paid on refund

Sir,

I have earned some pension amount from lici annuity plan for the FY 2018-19. I understand that the amount is fully taxable. Under which head of INCOME I can show the amount in itr1 for AY 2019-20?

Annuity payout will come under “income from other sources”

Many thanks ,Sir, for your prompt reply. But in the itr1 for AY 2019-20…..there are many sub-heads under “income from other sources”…..like….Savings Bank interest, Interest from deposits in Bank/ Post Office/Co operatives,Family Pension, Others etc. Which sub-head of “Income from other sources” is appropriate to show the annuity income?

Regards,

others

Many thanks,Sir, for your prompt reply. But in ITR1 for AY 2019-20 there are many sub-heads under “Income from other sources”….like Savings bank, Deposit interests in Bank/Post office/Co-operatives, Dividents, Family pension,Others etc.

Which sub-head of “Income from other sources” will be applicable to show the pension amount received from LICI annuity plan?

Regards.

Hi, I am a salaried profession. Apart from this i do trading of shares also. I have done Intraday, short term and long term trading. pls let me know which ITR form i have to use for filling AY2019-20. I always used ITR1 in past,.

If you trade in shares – you would have long/short term capital gains and hence use ITR 2

Sir,

I am so grateful for your clear and prompt reply.

I have another query. In ITR1 for AY 2019-20 there are many sub-heads under “Income from other sources”….like interest received from savings bank, deposit A/C, family pension,dividends, others etc. Under which sub-head of “Income from other sources” does the annuity received from LICI fall?

Regards.

Choose “Any other” & in Description mention Annuity