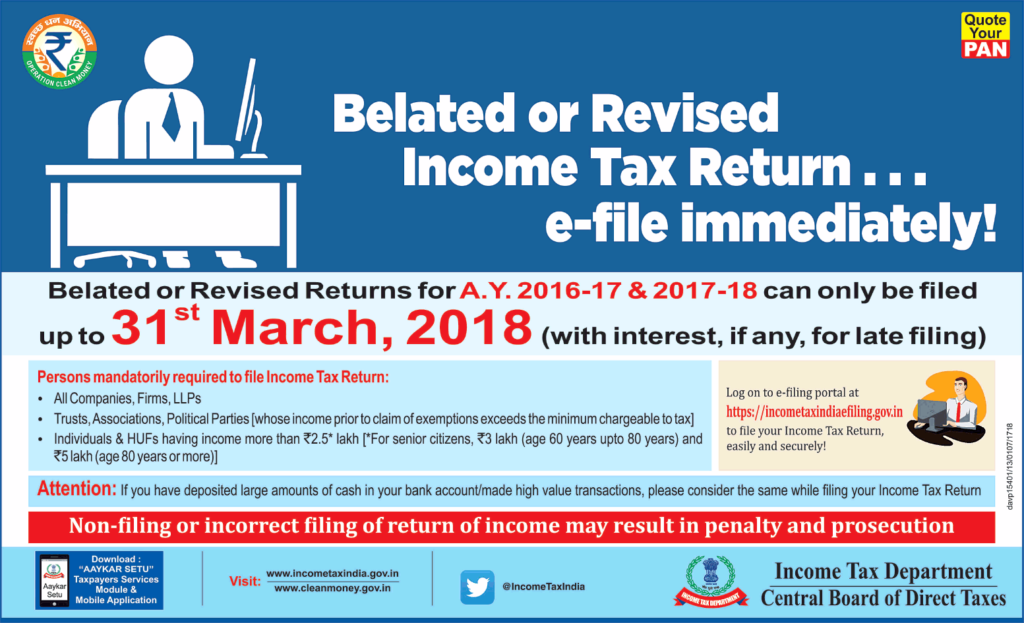

File Your Belated/Revised Income Tax Return by March 31, 2018 – If not done Yet

The financial year ends on March 31 and there are various important things that you must DO before this. But from this year you MUST file your belated or revised income tax returns (ITR) for present Assessment Year (AY 2017-18 or FY 2016-17) and last Assessment Year (AY 2016-17 or FY 2015-16) in case you have […]

File Your Belated/Revised Income Tax Return by March 31, 2018 – If not done Yet Read More »