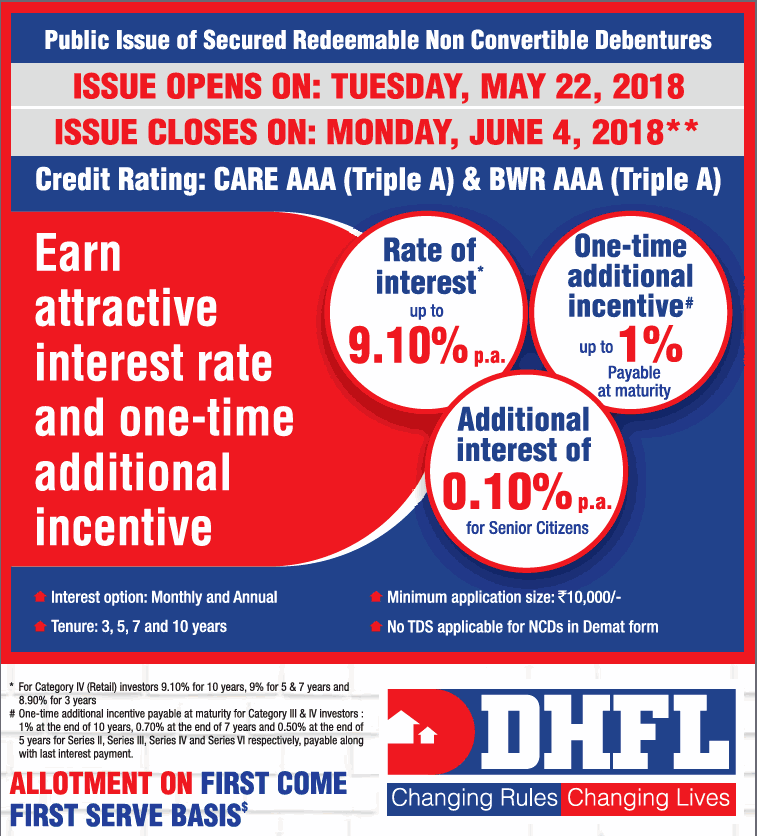

9.75% JM Financial Credit Solutions Limited NCD – May/June’18 – Should you Invest?

JM Financial Credit Solutions Limited has come out with public issue of non-convertible debentures (NCD) offering up to 9.75% interest rate. The issue opens on May 28 and closes on June 20, 2018. JM Financial Credit Solutions Limited, a venture between JM Financial Limited holding 50.01% and INH Mauritius holding 48.62% is a non-banking finance company […]

9.75% JM Financial Credit Solutions Limited NCD – May/June’18 – Should you Invest? Read More »

![Pradhan Mantri Vaya Vandana Yojana: Pension Scheme for Senior Citizens [updated as per Budget 2018] Pradhan Mantri Vaya Vandana Yojana - PMVVY 2017](https://www.apnaplan.com/wp-content/uploads/2017/05/Pradhan-Mantri-Vaya-Vandana-Yojana-PMVVY-2017.png)