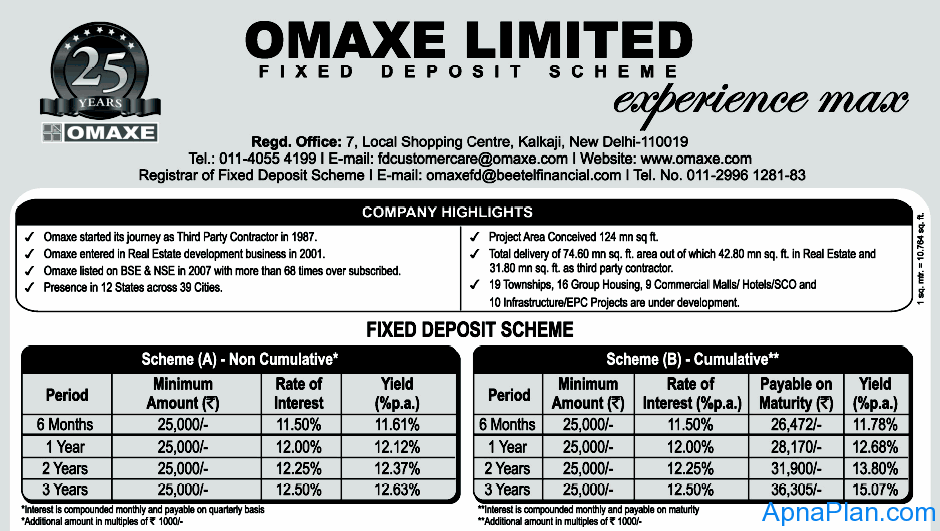

RBI Rate Cut Impact: Rush for Fixed Deposit and wait for your Loan

Reserve Bank of India (RBI) in its monetary policy presented on January 29, 2013 cut repo rate and cash reserve ratio by 25 basis points each. Repo rate, the rate at which banks borrow from the central bank, has been slashed to 7.75%; and the cash reserve ratio, the portion of bank deposits the banks […]

RBI Rate Cut Impact: Rush for Fixed Deposit and wait for your Loan Read More »

![UCO Tax Saver Deposit Scheme – Interest & Annual Yield [Miss-selling Advertisement] UCO Tax Saver Deposit Scheme](https://www.apnaplan.com/wp-content/uploads/2013/01/UCO-Tax-Saver-FD-619x1024.png)