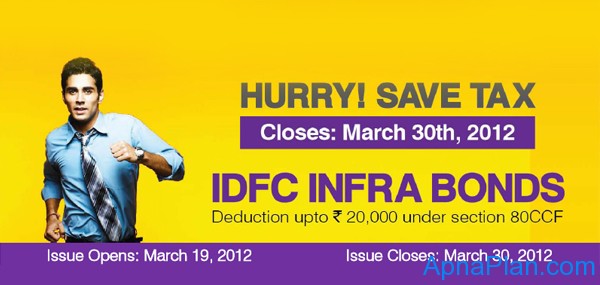

IDFC Tax Saving Infrastructure Bond – March 2012 Details

IDFC with its infrastructure bond has given you one more option for investment under Section 80CCF in March 2012. IDFC Infrastructure Bond Details: IDFC Infrastructure Bond Features: The bonds don’t attract any TDS in case the investments are in demat form The bonds are available in Demat & Physical form The bonds will be listed […]

IDFC Tax Saving Infrastructure Bond – March 2012 Details Read More »